The Dogecoin (DOGE) cost rally extended further on March. 29 hoping the cryptocurrency would obtain a major boost from Elon Musk’s Twitter acquisition.

Elon Musk boosts Dogecoin cost again

Dogecoin cost leaped by nearly 75% to achieve $.146 on March. 29, the greatest daily gain since April 2021.

Particularly, the meme-coin’s massive intraday rally came as part of a wider upward trend that began the 2009 week on March. 25. As a whole, DOGE’s cost acquired 150% throughout the March. 25-29 cost rally.

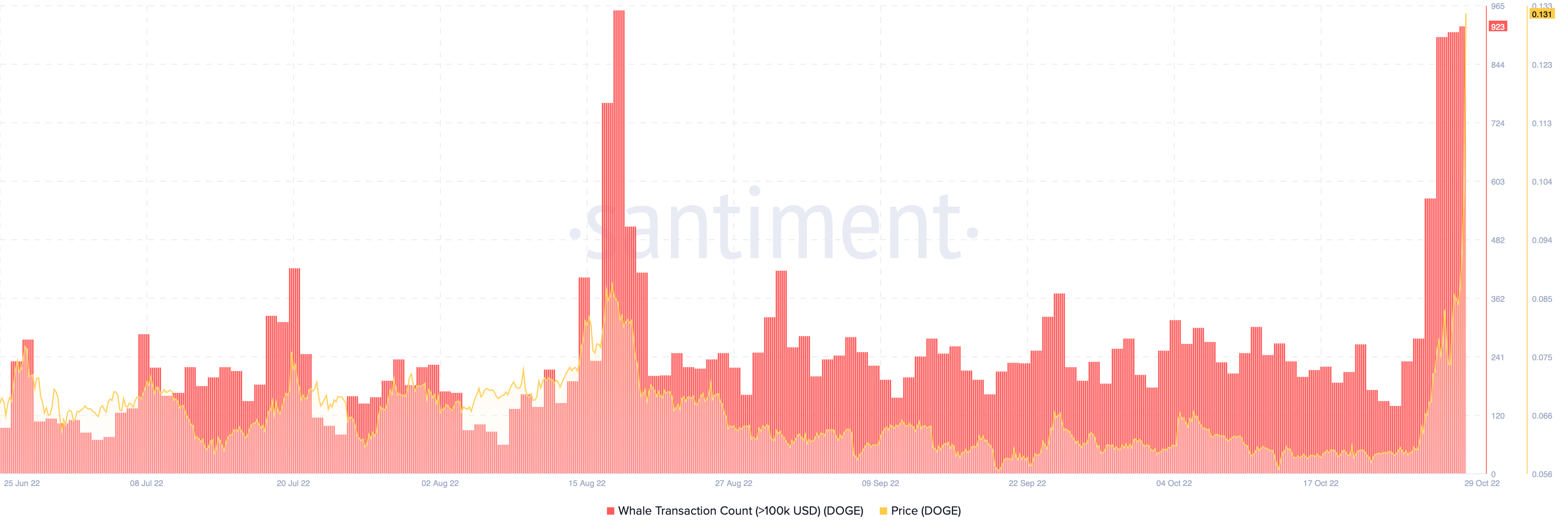

The surge seemed to be supported with a decent rise in its daily buying and selling volumes. That coincided having a spike in the amount of DOGE transactions exceeding $100,000, based on Santiment. Both indicators sugges an increasing interest in Dogecoin tokens among wealthy investors, approximately-known as “whales.”

The jump across Dogecoin’s key metrics reflect investors’ excitement about Elon Musk’s Twitter acquisition on March. 27. Captured, the millionaire entrepreneur had flirted with the thought of making Dogecoin a repayment method to buy the Twitter Blue subscription.

Musk’s Tesla and SpaceX already accept DOGE payments for his or her merchandise.

$DOGE, the state currency of Twitter.

— David Gokhshtein (@davidgokhshtein) October 28, 2022

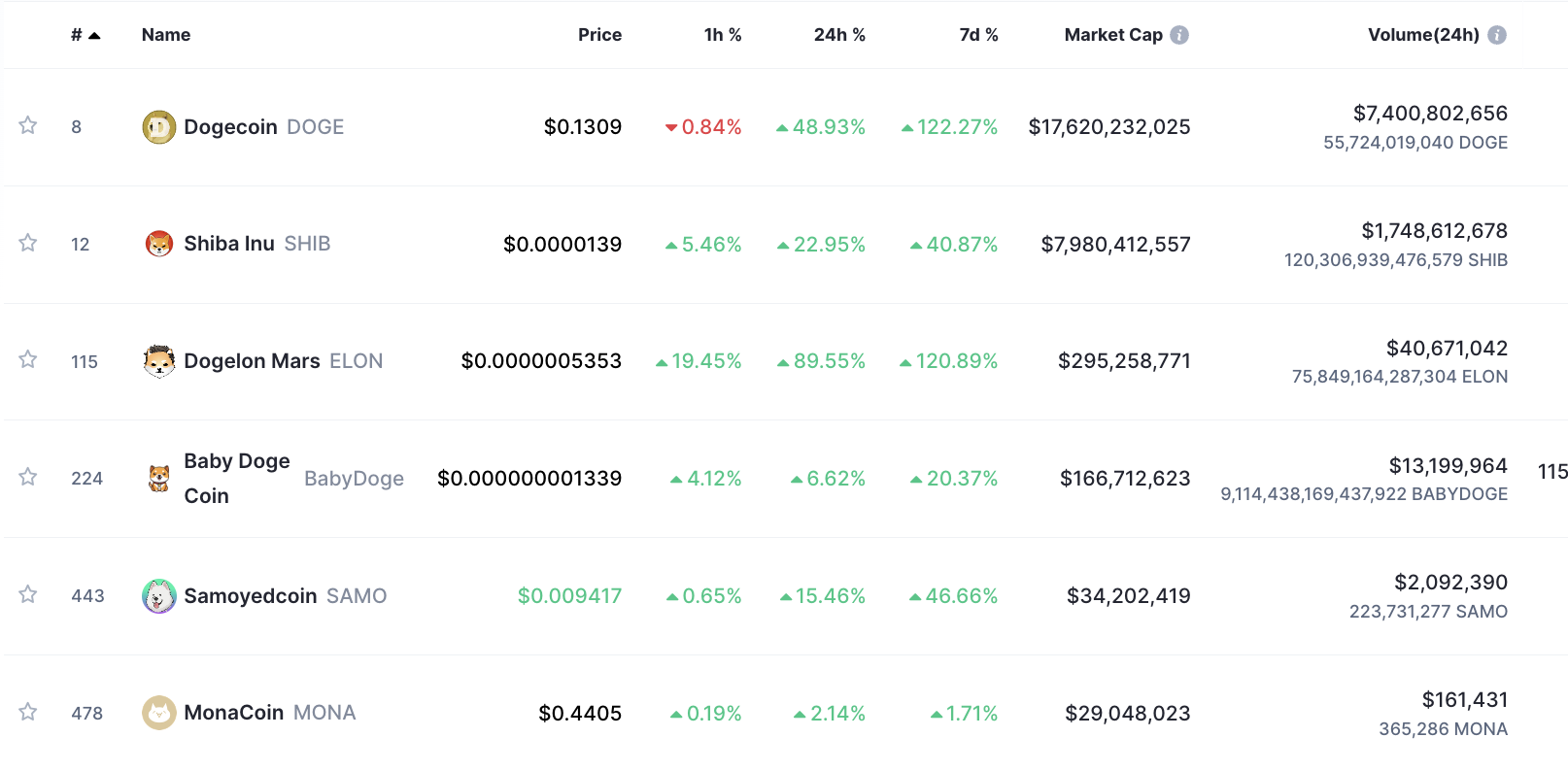

Shiba Inu, meme-coins follow DOGE

Shiba Inu (SHIB), the 2nd-largest meme token by market capital, published a duplicate-cat rally too.

On March. 29 alone, SHIB’s cost leaped by 30% to $.00001519, its greatest level since August 2022. Like Dogecoin, Shiba Inu’s rally came as part of a wider upward trend that began on March. 25. Since that time, its cost has acquired 53%.

Furthermore, other meme coins have leaped massively within the stated period, including Dogelon Mars (ELON), which rallied 140%.

Dogecoin most overbought since April 2021

Dogecoin’s ongoing cost rally is beginning to appear overstretched, however, based on a vintage technical indicator.

The relative strength index (RSI), a momentum indicator figuring out the quality of recent cost changes to evaluate overbought or oversold levels, has risen to 93.69 around the daily Dogecoin chart. This is actually the greatest level since April 2021, per month prior to the DOGE cost rallied to the record a lot of $.75.

Therefore, the “overbought” conditions don’t always mean an instantaneous bearish reversal. However they do reflect the present euphoric buying momentum on the market, which eventually prompts the cost to trend either sideways or correct downward.

Dogecoin’s 2018-2020 bear market on the weekly chart sheds light on similar cost action. Notably, DOGE crashed by almost 95% almost 2 yrs after peaking at $.0194 in The month of january 2018.

Related: Bitcoin cost started now, but has got the trend altered?

The token’s correction period first viewed it trending in the climbing down funnel. It broke from the range towards the upside in This summer 2020 but adopted the upside move having a sideways consolidation trend — between its Fib type of .0022 and .236 Fib type of $.0054 — until December 2020.

Compared, Dogecoin’s ongoing bear marketplace is shorter but shows an identical trend trajectory towards the 2018-2020 period, as proven above. Therefore, DOGE may fluctuate inside its current -.236 Fib line range (or even the $.055-$.176 range) following its climbing down funnel breakout.

Quite simply, DOGE could correct toward $.055 through the finish of the year, lower about 60% from current cost levels, when the fractal plays out as intended.

On the other hand, an instantaneous breakout over the .236 Fib line might have DOGE eye $.25 since it’s next upside target.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.