Dogecoin (DOGE) has surged nearly 100% quarter-to-date (QTD) on hopes that Elon Musk would integrate the token to the Twitter platform. However, DOGE’s possibility to continue its upward trend within the coming days is low, a very common market analyst argues.

Short Dogecoin hard?

Independent market analyst GCR stated he’s moderately short on DOGE according to its price’s recent response to a Musk tweet. Particularly, DOGE created a nearby top at $.158 on November. 1. The 24 hour, Musk shared an image of his pet Shiba Inu putting on a t-shirt using the Twitter emblem.

— Elon Musk (@elonmusk) November 1, 2022

GCR argues the Musk-effect is putting on off with regards to Dogecoin’s potential integration into Twitter, and therefore the majority of the gains happen to be priced in. Therefore, when the actual integration happens, it’ll likely be a sell-the-news event.

dog stock has only 2 bullets

bullet 1 – musk tweeting/teasing about integration already fired

bullet 2 – official integration into twitter has not shot, but could be sell this news

i am moderate short on doggo, but departing room available to short harder when they fire second bullet

— GCR (@GCRClassic) November 3, 2022

Overbought correction begins

Meanwhile, Dogecoin ongoing its correction move ahead November. 4, 72 hours after topping out at $.158.

DOGE’s cost dropped to as little as $.115 on November. 4, partly because of rumors of Twitter pausing its crypto wallet development project. That introduced the token’s internet percentage correction in the November. 1 local the top to the nearly 27%.

Additionally, the down-side move surfaced because of its very overbought conditions with the greatest relative strength index (RSI) since April 2021.

The correction has motivated Dogecoin cost to retest its December 2021-May 2022 support (based on the $.108-$.124 range the red bar within the chart above) for any potential pullback. The gold coin may achieve $.185, an amount coinciding using its .236 Fib line, when the recovery occurs.

On the other hand, a rest below the $.108-$.124 range might have DOGE drop to $.055 his or her primary downside target, lower 55% from current cost levels.

DOGE on-chain data

In addition, Dogecoin’s on-chain data reveals a regular stop by key metrics entering November, that could increase the sell-pressure.

Related: Shiba Inu cost drops to record low versus Dogecoin — Will history repeat having a 150% rally?

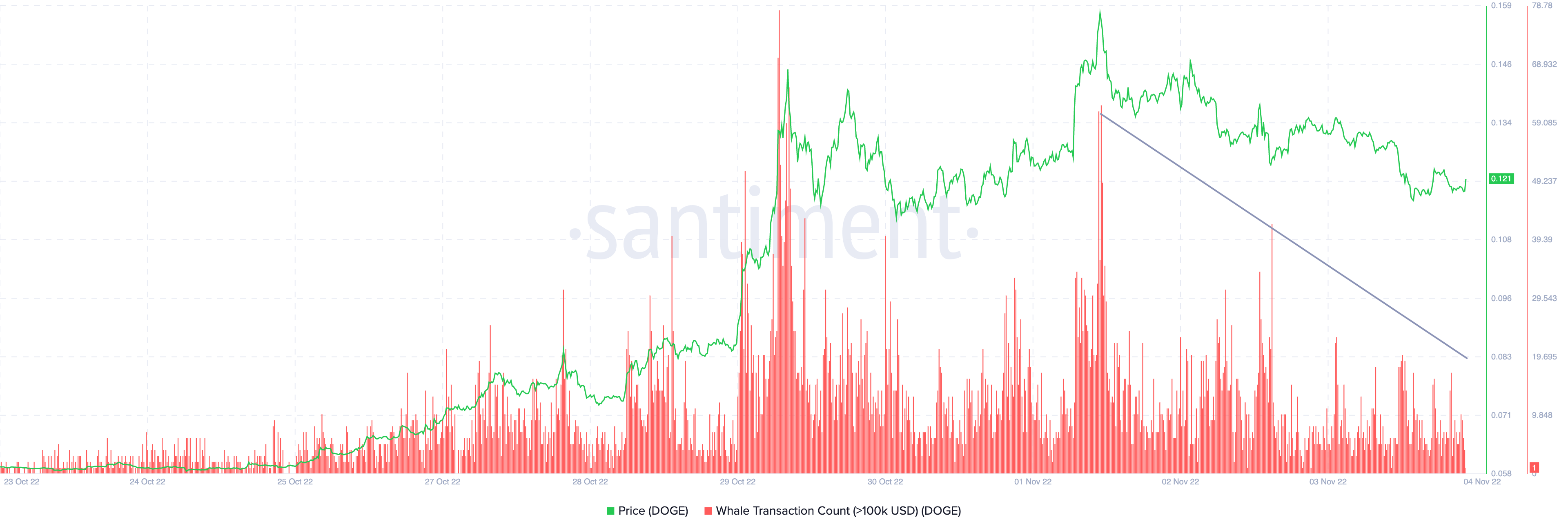

For example, DOGE’s Twitter-brought cost rally coincided having a sharp increase in whale transaction count (worth over $100,000), suggesting they supported the upside move. But after November. 1, less whales have interacted using the Dogecoin network.

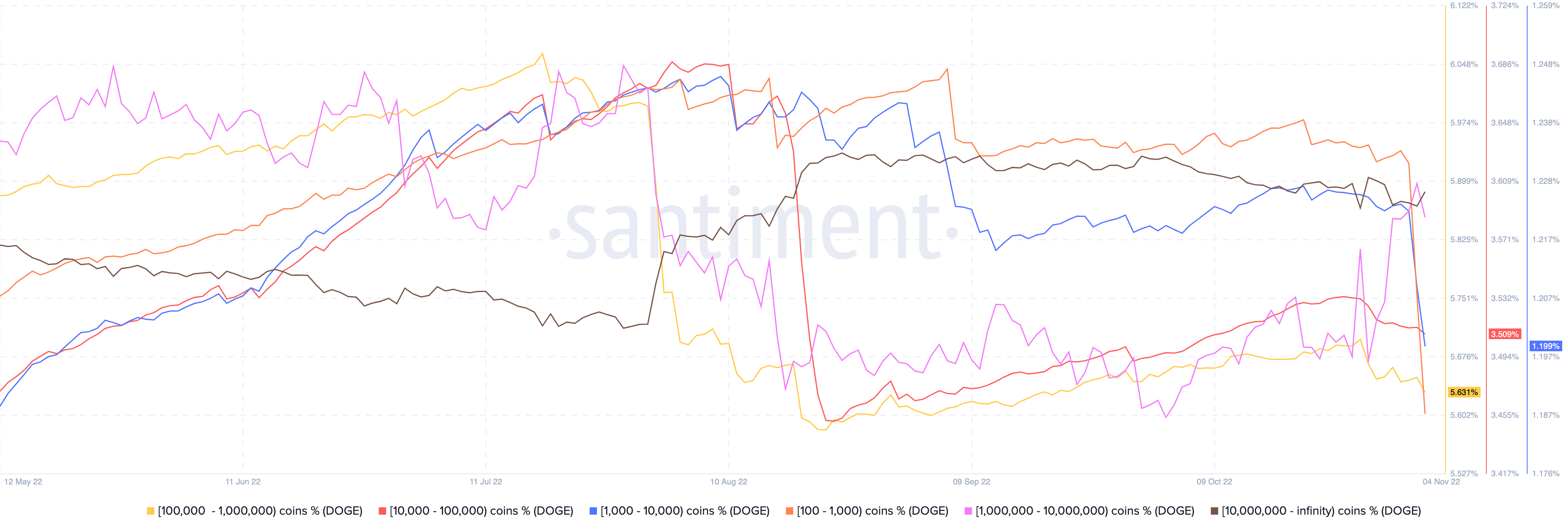

Meanwhile, the Dogecoin supply distribution across addresses holding between 1,000 and ten million DOGE tokens has fallen plus the cost. On the other hand, the availability controlled by addresses holding greater than ten million DOGE tokens has elevated modestly.

Additionally, the addresses holding below 100 DOGE happen to be growing, meaning that retail investors happen to be offsetting whales’ selling pressure to some extent.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.