Ether (ETH) cost nosedived below $1,100 in early hrs of June 14 to prices not seen since The month of january 2021. The down-side move marks a 78% correction because the $4,870 all-time at the top of November. 10, 2021.

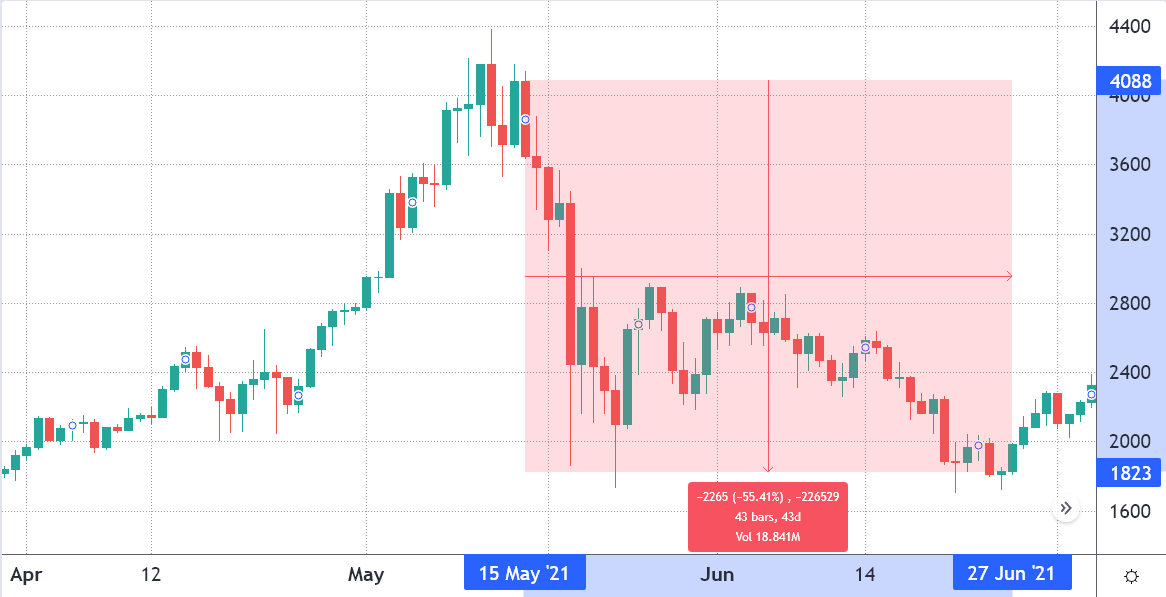

More to the point, Ether has underperformed Bitcoin (BTC) by 33% between May 10 and June 14, 2022, and also the before an identical event happened was mid-2021.

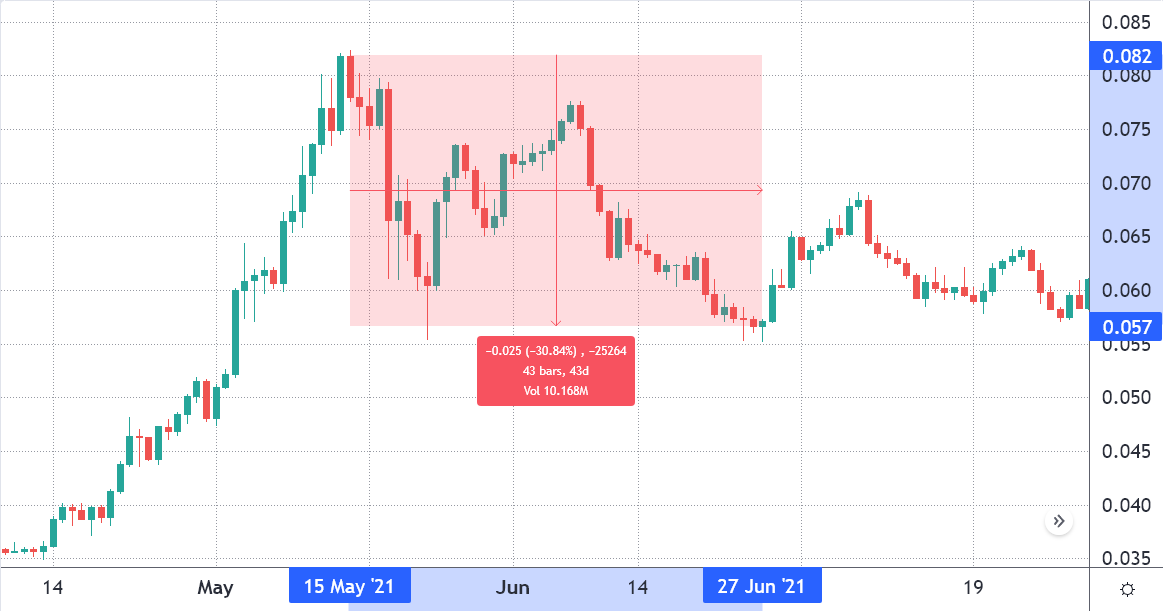

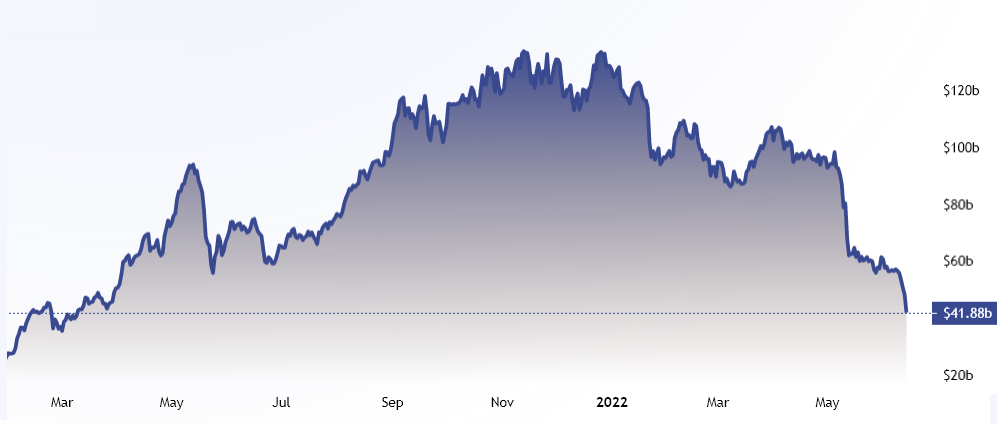

Despite the fact that Bitcoin oscillated inside a narrow range two days prior to the .082 ETH/BTC peak, this era marked the “DeFi Summer time” peak once the Ethereum network’s total value locked (TVL) catapulted to $93 billion from $42 billion two several weeks earlier.

What’s behind Ether’s 2021 underperformance?

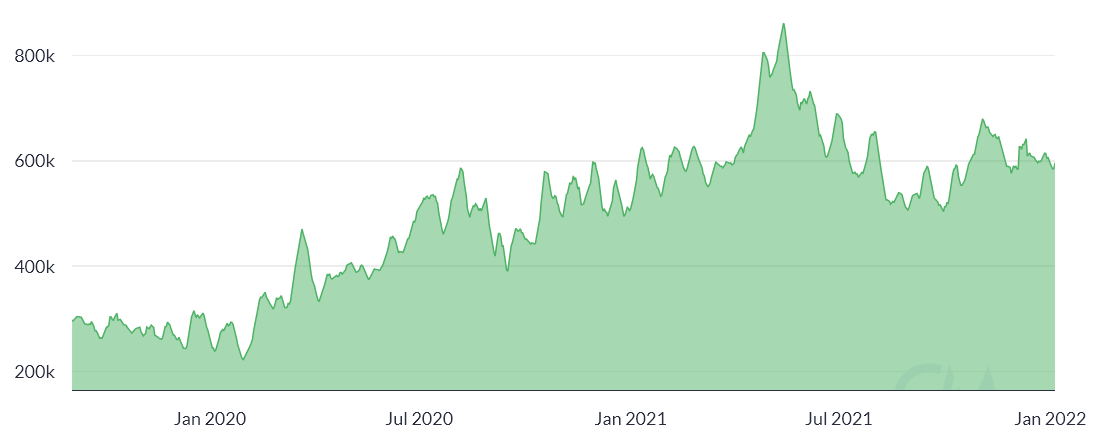

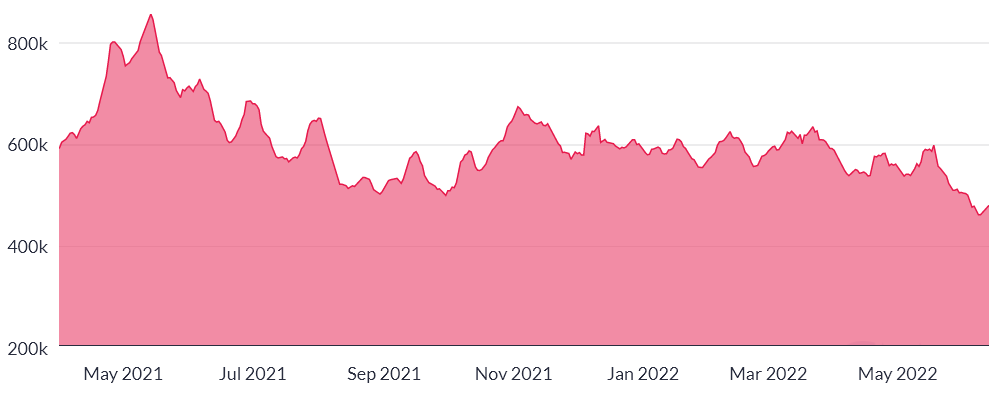

Before jumping to conclusions, a wider group of data is required to know very well what brought towards the 31% correction within the ETH/BTC cost in 2021. Searching at the amount of active addresses is a great starting point.

Data shows steady development in active addresses, which elevated from 595,620 in mid-March to 857,520 in mid-May. So, not just did the TVL growth take investors unexpectedly, but so did the amount of users.

The 31% Ether underperformance versus Bitcoin in June 2021 reflected a awesome-off period after unparalleled development in the Ethereum ecosystem. The issue for Ether’s cost was devastating, along with a 56% correction adopted that DeFi Summer time.

You have to compare recent data to know whether Ether is going to an identical outcome. For the reason that sense, individuals who anxiously waited for that 31% miss versus Bitcoin’s cost bought the altcoin in a cycle low near $1,800 on June 27, 2021, and also the cost elevated 83% in 50 days.

Is Ether flashing a buy signal at this time?

This time around, there’s no DeFi Summer time and before year’s 33% negative performance versus Bitcoin, the active address indicator had been slightly bearish.

By May 10, 2022, Ethereum had 563,160 active addresses, within the lower are the past handful of several weeks. This is actually the complete opposite from the mid-2021 movement that happened as Ether cost faster its losses in BTC terms.

One may still believe that despite a comparatively flat quantity of users, the Ethereum network have been growing by presenting a greater TVL.

Data implies that on May 10, 2022, the Ethereum network TVL held $87 billion in deposits, lower from $102 billion per month prior. Therefore, there’s no correlation between your mid-2021 awesome-off after DeFi Summer time and also the current 33% Ether cost downturn versus BTC.

These metrics show no proof of similarity backward and forward periods, but $1,200 may as well be considered a cycle low, and will also rely on additional factors in addition to the network’s use.

Thinking about how weak active addresses and TVL data were prior to the recent cost correction, investors should gentle when attempting to calculate an industry bottom.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.