Ethereum (ETH) is setting liquidation records now like a comparatively modest cost uptick reveals how bearish the marketplace is becoming.

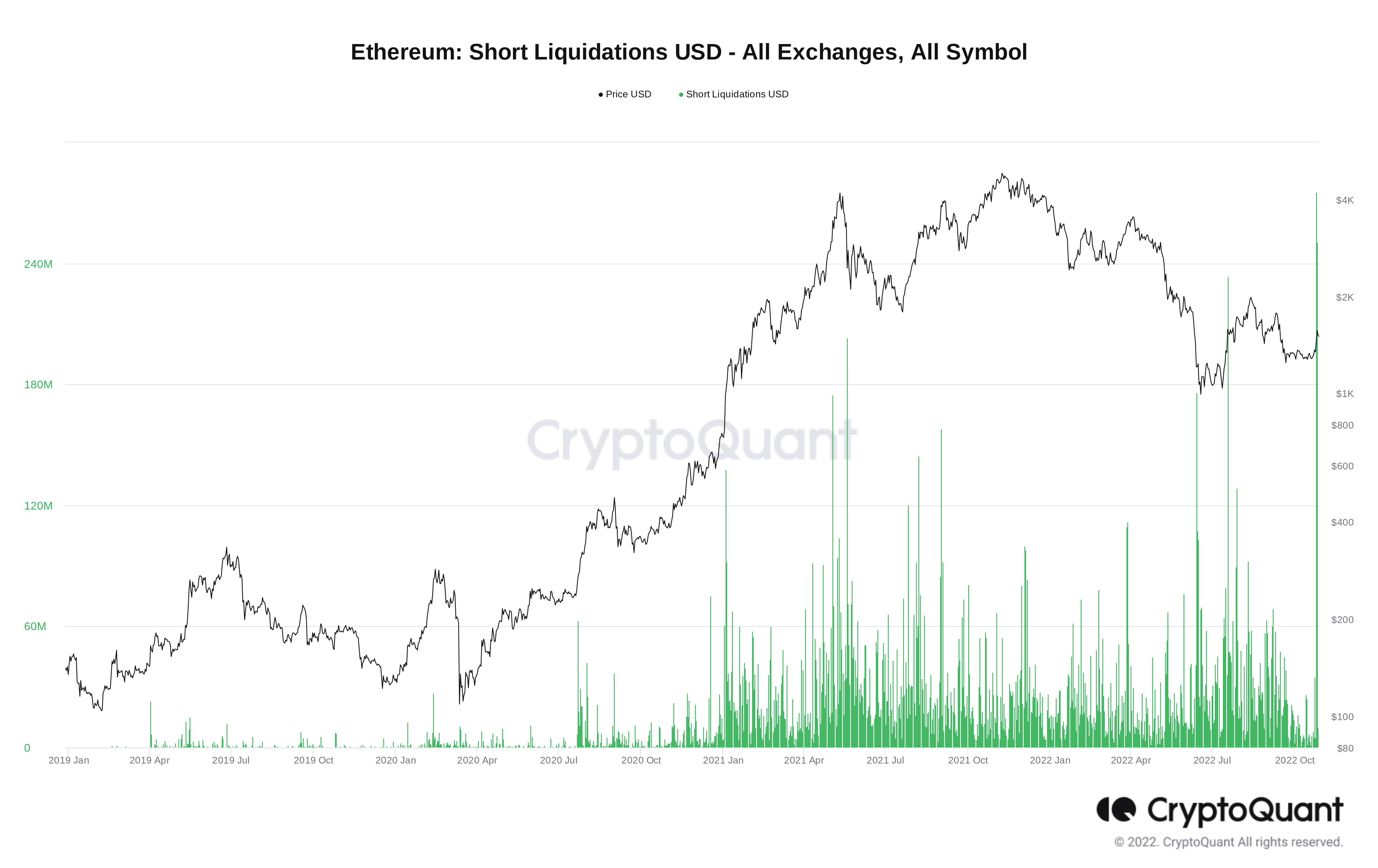

Data from on-chain analytics platform CryptoQuant confirmed that U.S. dollar-denominated short liquidations hit a brand new all-time at the top of March. 25.

2 days, half a billion dollars of ETH shorts

It is not only Bitcoin (BTC) causing bears severe discomfort now — data from exchanges also implies that Ethereum shorters have endured heavy losses.

ETH/USD delivered fairly impressive gains on March. 25-26, rising from lows of $1,337 to highs of $1,593 on Bitstamp before retracing, based on data from Cointelegraph Markets Pro and TradingView.

While nothing unusual for crypto as well as for altcoins particularly, the marketplace changes triggered through the cost action was out.

Just like Bitcoin, the marketplace became heavily short ETH, expecting a vacation to new macro lows after days of sideways action and unsuccessful breakouts.

It thus only required around $250 of upside to liquidate more short positions (in USD terms) than in the past — $275 million on March. 25, with another $250 million the next day.

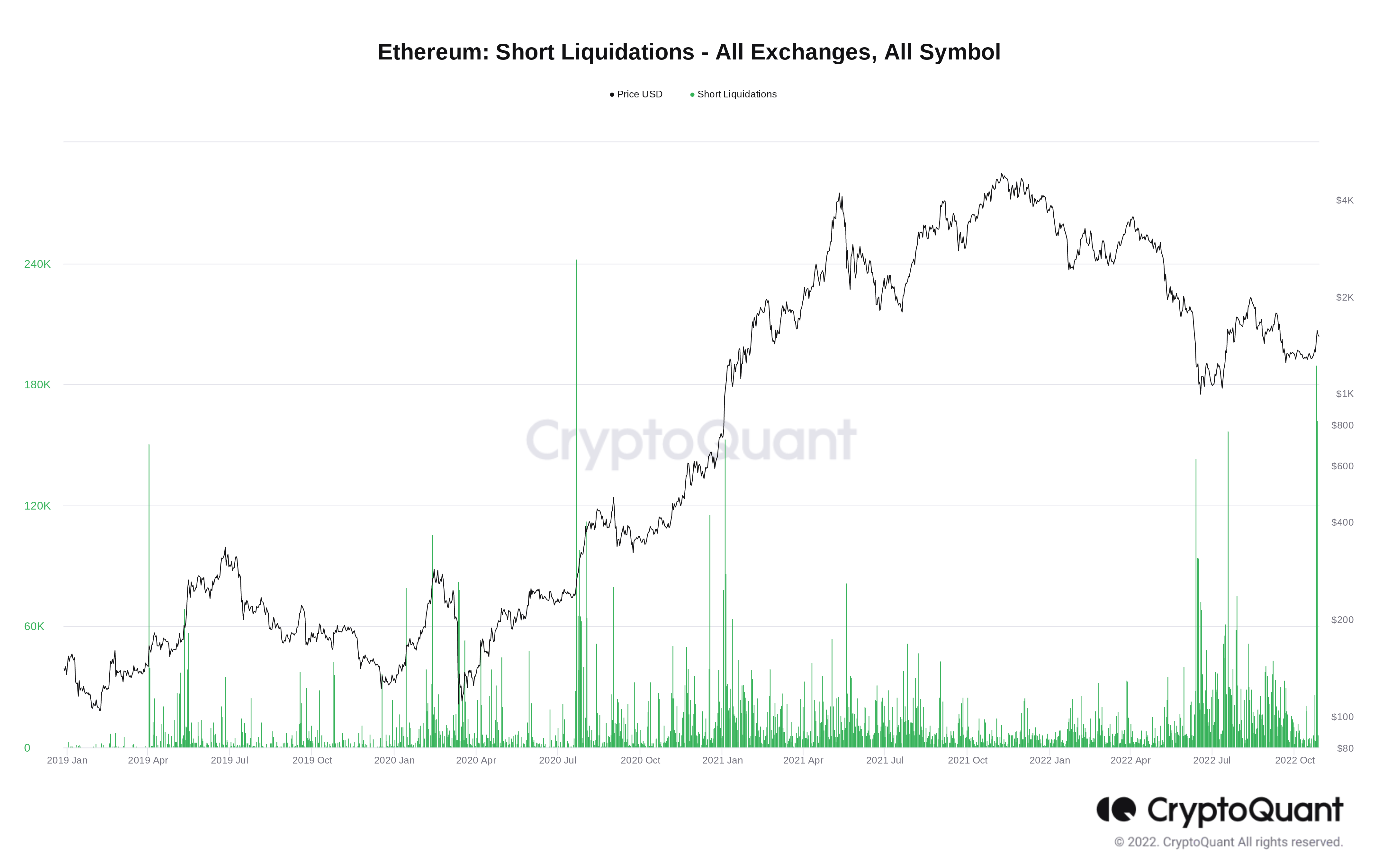

Over half a billion dollars’ price of positions easily wiped in 2 days and never a record in ETH — the need for the positions totaled 189,638 ETH and 161,986 ETH, correspondingly.

“$ETH short squeezes during the last two consecutive days. Daily short liquidations across all exchanges arrived at an exciting-time high,” CryptoQuant Chief executive officer, Ki Youthful Ju, commented around the data.

BTC gets rid of speculators

As Cointelegraph reported, the image on Bitcoin was broadly similar as cost performance solidified.

Related: Bitcoin weak hands ‘mostly gone’ as BTC ignores Amazon . com, Meta stock dip

Based on the latest figures from on-chain analytics resource Coinglass, March. 25 and 26 saw $328 million and $332 million of short liquidations, correspondingly, across exchanges.

The tally for March. 27 had been reduced at $5.seven million, this firmly consistent with established norms as Bitcoin consolidated above $20,000.

Nevertheless, exchange users were betting around the rally ongoing, as evidenced through the largest-ever daily BTC balance decrease on major exchange Binance.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.