The cost of Optimism (OP) continues to be skyrocketing forever of This summer because of its closeness to Ethereum.

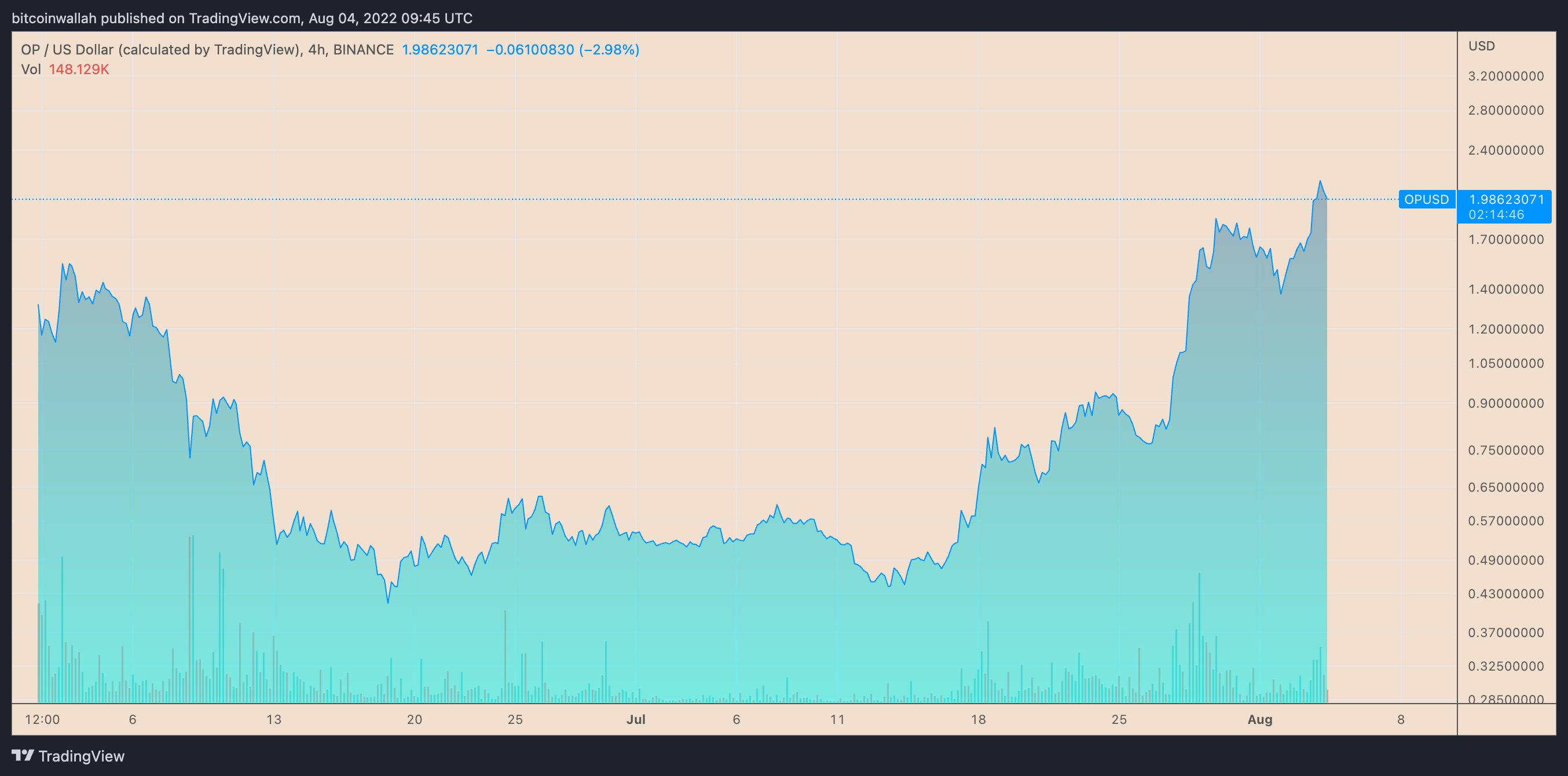

Particularly, OP’s cost rallied by nearly 300% in more than a month to achieve $2.31, its second-greatest level on record, on August. 4. The token received its bullish cues mainly in the excitement surrounding Ethereum’s potential transition to proof-of-stake in September with an upgrade known as “the Merge.”

Why the “Optimism”

In conclusion: Optimism is definitely an Ethereum rollup solution. Quite simply, the so-known as layer-2 solution handles a lot of money of Ethereum’s transaction verifications off-chain to improve scalability around the primary chain.

Optimism may need the Merge because of Ethereum’s “Rollup-Centric Roadmap,” which turns its primary chain right into a settlement and knowledge availability layer and places scalability at the disposal of layer-2 rollups via “danksharding.”

“Presently, using the combined rollup and Ethereum architecture, the present Ethereum-only transaction throughput of 15–45 TPS could scale up to 1,000–4,000 TPS,” noted Ally Zach, a investigator at Messari, adding:

“The development of shards has expanded the information storage convenience of rollups to improve this throughput to [the] north of 100,000 TPS.”

That explains why OP along with other layer-2 tokens have responded positively to the Merge announcement on This summer 15.

OP cost could drop 30% in August

Despite strong fundamentals, OP’s technical metrics suggest its rally could exhaust within the coming days.

Around the four-hour chart, OP’s rising cost coincides using its falling relative strength index (RSI), indicating “bearish divergence.” Meanwhile, the attempted breakout over the $2-level has faced strong rejection two times since This summer 29, including its 15% drawdown after peaking out in your area at $2.31 on August. 4.

Therefore, a long correction might have OP test its 50-4H exponential moving average (50-4H EMA the red wave) near $1.54 since it’s interim downside target. This curvy level has limited OP’s downside attempt on August. 2.

Related: Ethereum average gas fee falls lower to $1.57, the cheapest since 2020

Furthermore, a rest underneath the 50-4H EMA could push OP to $1.36, lower 30% from August. 4’s cost. Interestingly, the $1.36-level also offered as support in August and coincides having a multi-month climbing trendline support.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.