Inside a May 30 tweet, Ethereum (ETH) core developer Tim Beiko confirmed the much-anticipated Ropsten testnet trial from the Merge from proof-of-try to proof-of-stake should be expected “around June 21 approximately.”

Interestingly, Ether’s cost action is comparatively unchanged regardless of the unpredicted bullish announcement. There is a +10% spike on May 30, but individuals gains received back between May 31 and June 2. The cool thing is the Merge — presently anticipated in August — has not yet been priced in, giving traders and investors a potential early entrant advantage.

It’s necessary to monitor on-chain data

From your investing and buying and selling point of view, cryptocurrency markets possess a distinct disadvantage in comparison to controlled markets and transparency. The stock exchange is filled with legally needed disclosures. In the stock exchange, the retail trader can identify the number of shares of the stock are short, what institution bought (or offered) a sizable disclosed amount, what insiders bought or offered and an array of other kinds of knowledge.

The cryptocurrency markets don’t have individuals types of legal needs. Actually, the general public doesn’t determine if the Bitcoin (BTC) or Ethereum being bought and offered with an exchange may be the real cryptocurrency or a kind of internal derivative accustomed to facilitate liquidity. But crypto markets have something much better than the stock exchange and that’s on-chain data.

On-chain data enables investors and traders to watch a blockchain’s network activity. It may respond to questions: The number of Ether are now being delivered to an exchange? What are the large transactions? Are any “whale” wallets bigger or smaller sized? On-chain data might help see whether an investor or investor ought to be bullish or bearish.

On-chain data that measure inflows and outflows are frequently accustomed to determine a of whether a cryptocurrency is bullish or bearish. Inflow measurements are cryptocurrencies entering an exchange from outdoors wallets and therefore are frequently regarded as an indication of incoming selling pressure. Output measurements are cryptocurrencies exiting an exchange to exterior wallets and therefore are frequently regarded as an indication of holding or accumulation.

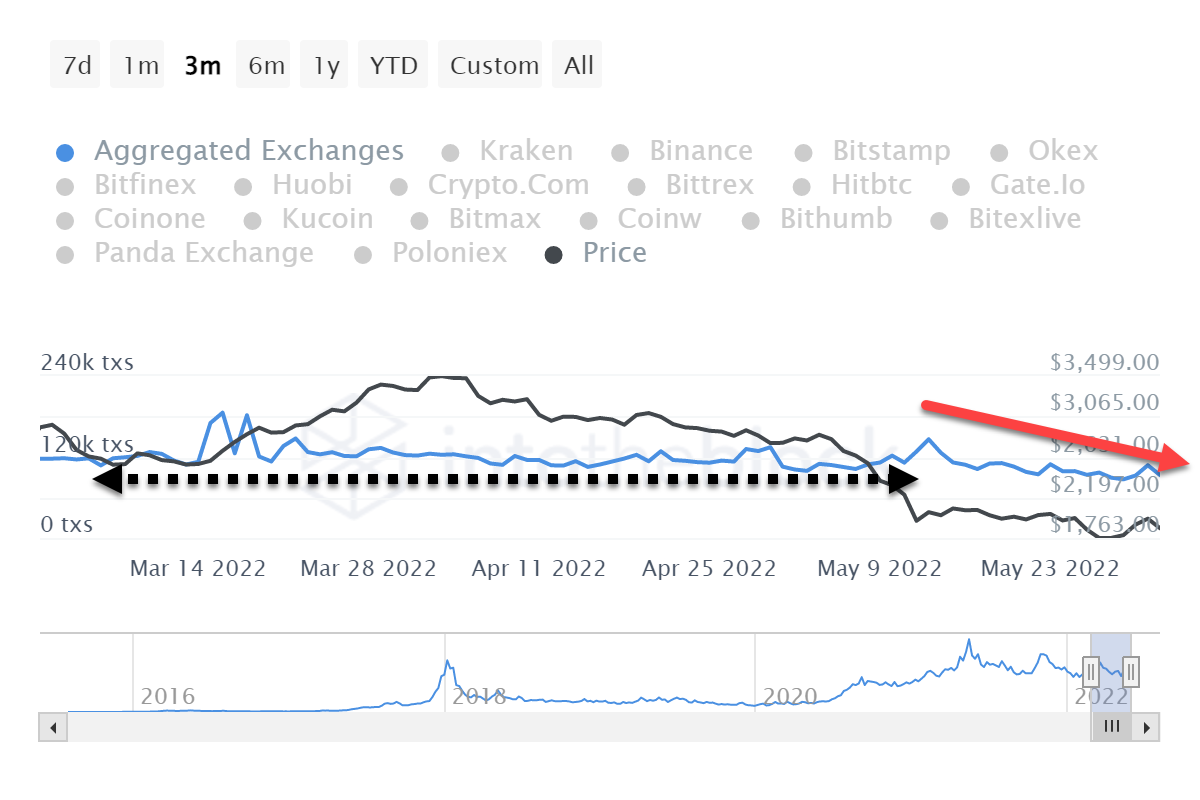

The amount of inflow transactions has remained relatively flat in the last three several weeks, having a noticeable drop since the center of May.

- Inflow 24h change: -13.50%

- Inflow 7-day change: -5.87%

- Inflow 30-day change: -8.08%

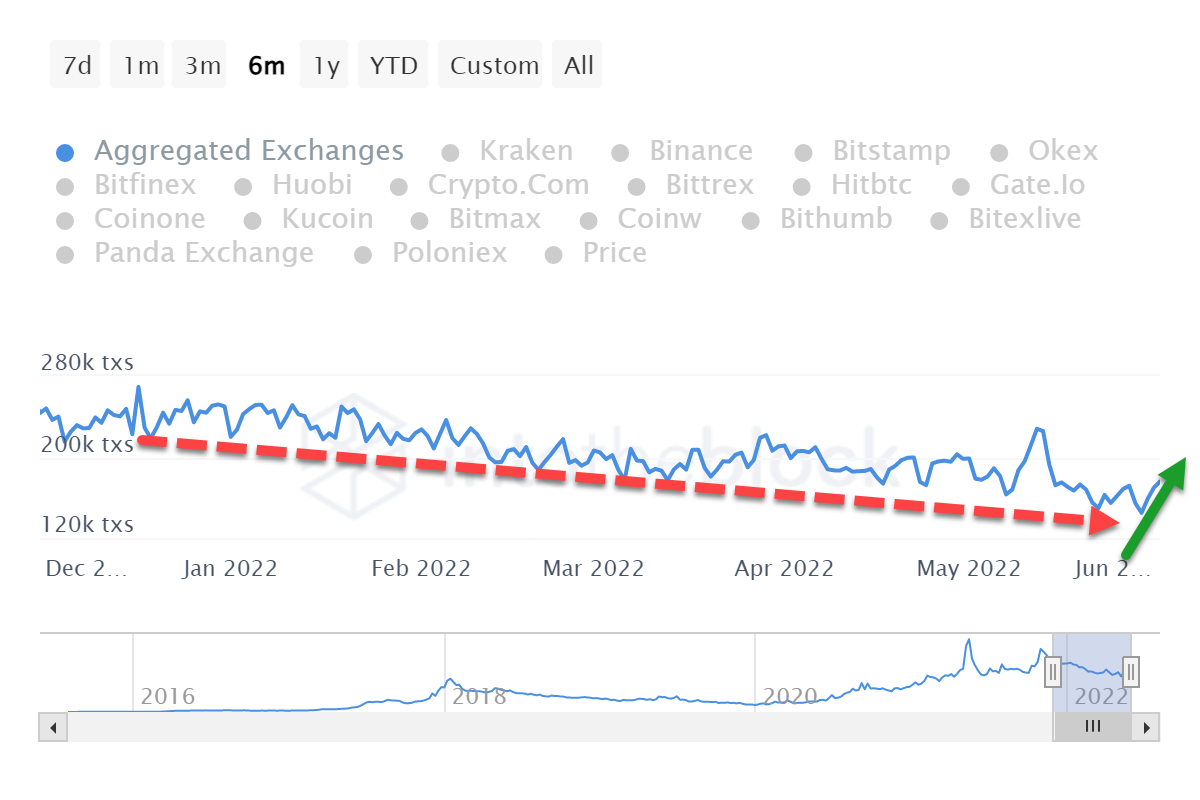

However, the amount of output transactions has declined since March. Additionally, there is a significant output spike on May 12, the date of the very most recent Ether flash crash, adopted with a resumption of the loss of outflows.

- Output 24h-change: +3.62%

- Output 7-day change: +8.87%

- Output 30-day change: -1.56%

You should observe that since May 29, outflows have elevated and inflows have decreased. This may be a bullish signal that big bucks is accumulating.

Related: 3 key indicators traders use to find out when altcoin season begins

Ether cost remains at major swing lows and oscillators are in historic lows

The approaching Merge event is among the most critical in Ethereum’s history. It’s rare to determine the world’s second best cryptocurrency remaining at 200-day lows and lower greater than 60% from the all-time high.

Possibly the most crucial and relevant details for Ether are the positioning of the relative strength index and also the composite index.

The weekly relative strength index remains in bull market conditions, but is simply over the final oversold degree of 40. The present worth of 42.15 may be the cheapest because the week of March 18, 2019.

The composite index, likewise, reaches near a historic low. The composite index, produced by Connie Brown, is basically the RSI having a momentum indicator. It’s an unbounded oscillator and may catch divergences the RSI cannot. The weekly composite index value may be the third cheapest in Ethereum’s background and the cheapest because the week of March 26, 2018.

The ultimate oversold readings around the Ether weekly chart, increase in outflows and decrease in inflows can provide Ethereum investors and traders a very good reason to become bullish soon. However, any potential bullish reaction will probably be quick and abrupt, but restricted to the 2022 volume reason for control at $2,600.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.