Your opportunity of ETHPOW (ETHW) across multiple crypto exchanges continues to be adopted with a huge stop by cost despite some initial success.

ETHPOW drops 80%

Around the daily chart, ETHW’s cost came by greater than 80% to $25 on Sept. 10, more than a month after its market debut.

To begin with, ETHPOW only exists like a futures ticker, for the time being, created in anticipation that the approaching network update on Ethereum could cause a series split.

Ethereum will undergo a major protocol change known as the Merge by mid-September, switching its existing consensus mechanism from proof-of-work (Bang) to proof-of-stake (PoS).

Therefore, Ethereum will obsolete its army of miners, replacing all of them with “validators,” that are nodes that will carry out the same tasks by just staking some tokens using the network.

Consequently, current Ethereum miners will have to migrate with other Bang chains or shut lower. Ethereum Classic (ETC), which carries the initial Ethereum Bang code, has benefited probably the most by becoming a haven for such miners.

For example, the chart below shows Ethereum Classic’s hashrate rising and Ethereum’s hash rate shedding dads and moms prior to the Merge.

But Ethereum Classic might not be your best option for ETH miners.

Chandler Guo, probably the most prominent crypto miners, has suggested that miners still validate and add blocks to the present Bang Ethereum chain publish-Merge. This so-known as contentious hard fork would keep your current Ethereum Bang chain alive, which Guo and supporters have termed ETHPOW.

And just like the Ethereum blockchain has its own native gold coin in Ether (ETH), the brand new ETHPOW chain may have its asset known as ETHW. Anybody holding ETH in front of the Merge will get the same quantity of ETHW following the potential chain split.

Related: Ethereum Merge can trigger high volatility, BitMEX Chief executive officer warns

However, because of the significant downside chance of ETHPOW, traders seem to be much more comfortable holding ETH, enabling these to receive ETHW too should a series split occur.

History indicate $ETH Bang forks would be best offered. ETHW IOUs are actually $30-33 (-67% from 30 days ago). I would not sell the forks — in situation it does not happen — as well as your $ETH is locked in to the contract.

Therefore if you are fast, consider this like a free 1.7% dividend in your $ETH. https://t.co/RRCc7kmV24

— Mira Christanto (@asiahodl) September 9, 2022

Additionally, decreasing ETHW cost might also claim that traders are betting that the Ethereum chain split has become not as likely.

Paradigm report cast another bearish blow on ETHW

Inside a report printed Sept. 1, crypto investment firm Paradigm argues that the price of one ETHW token shouldn’t be greater than $18 after launch. That’s nearly 90% underneath the token’s record a lot of $198, established on August. 9.

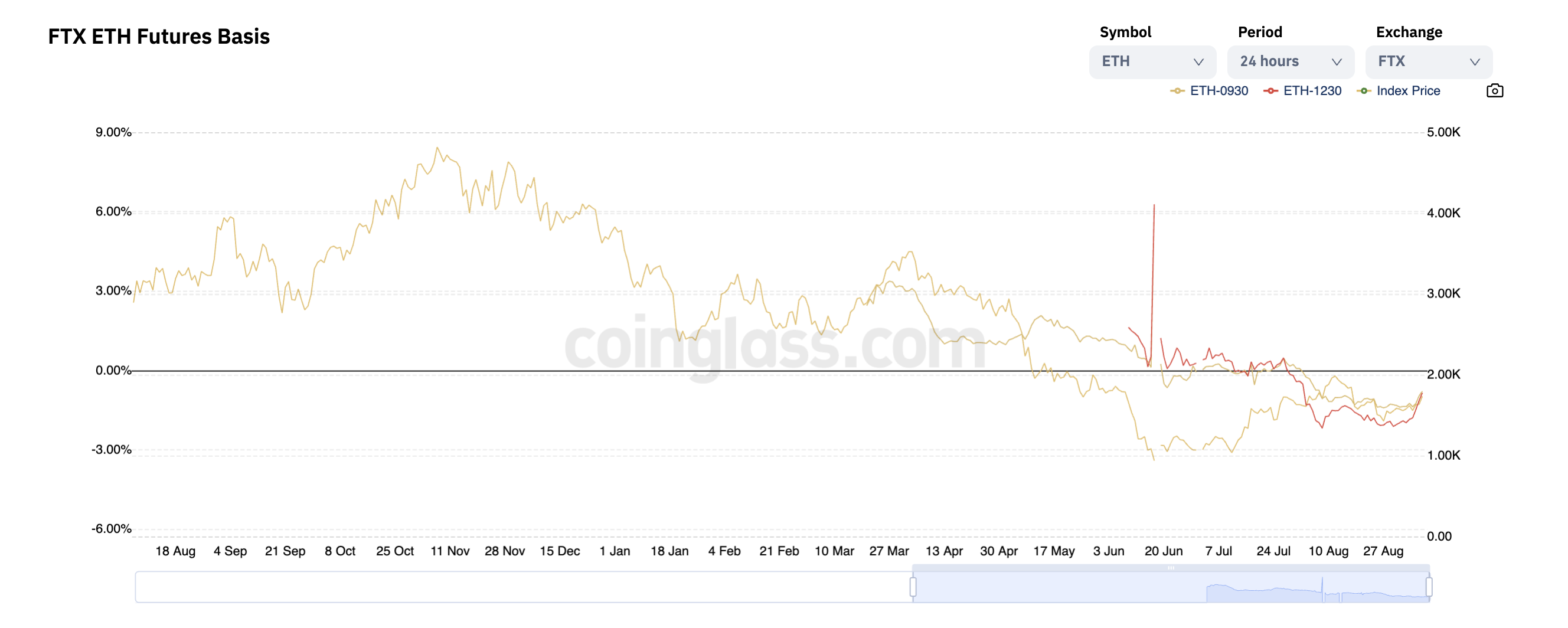

The firm reported backwardation, when futures trade less than the place prices, within the Ethereum Sept. 30 futures contracts as the explanation for its $18-cost target for ETHPOW.

The report highlights that some exchanges, including FTX and Deribit, will appraise the rates of the ETH futures/perpetual contracts by referencing Ethereum’s PoS version.

Because the ETH futures cost now trades in an $18 discount when compared with place prices, the ETHPOW token could draw a minimum of an $18 valuation upon the possibility fork.

“We are able to infer just how much the marketplace estimates ETH Bang is definitely worth from simply searching at place-future basis, since place = POS + Bang, while future is simply POS,” the report described, adding:

“Presently, the foundation is implying ETH Bang to become priced ~$18, that is ~1.5% of ETH market cap.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.