The economist Benjamin Graham, recognized to some because the father of worth investing, once compared the marketplace to some voting machine within the short term along with a weighing machine over time. While Graham likely could have been skeptical at the best about crypto and it is built-in volatility had he resided to determine it, his economic theory nonetheless pertains to certain aspects within.

Because the emergence of altcoins, the blockchain space has operated almost solely like a “voting machine.” Many projects have, generally, been financially unsuccessful as well as harmful to investors and also the space in particular. They’ve, rather, switched crypto right into a memelord recognition contest, as well as their success with that front can’t be understated. Sometimes that competition is dependant on who promises the very best future use situation — but whether that future really arrives is yet another issue altogether. Frequently it’s according to who markets themselves best, through sophisticated-searching infographics or absurd token names and a number of connected “dank” memes. Anything, the prosperity of nearly all projects is dependant on speculation and very little else. This is exactly what Graham was talking about as that “voting machine.”

So, what’s wrong here? Many prescient individuals have made existence-altering money while playing the sport, and also the constant talk of funding and building potentially world-altering decentralized tech may be the norm, therefore it appears such as the space happens to be an ideal atmosphere for founders and developers, right? It’s not. These successes have frequently come at the fee for unsophisticated, anxiously misguided investing rookies. In addition, the majority of that value winds up at the disposal of the ever-present so-known as vaporware retailers who propagate nothing more than misplaced value and damaged promises. So, where’s Graham’s weighing machine, so when does it begin to enact its pressure? In fact, at this time.

Related: The decoupling manifesto: Mapping the next thing from the crypto journey

The crypto crash versus. the us dot-com bubble

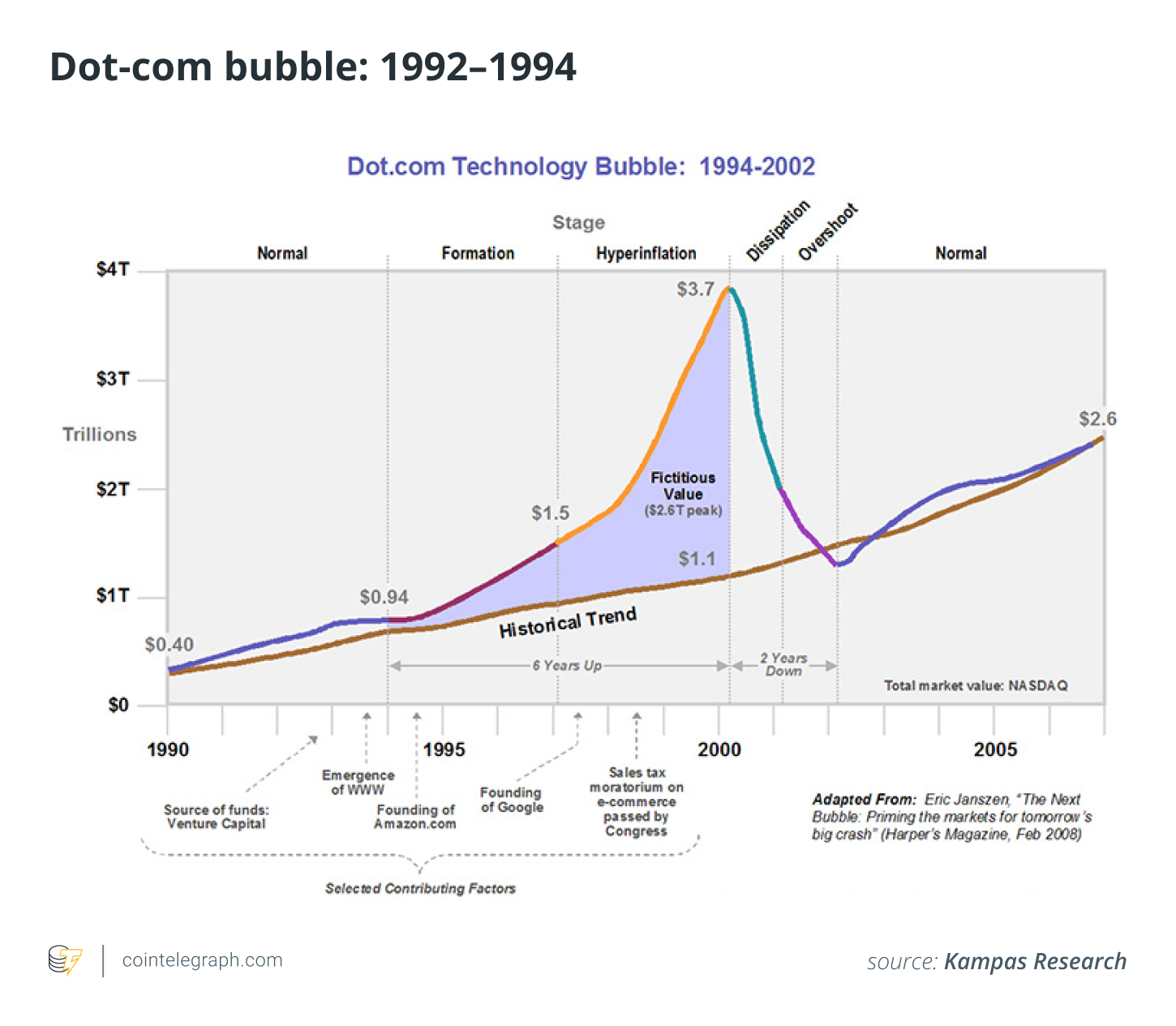

The us dot-com bubble is a perfect historic precedent for the purposes. The 2 spaces share an exuberance to shoehorn developing tech into issues that don’t exist, excessive use of capital, ambitious promises without any hard tech backing them, and lastly, a gross misunderstanding of the items any one of this really is even about for the investor (begin to see the domain claims for pets.com, radio.com, broadcast.com, etc.)

Why did individuals companies ever even gain favor? Since they had apparent names. When the brunt of investors don’t know very well what they’re buying but wish to join the party, why don’t you choose a point-blank name?

Related: Would you still compare Bitcoin towards the tulip bubble? Stop!

In addition to this, the figures are uncannily similar. Let’s put these in perspective:

- In 2000, the us dot-com sector peaked at $2.95 trillion. Comprising inflation, that might be $4.95 trillion during the time of penning this.

- After that it slumped to some low of $1.195 trillion. Comprising inflation, that might be $3.27 trillion during the time of penning this.

- The entire market cap of crypto arrived at $2.8 trillion. Comprising inflation, that might be $1.67 trillion in 2000.

- It’s now in a low of $1.23 trillion. Comprising inflation, it might be $.073 trillion in 2000.

- The delta between your peak from the us dot-com bubble is 59.5% from high to low.

- The delta between your peak of the present crypto bubble is 56% from high to low.

Inflation will skew these slightly, but take the time to think about that Apple alone reaches a market cap of $2.45 trillion during the time of writing. Just one tech sector stock has got the same market capital as all crypto and 1 / 2 of the us dot-com sector when adjusted for inflation.

Velocity begets volatility

As gloomy as that downturn appears, it isn’t an emergency. Imagine understanding the market bottom have been arrived at for that tech sector in, say, 2003. Everyone was convinced the tech sector was on its last legs. Sure, the figures above could (and really should) be used having a heavy touch of suspicion, and something could keep in mind that history doesn’t necessarily repeat itself exactly — rather, it rhymes. Since entering the blockchain space in 2016, I’ve viewed it move quicker than virtually every other financial sector. The needed persistence to hold back out a crypto downturn requires much less strength compared to waiting period between 2003 and 2010.

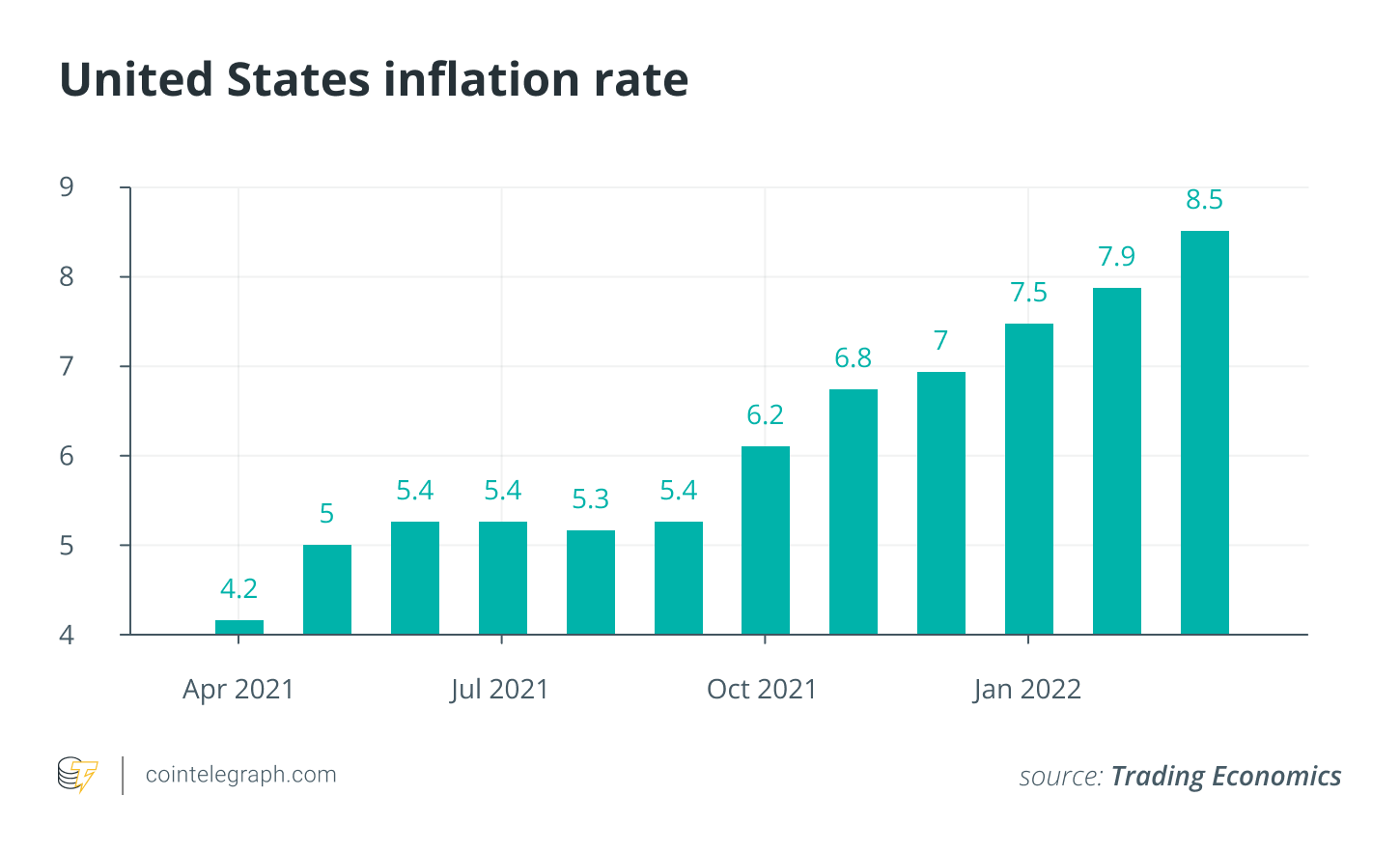

Previously couple of several weeks, crypto has concurrently attracted the shortest straw from macroeconomic forces and experienced another “black swan event” like Mt. Gox, the 2017–2018 crypto winter and the 2020 crash. Now, it had been the Terra crash.

All these occasions typed disaster, ruin, plague and dying for that average investor yet in some way, developers ongoing to build up, miners and node operators ongoing to function, and smart money ongoing to purchase. (Funds like a16z, StarkWare and LayerZero elevated about $15 billion combined fairly lately). Why? Emotional decisions that influence one group don’t always influence all of the others. One of these simple data sets is susceptible to it, as the other has overcome it. They are individuals and entities who don’t feel below par about beating you. They don’t shame causing you to generate losses. They don’t feel anything until they’ve recognized a loss of revenue — full stop. Quite simply, emotion inherently should be taken off the equation regarding decision-making.

Related: The decoupling manifesto: Mapping the next thing from the crypto journey

The way the Terra saga affects you, and just what comes next

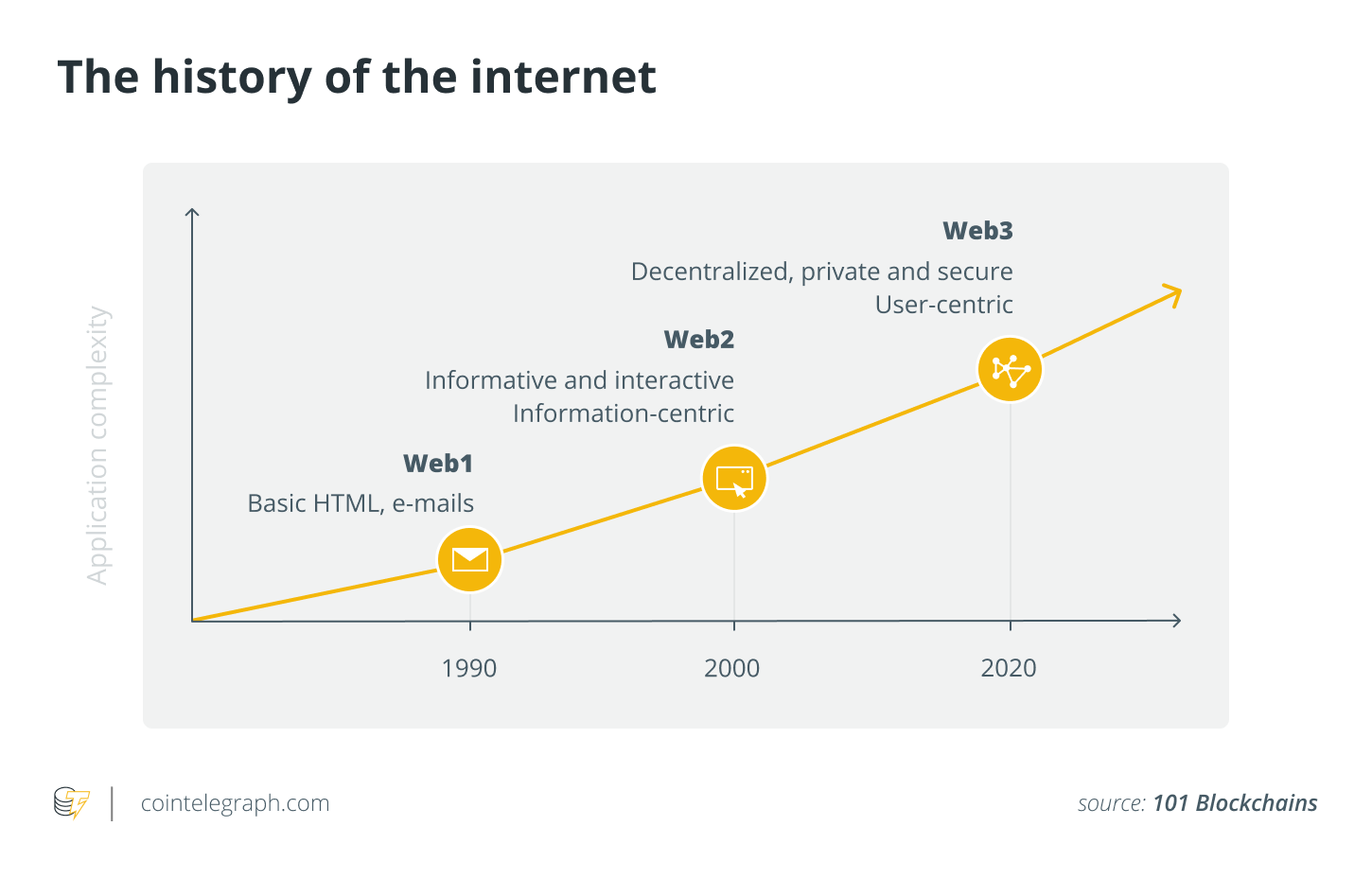

Odds are, the Terra crash continuously ruin your portfolio and reassurance. Meanwhile, the ever-present stoic investors rear their ugly mind, getting offered the very best just days ago and allowing you to plummet to some 70% loss. But don’t panic. Consider the good reputation for the web, and think about this rather. It’s difficult to say precisely where we’re on the market adoption cycle of crypto and just how far we’re from the time it genuinely trims body fat. However, it will appear like we’re very close, and situations are moving considerably faster compared to us dot-com sector did.

All of this creates a relatively straightforward framework for many intelligent lengthy-term investment opportunities — particularly if you take notice of the means by which increasingly more average users adopt Web3. If broadband was the inciting incident that brought to massive user growth, I’d argue a simple-to-use Web3 wallet that needs no setup to have interaction with plenty of blockchains is going to be crypto’s similar incident. Strangely enough, Robinhood lately announced it might be releasing an easy-to-use Web3 wallet really soon. When a solution like this arrives that enables for Web3 interaction with only a couple of clicks, the floodgates will completely open.

After that, it’s dependent on figuring out exactly what the blue chips sitting at the very top 20–30 market capitalizations of crypto is going to be, after which buying and just being patient. However , there aren’t any guarantees, with the exception of hindsight, and also the closer an industry approaches the purpose of maturation, the less upside can be obtained towards the investor. Probably the most prudent factor to complete would be to spend some time and approach buying a new space such as this having a obvious, defined strategy.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Axel Nussbaumer may be the v . p . of digital asset management at Blockmetrix, a Dallas-based Bitcoin mining company. Before just as one entrepreneur in 2015, he studied business at Southern Methodist College and labored for any private equity finance fund located in Texas. In 2016, he shifted focus to blockchain technology. His early interest and participation within the space have brought to multiple effective investments and an abundance of experience and understanding, that they has imparted on the net for example Nasdaq and Forbes.