Bitcoin (BTC) cost faster its sell-off on November. 21 hitting a brand new yearly low at $15,654.

The move follows an industry-wide decline which was catalyzed by investors running for that hillsides in fear the FTX-caused contagion would infect every corner from the crypto sector.

Stocks also closed your day at a negative balance, using the tech-heavy Nasdaq lower 1% and also the S&P 500 losing .42% on the rear of investors’ concerns about rising rates of interest.

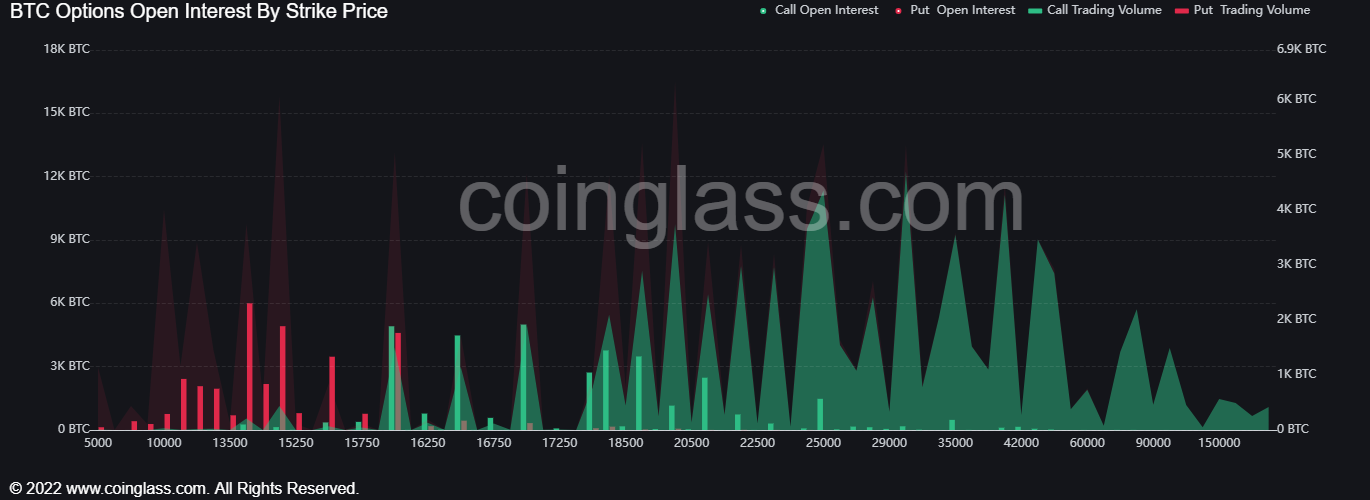

Data from Coinglass shows over $100 million in leverage longs were liquidated on November. 20 and November. 21 as investors fear an faster sell-if Digital Currency Group (DCG) and BlockFi neglect to secure funding and have to declare personal bankruptcy.

Some analysts are betting on Bitcoin cost declining below $14,000 which may put another 10,000 BTC in danger of liquidation.

Let’s investigate primary explanations why the Bitcoin cost is lower today.

On-chain data cites historic “peak recognized losses”

Bitcoin cost is reacting towards the stress placed available on the market through the FTX prevalent contagion, reaching an annual low following a period where lots of thought a bear market bottom have been found.

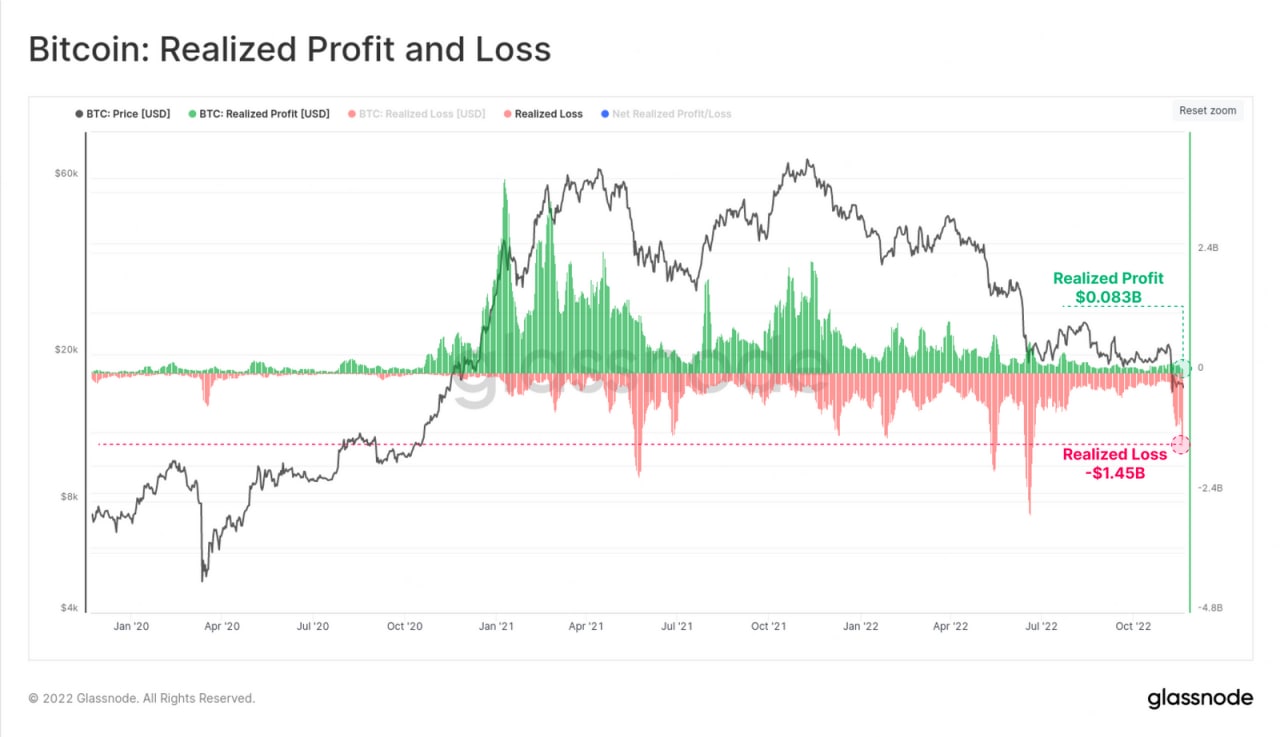

Data from Glassnode shows $1.45 billion in recognized losses for that week of November. 12, ranking because the 4th largest ever.

Based on Glassnode:

“A comparably small $83M in recognized profits happened, suggesting that most spent volume at the moment is sourced from investors in the current cycle”

Rising rates of interest in america and abroad weigh on Bitcoin cost

In line with the Consumer Cost Index Report, inflation within the U . s . States elevated by .6% in September when compared to previous month.

The Customer Cost Index report – probably the most broadly adopted barometer of inflationary pressure within the U . s . States – rose 8.2% in September when compared to same month last year, a little more compared to 8.1% predicted by experts.

Using the approaching CPI reporting event on November. 10, Bitcoin saw an unpredictable 12% loss of 24 hrs hitting record lows for 2022.

Investors fear contagion will touch every corner from the crypto market

DCG’s Grayscale Bitcoin Trust holds 633,000 BTC, placing it among the largest holders from the digital asset. Another DCG subsidiary, Genesis Buying and selling has contact with FTX and also the recent volatility leaves an evident $1 billion hole within their balance sheet. The truth that Genesis is battling to secure funding, and signaling that it could don’t have any alternative choice but to launch personal bankruptcy, causes investors to think another next black swan event is incorporated in the making.

Related: Exactly why is the crypto market lower today?

Based on the Wall Street Journal, BlockFi is yet another crypto-focused company facing imminent personal bankruptcy whether it cannot look for a purchaser. This really is further proof that fallout from FTX will continue to ripple through large companies with exposure.

SoFi can also be pressurized from regulators. The Senate Bank Committee cautioned the organization in letters on November. 21 to adapt to banking standards. An answer by SoFi is required by 12 ,. 8.

What is the opportunity for Bitcoin cost to reverse course?

Rapid-term uncertainties within the crypto market don’t have the symptoms of altered institutional investors’ lengthy-term outlook. Based on BNY Mellon Chief executive officer Robin Vince, a poll commissioned through the bank discovered that 91% of institutional investors were interested in purchasing tokenized assets within the following years.

Around 40% of these curently have cryptocurrency within their portfolios and roughly 75% are positively purchasing digital assets or thinking about doing this.

Worries are high following the FTX meltdown and also the large divestment from Bitcoin is reflected through the high recognized losses and growing short interest being registered by on-chain and derivatives data.

Within the lengthy term market participants still expect the cost of Bitcoin to increase, especially as increasing numbers of banks and banking institutions are apparently embracing digital cash for settlement purposes even amongst the chaos.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.