Manchester U . s . Fan Token (MUFC) is really a dead gold coin and never associated with the sports franchise, only one Elon Musk tweet was enough to bring back it on August. 17.

Also, I’m buying Manchester U . s . ur welcome

— Elon Musk (@elonmusk) August 17, 2022

Fake Man U token pumps after Elon Musk’s tweet

To explain, MUFC isn’t an official Manchester U . s . crypto token. It found existence in August 2021 following a group of programmers, who’re stated to become hardcore Manchester U . s . fans, falsely claimed that holding MUFC will give buye affect on the football club’s decisions.

They later conducted an “airdrop” round of 10,000,000,000 MUFC in November 2021, promising to supply 10,000 MUFC to users who adopted its official social networking handles. The prospects of having free MUFC tokens helped its cost rally up to $1.

However the project switched to be vaporware, eventually leading MUFC lower by 100% after November. It had been considered extinct until a tweet from millionaire entrepreneur Elon Musk on August. 17 elevated it from oblivion.

The Tesla Chief executive officer tweeted he would purchase the Manchester U . s . soccer club, that they later accepted would be a “lengthy-running joke.”

No, this can be a lengthy-running joke on Twitter. I am not buying any teams.

— Elon Musk (@elonmusk) August 17, 2022

Nevertheless, the content sent the financial assets associated with Manchester U . s . soaring, including its stock MANU, which rose 1.97% in pre-market buying and selling, and Tezos (XTZ), the club’s official blockchain and training partner, whose market valuation surged by $138.85 million.

Even Manchester City’s official crypto token, CITY, sprang greater by nearly 14% to achieve $7 per piece after Musk’s tweet, despite Manchester City as being a different soccer club.

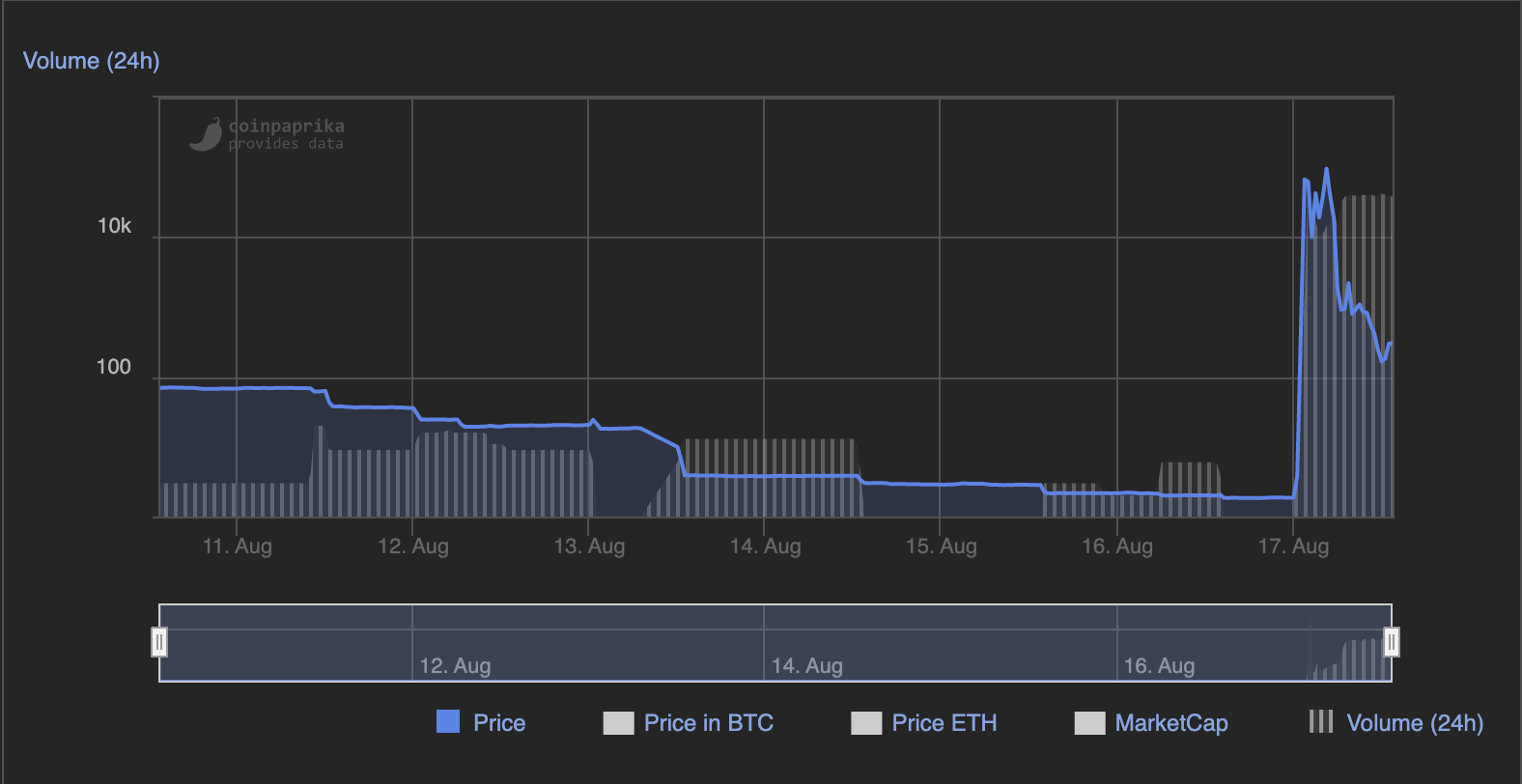

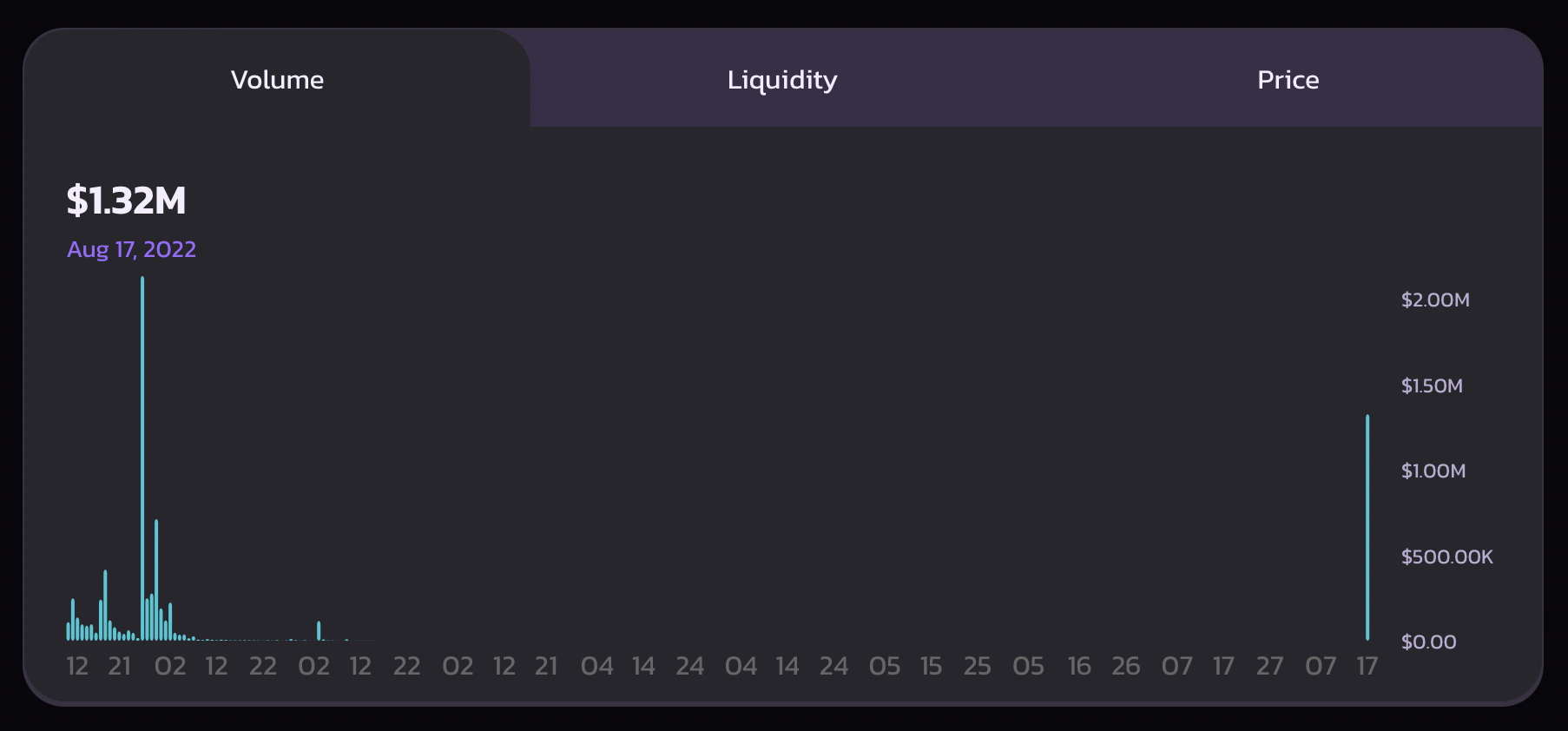

However, MUFC surged by over 3,000% hrs after Musk’s tweet about buying Manchester U . s ., according to data fetched by CoinPaprika.com.

“Manchester U . s . fan token” has zero liquidity

However, the MUFC rally seems to become cost manipulation because of very poor liquidity and volume.

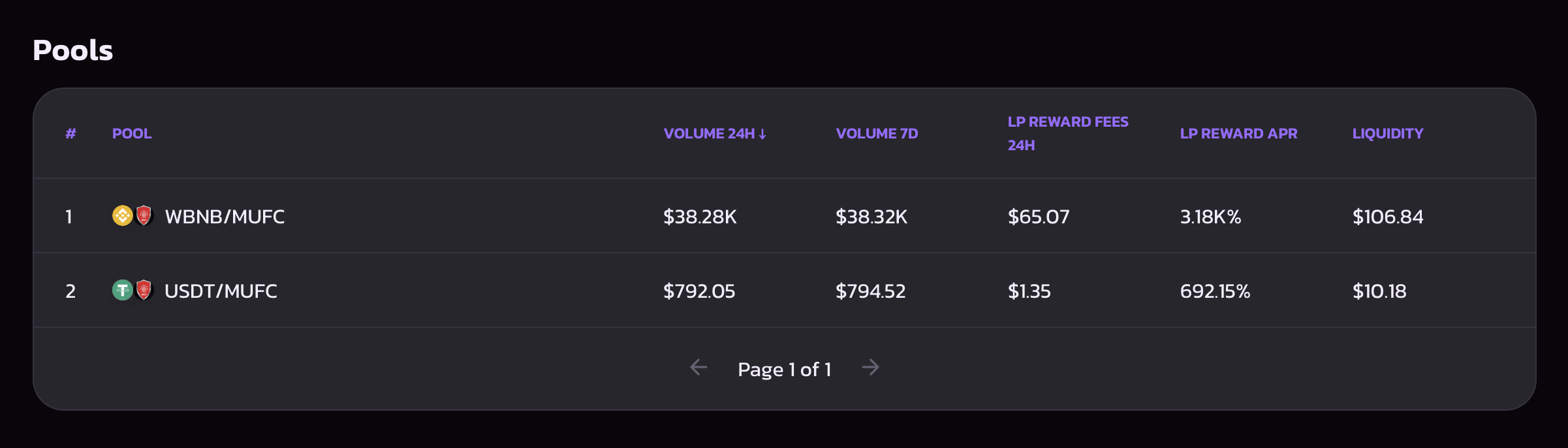

Particularly, within the last 24 hrs, MUFC have been buying and selling only against two crypto assets: WBNB and USDT. As the liquidity for that WBNB/MUFC pair was mere $106.84, it had been lower for that USDT/MUFC pair around $10, according to data from PancakeSwap, a decentralized exchange.

Meanwhile, the internet volume that backed MUFC’s 3,000% rally was roughly $39,000 within the last 24 hrs, suggesting less traders behind the main upside move.

Thus, a small amount of speculators likely used MUFC’s poor liquidity to artificially pump the token. The amount of traders who bought the false upside narrative remains unclear, but given thatMUFC has came by 50% from the local top, the chance that it is rate would go back to zero is high.

Related: Crypto scams fall 65% after naive noobs exit the trade: Chainalysis

Meanwhile, the incident reasserts Musk’s strong affect on the crypto market, especially on memecoins like Dogecoin.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.