There’s a classic saying, “cash rules,” but if it’s relaxing in a financial institution account or, within the situation of crypto — a wallet, it diminishes daily because of inflation. This is particularly the situation now as inflation within the U . s . States breaks its 40-year record. As the dollar-cost-averaging (DCA) strategy enables a trader to minimize the results of volatility by buying an unsound asset over time times, inflation still causes home loan business a target asset’s value with time.

For example, Solana (SOL) includes a pre-set protocol inflation rate of 8%, and when the yield isn’t generated through farming or utilizing decentralized finance (DeFi), one’s holdings are depreciating for a price of 8% each year.

However, regardless of the U.S. Dollar Index (DXY) growing by 17.3% each year, by This summer 13, 2022, the about receiving significant returns within the bull market continue to be pushing investors to interact with volatile assets.

Within the approaching “Blockchain Adoption and employ Cases: Finding Solutions in Surprising Ways” report, Cointelegraph Research will dig much deeper into different solutions that can help to face up to inflation within the bear market.

Download and buy reports around the Cointelegraph Research Terminal.

Crypto winter is really a period where anxiety, panic and depression begin to burden investors. However, many crypto cycles have proven that real value capture could be achieved throughout a bear market. For a lot of, the present sentiment is the fact that “buying and holding,” coupled with DCA, might be among the best investment opportunities throughout a crypto winter.

Generally, investors refrain from outright investment and gather capital to buy assets once the macro condition improves. However, timing the marketplace is challenging and it is only achievable for active daily traders. In comparison, the typical retail investor carries greater risks and it is more susceptible to losses originating from rapid market changes.

What to do?

In the middle of various calamities within the crypto world, placing assets in staking nodes on-chain, locking in liquidity pools or generating yield through centralized exchanges all have a hefty quantity of risk. Given individuals uncertainties, the large querry is still whether it’s better to just buy and hodl.

Anchor Protocol, Celsius along with other yield platforms have lately shown when the building blocks of yield generation is poorly supported by the tokenomics model or even the platform’s investment decisions, too-good-to-be-true yields might be substituted with a wave of liquidations. Generating yield on idle digital assets via centralized or decentralized finance protocols with robust risk management, liquid rewards and yield choices that aren’t too aggressive is most likely minimal dangerous path for fighting inflation.

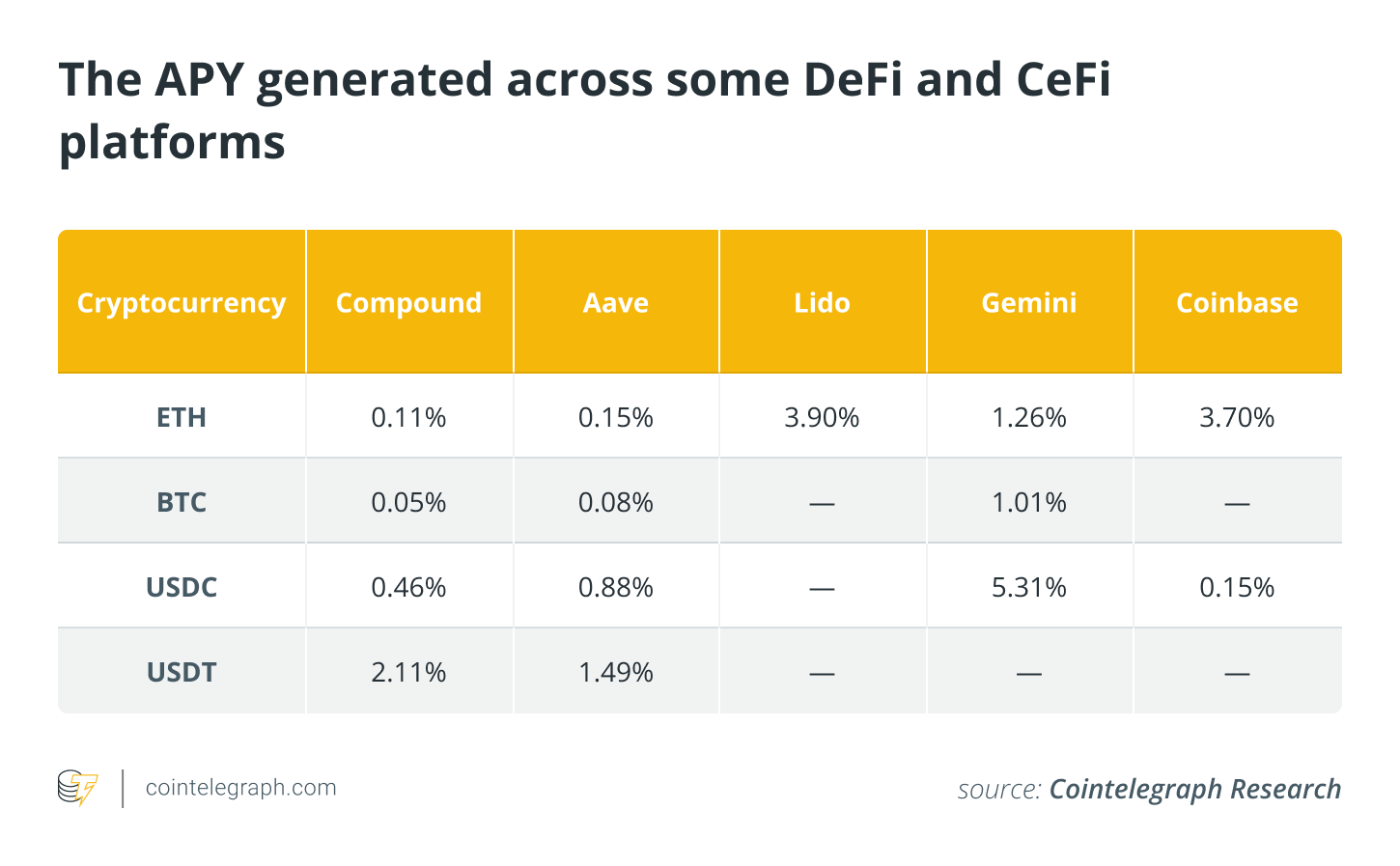

Both DeFi and centralized finance (CeFi) protocols can provide different amounts of yields for identical digital assets. With DeFi protocols, the chance of lock-ups to create marginal yield is an additional major factor, because it limits an investor’s capability to react rapidly if the market adversely change. Furthermore, strategies may carry additional risks. For example, Lido liquid staking with stETH derivative contracts is susceptible to cost divergence in the underlying asset.

Although CeFi for example Gemini and Coinbase, unlike multiple other such platforms, have shown prudent user fund management with transparency, yield choices on digital assets are minor. While remaining inside the risk management framework and never taking aggressive risks using the user’s funds is advantageous, the returns are relatively low.

And keep a buying discipline inside the DCA framework and doing research are very important, locating a low-risk solution generating substantial yields might be tricky. Meanwhile, a brand new crypto market cycle is placed to create developments which will hopefully bring novel solutions, attractive both in risk and returns. Cointelegraph Research evaluates multiple platforms and assesses the sustainability of current DeFi and CeFi yields in the approaching report.

This information is for information purposes only to represent neither investment recommendations nor a good investment analysis or perhaps an invitation to purchase or sell financial instruments. Particularly, the document doesn’t function as a replacement for individual investment or any other advice.