Trust Wallet Token (TWT) has surged by nearly 150% within the last six days, bucking the downturn within the cryptocurrency market, whose internet capital has crashed by almost $100 billion within the same period.

TWT whale accumulation accumulates momentum

TWT’s cost arrived at an intraday a lot of $2.43 on November. 15, each day after creating an archive high at nearly $2.75. At its cheapest in 2022, the token was altering hands for $.40, that makes it among the year’s best-performing assets, with more than 225% year-to-date gains.

The Trust Wallet Token’s upward trend selected up momentum in November following a collapse of Mike Bankman-Fried’s FTX, prompting a financial institution run situation in which traders withdrew their from exchanges en masse.

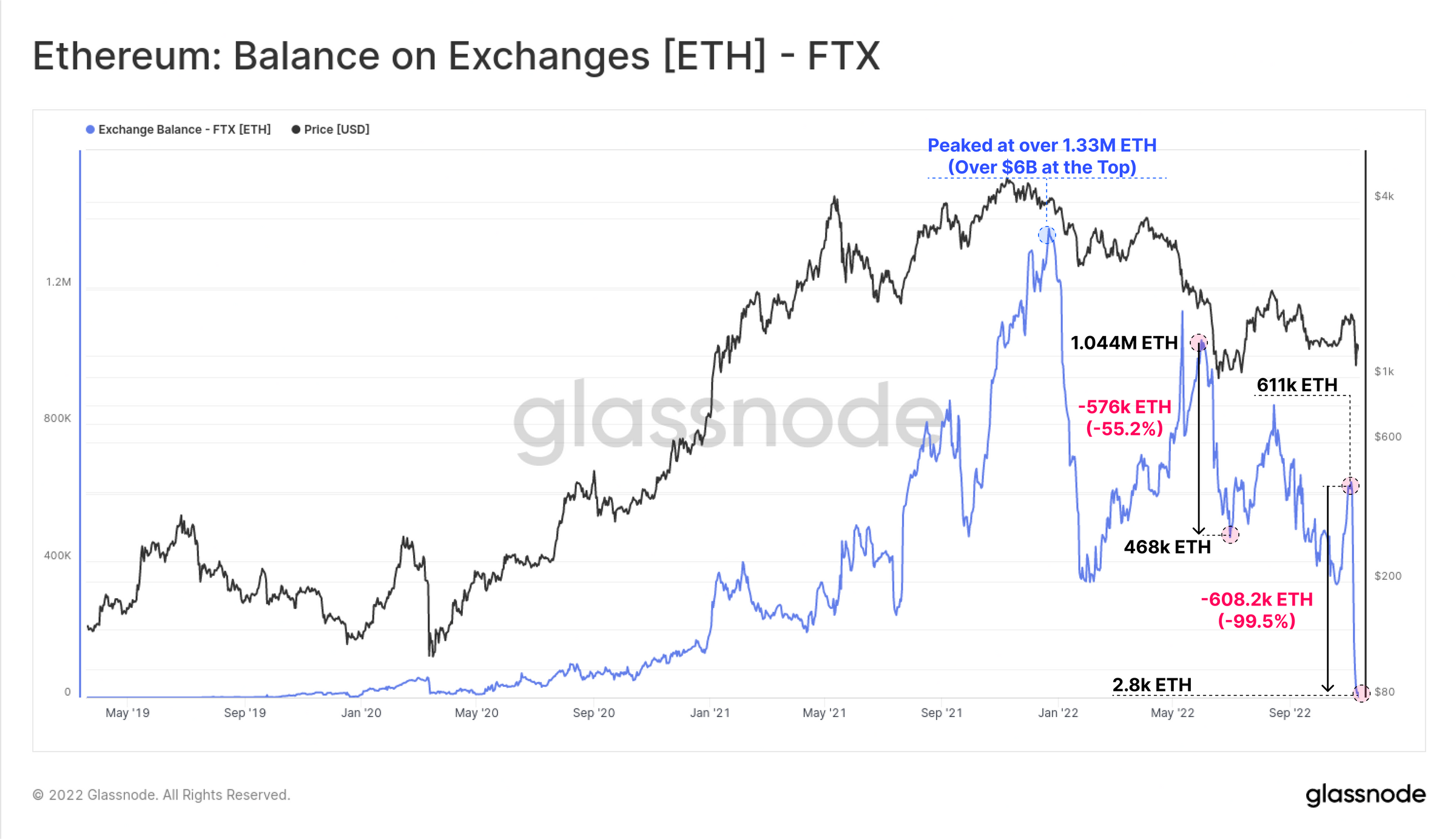

For example, the entire quantity of Bitcoin (BTC) in FTX’s wallets dropped to zero within the week ending November. 13. Similarly, the exchange’s Ether (ETH) reserves fell from 611,000 to simply 2,800 within the same period.

Distrust in centralized exchanges appears to possess boosted hunger for self-child custody wallets. Binance Chief executive officer Changpeng Zhao’s endorsement from the token’s parent platform, Trust Wallet, has additionally performed a significant part in driving in the TWT cost.

.@TrustWallet your keys, your coins. https://t.co/pJUc26kQ7n

— CZ Binance (@cz_binance) November 13, 2022

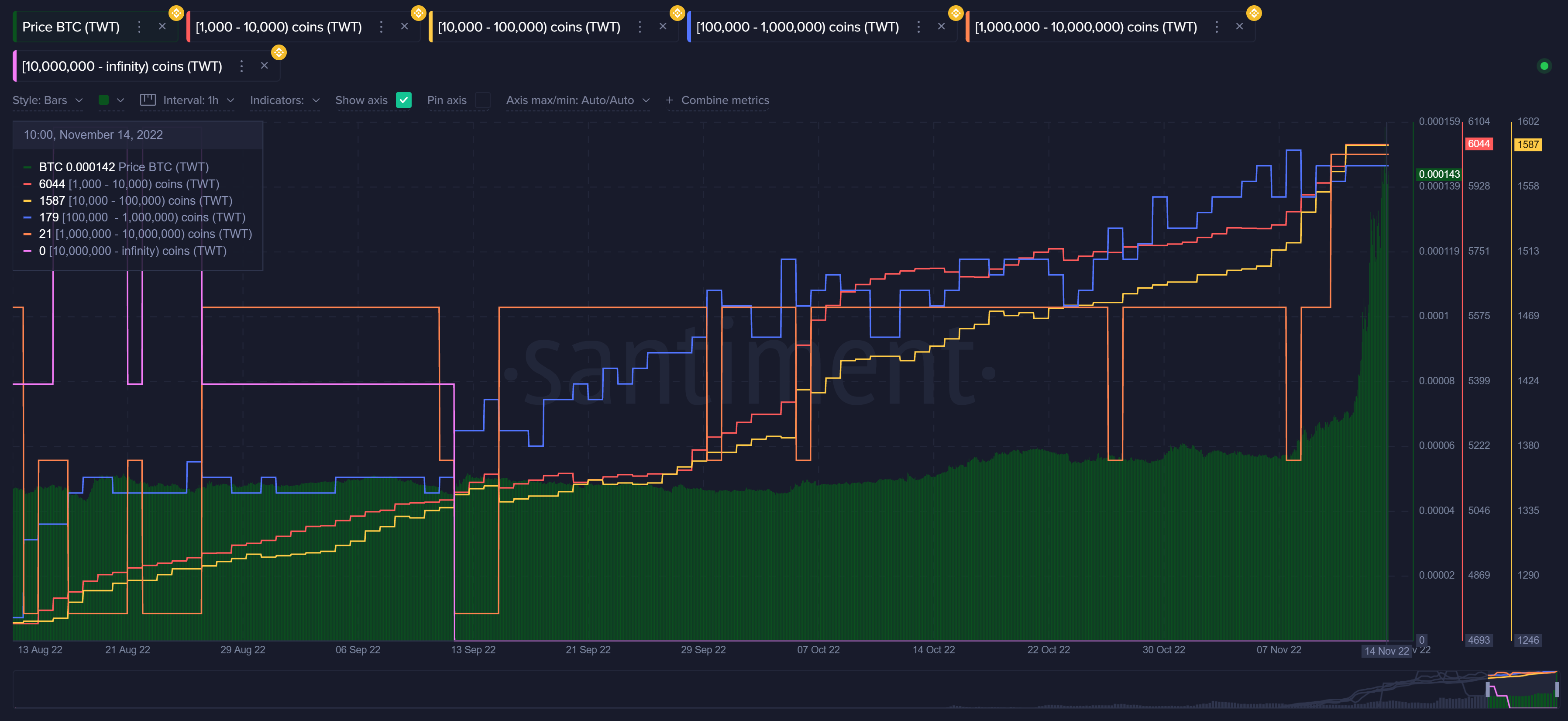

In addition, the Trust Wallet Token supply rate held by addresses having a balance between 1,000 TWT and ten million TWT tokens surged throughout the six-day cost upward trend, suggesting whale accumulation.

Meanwhile, the token’s buying and selling volume has soared from 279 million TWT to 593.25 TWT within the same period, showcasing market’s conviction in the upward trend.

TWT works as a utility token for Trust Wallet, in which traders can purchase, sell and collect nonfungible tokens (NFTs), in addition to exchange and stake cryptocurrencies. Consequently, TWT typically operates like a centralized exchange token, while Trust Wallet enables users to manage their very own funds.

Thus, it’s likely Trust Wallet become an off-ramp for traders pulling their from cryptocurrency exchanges within the wake from the FTX fiasco, with TWT cost rallying in reaction.

‘Not your keys, not your #crypto‘ continues to be resonating round the Twitter space of these past couple of days.

Even though many people utilise centralised exchanges, lots of users are yet to harness the strength of self child custody.

Begin taking control, today https://t.co/h3pVVNzgpL

— Trust – Crypto Wallet (@TrustWallet) November 11, 2022

Trust Wallet Token’s “overbought” risks

Theoretically speaking, TWT risks an enormous cost correction dads and moms prior to the year’s finish.

A minimum of two indicators are meaning only at that bearish outlook. First, TWT’s weekly relative strength index (RSI) is just about the most “overbought” since Feb 2021, suggesting a time period of cost consolidation or correction ahead.

Second, TWT shows indications of upside exhaustion after hitting an climbing trendline resistance that capped the token’s upside attempts in 2021.

In the past, a pullback in the stated resistance line has pressed TWT toward one multi-month climbing trendline support multiple occasions. In 2022, this rising level coincides with another horizontal support line at $.878, lower 60% from today’s cost levels.

Related: Binance Chief executive officer urges crypto buyers to ‘hold’ among ‘unpredictableness’

On the better note, TWT has flipped a multi-month horizontal trendline resistance near $1.535 as support during its ongoing cost rally, which might help limit its bearish prospects. That stated, a decisive rebound from $1.535 might have TWT cost choose a new record full of late 2022 or early 2023.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.