Bitcoin (BTC) and cryptocurrency may “take many years to recover” in the FTX scandal, one industry analyst warns.

Inside a Twitter thread on November. 11, Filbfilb, co-founding father of buying and selling suite DecenTrader, stated the Terra debacle was itself still happening.

Filbfilb: “I’ve never witnessed this type of debacle”

The crypto market is experiencing “a obvious situation of the items rises must come lower,” Filbfilb summarized.

As the fallout from FTX and Alameda Research only starts to become apparent, many industry companies and connected tokens happen to be left reduced to some shadow of the former selves.

Among personal bankruptcy concerns from individuals with contact with FTX and investigations from regulators, the outlook looks bleak for that industry’s status.

For Filbfilb, FTX–Alameda is itself an item from the implosion of Terra, Three Arrows Capital yet others captured.

“1) The majority of all of this backlinks towards the first 3 AC / Celius meltdown,” he started.

He highlighted two other key causes:

“2) Companies within the space compounded their aspirations according to supernormal, parabolic industry growth. 3) Funds are king cash flows of numerous entities are lower towards the tune of 80%.”

Everything is actually very familiar excessively eager companies create an ecosystem on steroids, which grows too rapidly and assumes an excessive amount of risk.

“Price, users, cashflow and compounded, mix-collateralized companies using quickly declining assets as balance sheet assets with future obligations works when cost increase — its suicide once the tide is out,” Filbfilb ongoing.

As a result, for that cycle to not repeat itself, it might take “many years” of restructuring.

“So yes, im annoyed concerning the whole factor, ive never witnessed this type of debacle, i realize why we’re where we’re but it’s inexcusable by some people involved and they should be held to account,” he concluded.

FTX ex-sales mind shuns personal bankruptcy “boomer procedures”

Feelings are tense for numerous investors and companies with funds tangled up in now-frozen FTX accounts.

Related: Hodlers in loss take a seat on 50% of BTC supply after $5.7K Bitcoin cost dip

On November. 11, Zane Tackett, the exchange’s former mind of worldwide sales, confirmed rough liabilities totaled -$8.8 billion.

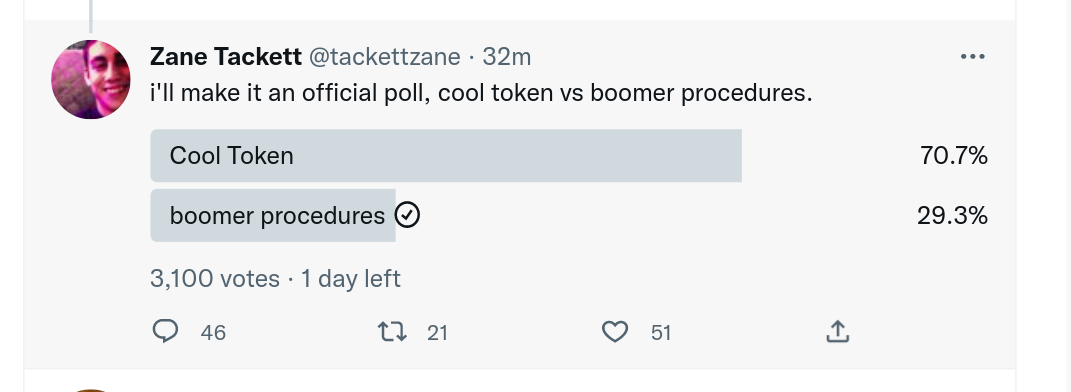

Inside a Twitter thread of their own, he quizzed users on whether FTX should produce a “cool token” as a means of restructuring debt rather of declaring personal bankruptcy within the traditional manner, something he known as “boomer procedures.”

“There’s not a way to color a fairly image from these figures, however when I saw the total amount sheet today i believed it was likely to be much worse,” he revealed.

“Now, granted, there is a massive hole in liquid assets, there’s a reasonably large slice of alternation in the ventures portfolio.”

Under an hour or so after publication, laptop computer had accrued 3,100 responses, with 71% with token creation.

This type of move could be much like those of fellow exchange Bitfinex, which, in 2016, released its UNUS SED LEO (LEO) token after it had been hacked for $70 million in BTC.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.