2022 would be a tough year for crypto, and November was especially difficult on investors and traders alike.

Although it was incredibly painful for a lot of, FTX’s blowup and also the ensuing contagion that threatens to drag other centralized crypto exchanges lower with it may be positive within the lengthy run.

Let me explain.

What individuals learned, although within the hardest possible way, is the fact that exchanges were running fractional reserve-like banks to finance their very own speculative, leveraged investments in return for supplying users having a “guaranteed” yield.

Somewhere over the crypto Twitterverse, the saying “If you do not know in which the yield originates from, you’re the yield!” is going swimming.

It was true for decentralized finance (DeFi), and it is proven true for centralized crypto exchanges and platforms, too.

Who’d have known that the couple of ill-timed bank runs would pull lower the whole house of cards by showing that although exchanges have the symptoms of high revenue and a lot of tokens on their own books, most are completely not able to satisfy user withdrawal demands?

They required your coins and collateralized these to fund highly speculative bets.

They locked your coins in centralized DeFi platforms to earn yield, most of which they guaranteed to express.

They placed user funds, with their own reserves, into illiquid assets which were difficult to convert into stablecoins, Bitcoin (BTC) and Ether (ETH) when clients and platform users desired to access their.

Not your keys, not your coins.

Never has got the phrase rang truer.

Let’s explore a couple of stuff that are happening within the crypto market now.

Investors withdrew an archive quantity of coins from exchanges to self-child custody

As Cointelegraph reported the 2009 week, crypto investors panic-withdrew record levels of Bitcoin, Ether and stablecoins from exchanges.

Separate reporting reported a sharp uptick in hardware wallet sales as investors recognized the significance of self-custodying their portfolios.

If the amount of insolvencies and “temporarily pausing of deposits and withdrawals” messages still appear within the next couple of days, it appears likely this trend of coins departing exchanges and popping into hardware wallets continues.

With #Bitcoin simply flooding from exchanges, we’ve a ~5yr full of Sovereign Way to obtain 87.7% from the total.

All $BTC which ran into exchanges since Jan 2018, has been withdrawn.

Self-child custody, and place driven #Bitcoin financial markets are back around the menu. pic.twitter.com/Kqr36SBBJC

— _Checkɱate ⚡☢️️ (@_Checkmatey_) November 18, 2022

DEXs and DeFi saw an uptick in inflows, possibly an indication of items to come

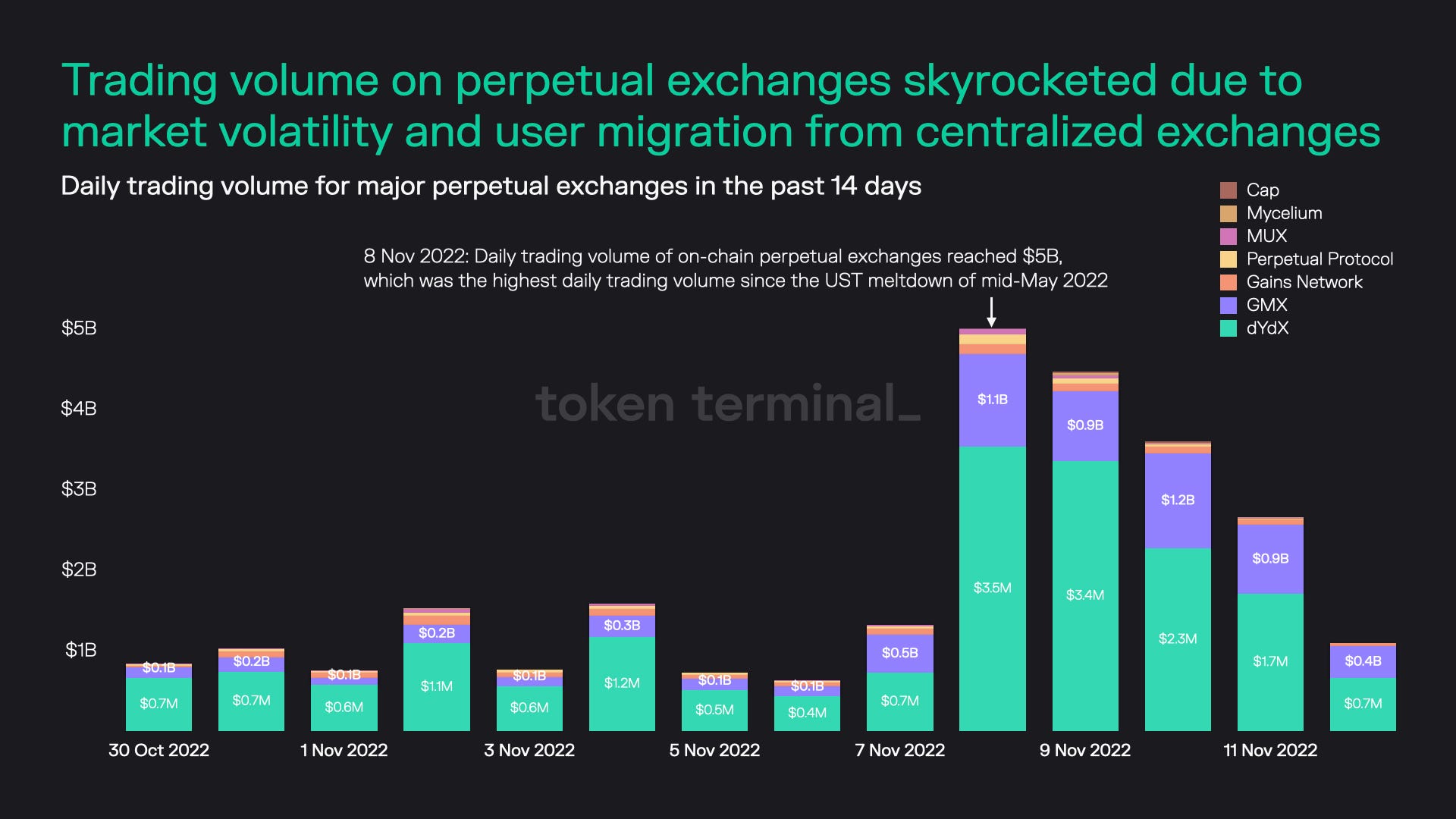

Cointelegraph also reported around the uptick in decentralized exchange (DEX) activity and inflow to DeFi occurring concurrently using the record outflows from exchanges. Following the occasions of history two days, rely upon centralized exchanges and crypto companies might be damaged, and also the current and then wave of crypto investors could embrace the greater Web3-focused DEX and DeFi protocols.

Obviously, what DeFi and DEXs need really are a more transparent framework and procedures that ensure user money is safe and getting used “properly.”

Related: DeFi platforms see profits among FTX collapse and CEX exodus

A regular flow of not so good news could present a pleasant chance

Presently, Ether’s cost looks a little soft from the technical analysis perspective, and also the recent news concerning the FTX crook holding the 31st largest Ether place position, plus concerns over censorship, centralization, the U . s . States Office of Foreign Assets Control enforcement about this “whale” along with other Ethereum-based protocols which have exposure or personal bankruptcy closeness to FTX and Alameda could awaken a little bit of FUD that impacts the altcoin’s cost action.

Top Ten addresses using the largest ETH holdings:

– 6 are CEX related wallets

– Jump Buying and selling arriving third with more than 2M ETH

– @arbitrum bridge with ~750K ETH

– ETH Staking & WETH contract has over 19M ETH combinedWishing to determine less CEXes out there each year pic.twitter.com/S1HHi5swnN

— Martin Lee Nansen (@themlpx) November 18, 2022

Uncertainty on once the Shanghai upgrade is going to be enacted and investor concerns about when staked coins can really be withdrawn will also be interesting conversations that may turn short-term sentiment against Ether.

The thesis is fairly simple. ETH has held support around $1,200–$1,300 pretty much through all the previous several weeks of bearish market developments, and can the possibility challenges pointed out above result in a test from the level again?

Stakers are basically place lengthy and earning yield, so only at that juncture, opening a minimal-level short position with taking profits orders at $700–$600 may be rewarding.

This e-newsletter was compiled by Big Smokey, the writer of “The Humble Pontificator Substack” and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.