FTX Token (FTT) and Solana’s SOL (SOL) suffered a difficult weekend of buying and selling that saw altcoins take double-digit losses within the 15%–30% range, however the tide switched as news broke that Binance might be while obtaining FTX.

On November. 8, FTX Chief executive officer Mike Bankman-Fried first required to Twitter to announce a liquidity-discussing partnership with Binance. Changpeng “CZ” Zhao, Chief executive officer of Binance, decided to part of and supply liquidity as to the was beginning to resemble a bank run. Bankman-Fried billed the event as user-focused and benefiting the whole industry.

1) Hey all: I’ve got a couple of bulletins to create.

Everything has come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are identical: we have started to a contract on the proper transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

— SBF (@SBF_FTX) November 8, 2022

CZ also confirmed that Binance would part of to help FTX using its liquidity crunch, using the Chief executive officer tweeting instructions of intent to buy FTX.

This mid-day, FTX requested for the help. There’s a substantial liquidity crunch. To safeguard users, we signed a non-binding LOI, planning to fully acquire https://t.co/BGtFlCmLXB which help cover the liquidity crunch. We are performing a complete DD within the future.

— CZ Binance (@cz_binance) November 8, 2022

Since November. 7, FTX continues to be experiencing liquidity issues after news broke surrounding Alameda Research’s odd-searching books. As FTX was battling withdrawals using their exchange, even freezing withdrawals at some point, Binance announced it might sell the whole FTT allocation it possessed.

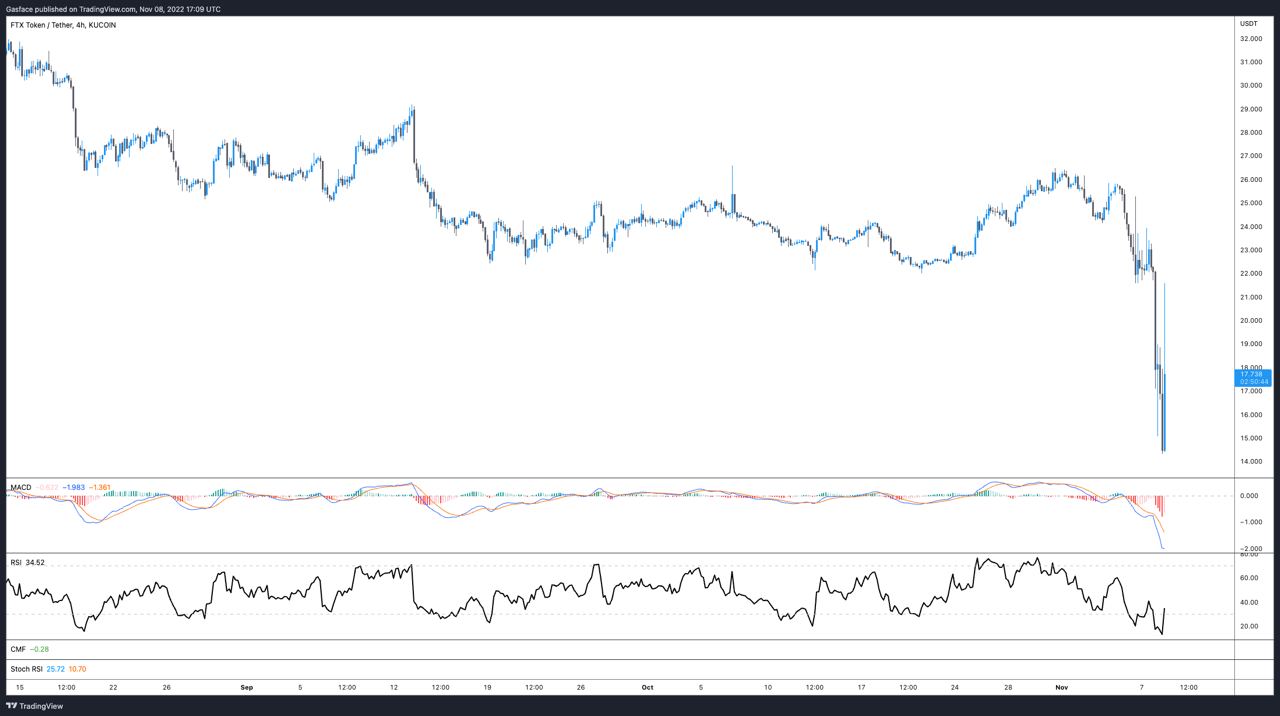

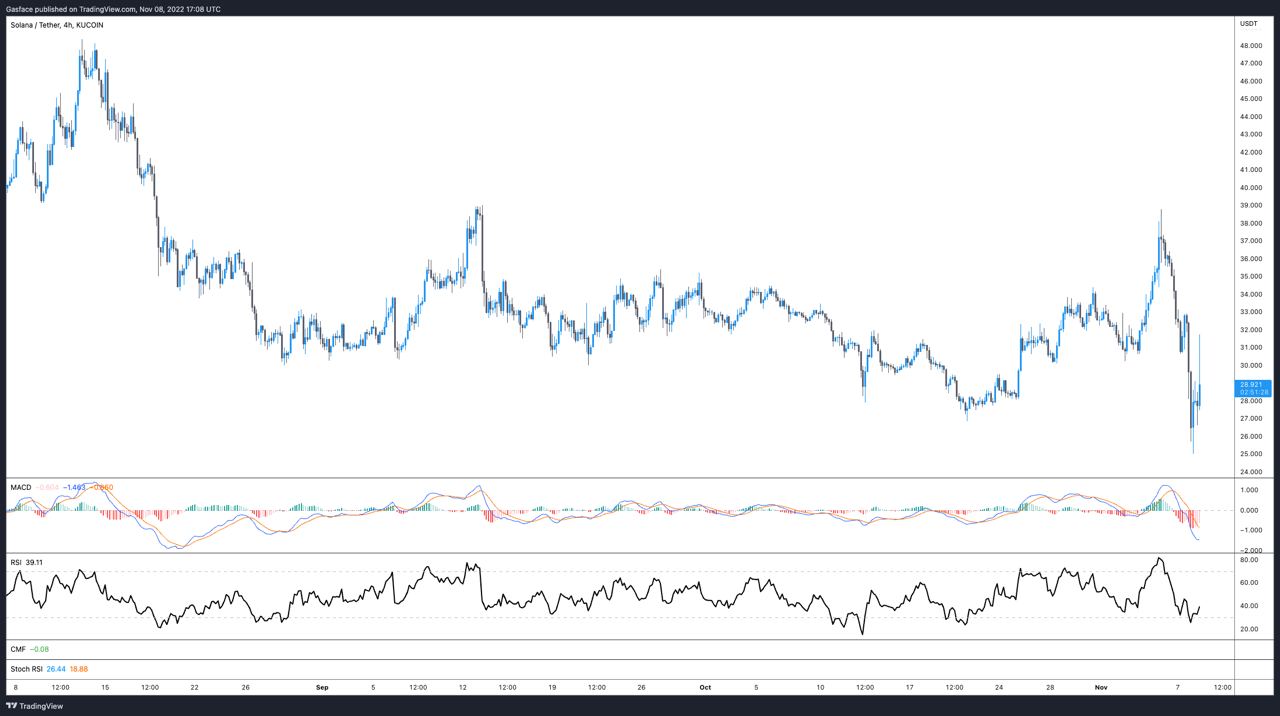

Throughout the disagreement between exchanges, FTT cost dropped 38.7% from $25.71 to $15.76, and SOL cost fell 31.23% to some five-month low at $25. After news of the potential agreement between FTX and Binance, FTT cost bounced greater than 20%, however it still trades well below what have been lengthy-time support at $22.

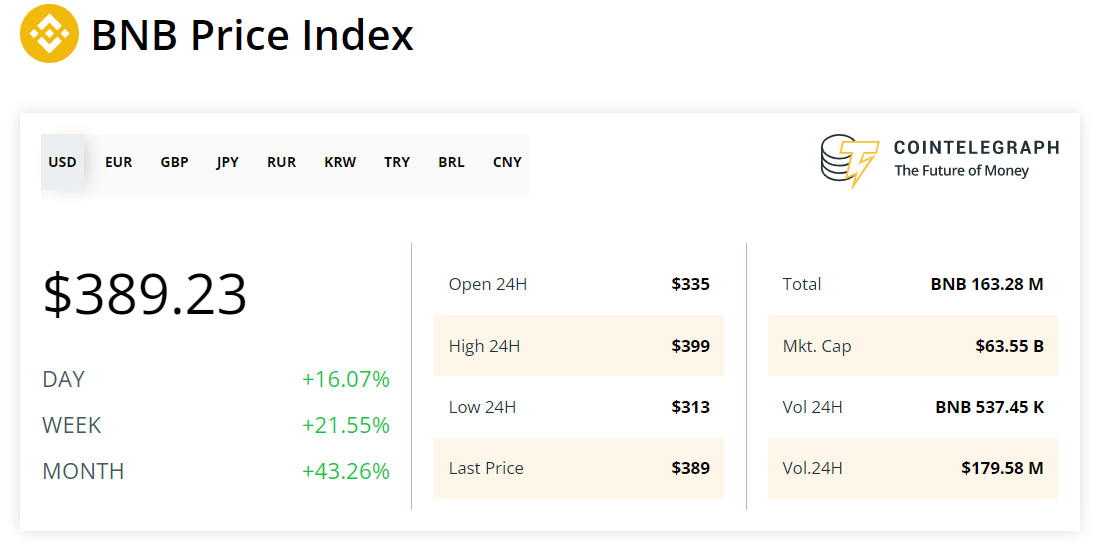

The cost of BNB (BNB) has additionally endured in the last couple of days, shedding by 14%, however the news of Binance saying yes to get FTX was adopted through the exchange token staging a 25% rally inside the hour.

Related: Bitcoin cost swings over $20K as Binance helps FTX ‘liquidity crunch’

As the story is developing and lots of unknown variables remain, the broader crypto market has reacted positively towards the news. Bitcoin (BTC) briefly rallied over $20,000 before sliding into the $19,800 range, while Ether (ETH) is constantly on the trade above $1,500.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.