A continuing selloff within the FTX Token (FTT) market could worsen within the coming several weeks because of a mixture of pessimistic technical and fundamental indicators.

FTT could plunge 30%

Theoretically speaking, FTT has created an inverse-cup-and-handle pattern around the daily chart, identifiable by its crescent-formed cost trend adopted with a less extreme upward retracement.

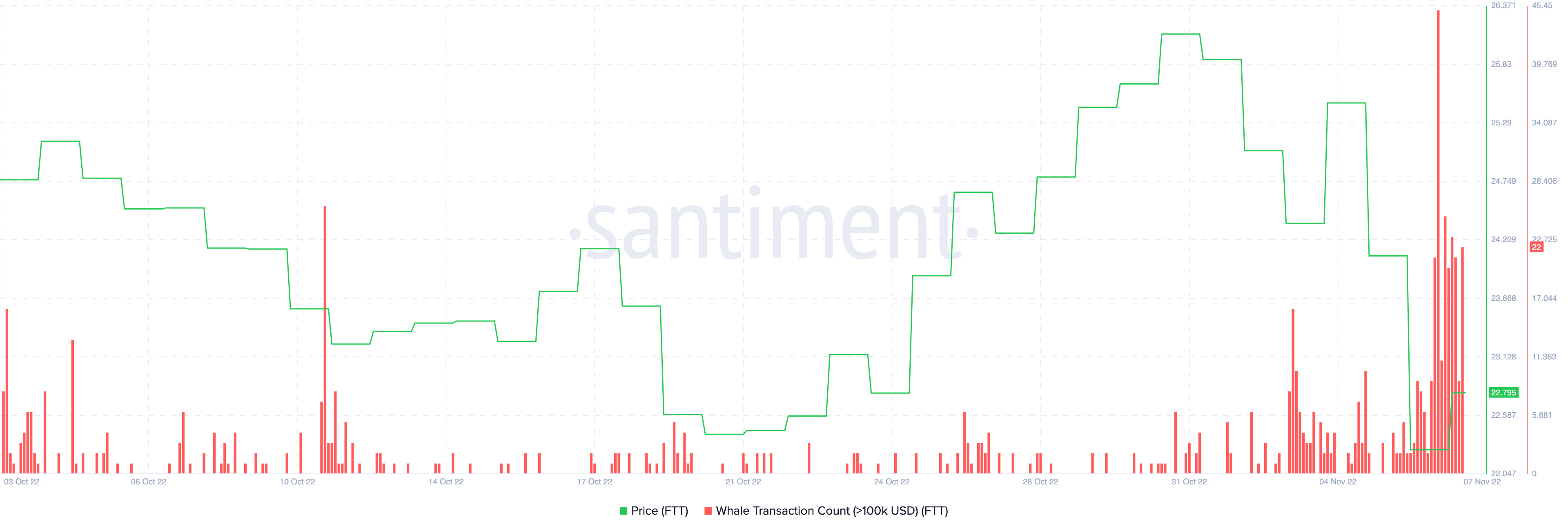

On November. 6, FTT broke underneath the pattern’s support line near $22.50, supported with a volume spike. The FTX exchange token’s selloff ongoing on November. 7 underneath the support line, raising perils of a bearish continuation phase within the coming several weeks.

Usually of technical analysis, the inverse-cup-and-handle breakdown can push the cost lower through the length comparable to the space between your pattern’s support and peak level. That puts FTT’s breakdown cost target around $16, lower roughly 30% in the current cost.

The bearish technical setup came as Changpeng Zhao (CZ), the Chief executive officer of crypto exchange Binance, stated his company would liquidate its entire FTT holdings within the coming several weeks, on fears the token might collapse within the in an identical way as Terra (LUNA) in May 2021.

Binance was an earlier investor in FTX.

Liquidating our FTT is simply publish-exit risk management, gaining knowledge from LUNA. We gave support before, but we will not make believe you have sex after divorce. We’re not against anybody. But we will not support individuals who lobby against other industry players behind their backs. Onwards.

— CZ Binance (@cz_binance) November 6, 2022

Raising selloff risks, the announcement adopted a large transfer of roughly 23 million FTT tokens worth $530 million to Binance, which CZ confirmed would be a “part” earmarked for liquidation.

Yes, this belongs to it. https://t.co/TnMSqRTutr

— CZ Binance (@cz_binance) November 6, 2022

This coincided having a spike in individual transactions more vital than $100,000.

Alameda Research faces insolvency allegations

Binance’s decision required cues from allegations that Alameda Research,a crypto-focused hedge fund founded by FTX exchange’s Mike Bankman-Fried, could turn insolvent from the contact with illiquid altcoins, including FTT.

Particularly, Alameda Research had $14.6 billion on its balance sheet by June 30, with FTT to be the largest holding at $5.8 billion, creating 88% of their internet equity. Additionally, the firm held $1.2 billion in Solana (SOL), $3.37 billion in unknown cryptocurrency, $2 billion in “equity securities,” along with other assets.

However, Alameda Research apparently had liabilities worth $8 billion, including $2.2 billion price of loans collateralized by FTT. That, along with the firm’s alleged contact with illiquid altcoins, motivated some analysts to calculate its insolvency later on.

“Alameda should never be in a position to money in a substantial part of FTT to repay its financial obligations,” authored Mike Burgersburg, a completely independent market analyst, for that Dirty Bubble Media Substack, noting:

“You will find couple of buyers, and also the largest buyer seems is the very company which Alameda is most carefully associated with […] the fair market price of the FTT in case of large sales would quickly approach $.”

Interestingly, on-chain data trackers detected wallets connected with Alameda Research sending nearly $66 million price of stablecoin tokens to FTX addresses on November. 6, potentially to soak up the token’s sell-side pressure.

Damage control

Alameda Research Chief executive officer Caroline Ellison countered these allegations, noting the firm had greater than $10 billion price of assets coupled with came back the majority of its loans because of the tightening within the crypto credit space in 2022.

A couple of notes around the balance sheet info that’s been circulating lately:

– that exact balance sheet is perfect for a subset in our corporate entities, we’ve > $10b of assets that aren’t reflected there— Caroline (@carolinecapital) November 6, 2022

Bankman-Fried known as the rumors “unfounded,” assuring supporters that FTX keeps audited financials.

Related: FTX in talks with investors to boost $1B for more acquisitions

However, FTX traders seem to be using the careful route, reflected with a 95% stop by the exchange’s stablecoin reserves within the last two days. By November. 7, FTX held $26.141 million price of dollar-pegged tokens, its cheapest each year.

Meanwhile, investors happen to be selling their FTT holdings baffled among the continuing Alameda Research fiasco, per EtherScan data. For example, a little whale apparently required a 65% loss on its FTT investment

Still, independent market analyst Satoshi Flipper sees a possible FTT cost rebound ahead because it retests a lengthy-standing support range visible around the weekly chart below.

“An excessive amount of FUD so I am lengthy here @ $22.95,” the analyst authored.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.