Following a strong 2,000% rally at the begining of 2021, Fantom (FTM) cost collapsed alongside multiple altcoins although the blockchain comes with an impressive capacity, it’s yet to locate mass adoption because of the insufficient an engaging use situation. FTM cost hit an exciting-time high at $3.46, simply to collapse to the pre-bull market lows under $.25 following the failure from the Solidly DeFi project and also the departure of developer Andre Cronje.

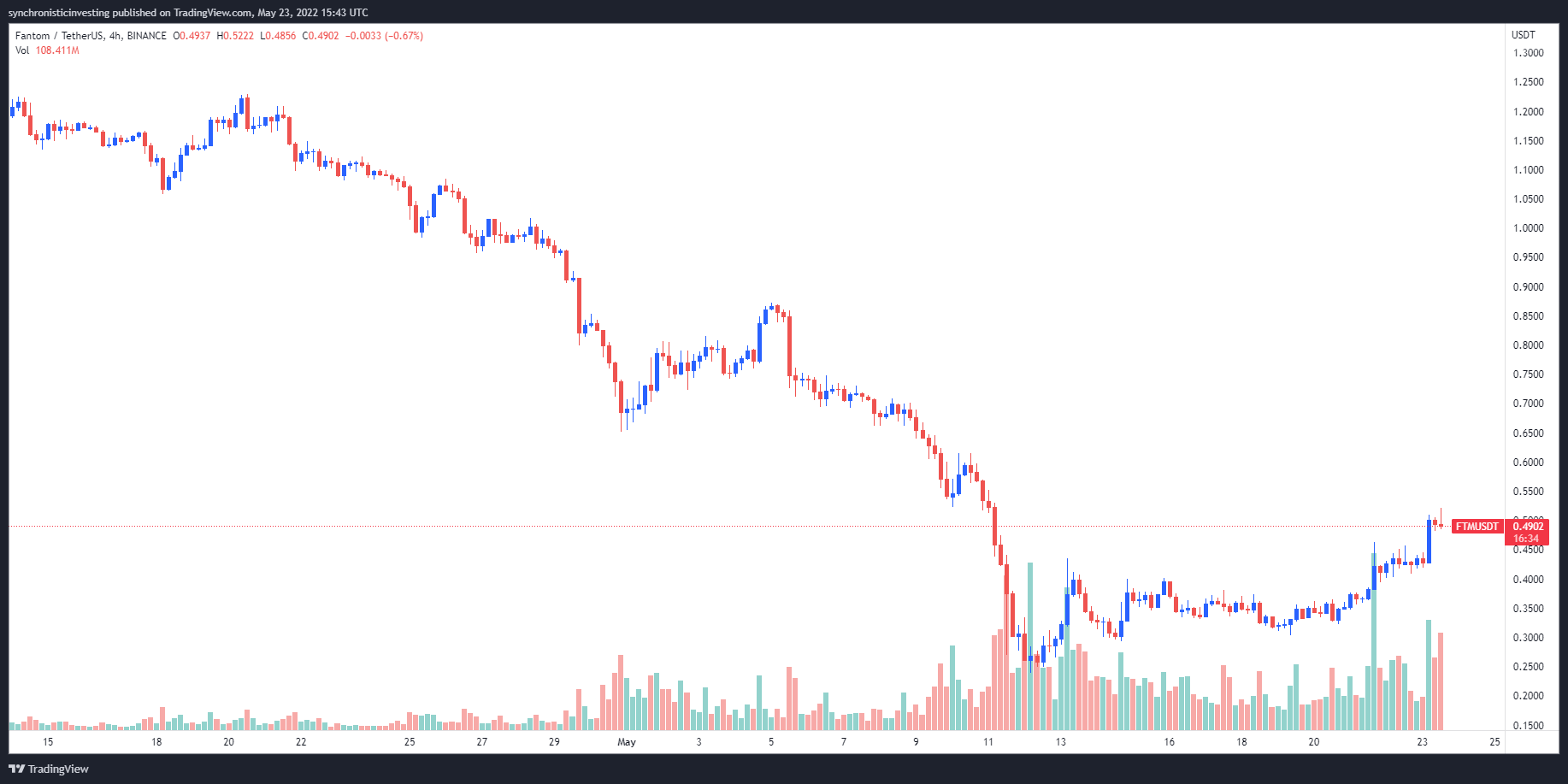

Data from Cointelegraph Markets Pro and TradingView implies that since shedding to $.238, FTM has rallied 119.23% to $.5216 on May 23.

Three good reasons for that upward trend in FTM cost would be the launch from the first native stablecoin around the Fantom network, new protocol upgrades and partnership bulletins, which bring new functionality towards the network, and speculation that Andre Cronje is dealing with decentralized finance (DeFi) protocols on Fantom.

Fantom launches its first native stablecoin

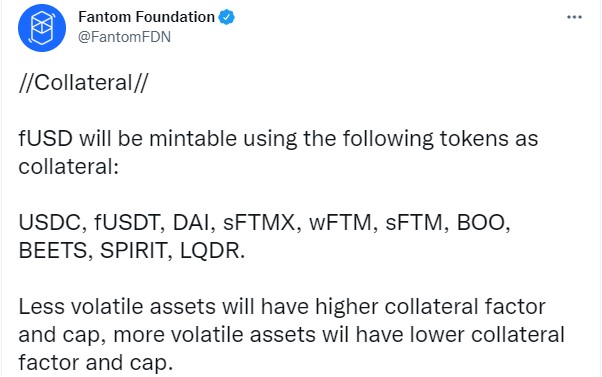

The most known development to happen within the Fantom ecosystem previously couple of days was the discharge of fUSD, the very first native stablecoin around the network.

The launch of fUSD occurs the heels from the collapse of TerraUSD and appears to capture a few of the capital flight from algorithmic stablecoin by providing an over-collateralized alternative.

On May 20, the Fantom Foundation released an update outlining the utmost collateral factor and minting cap for every supported type of collateral. The building blocks also set the fUSD staking reward at 11.3%

The update also incorporated information on Fantom liquid staking, setting a worldwide cap of 150 million staked Fantom (sFTM), removing validators for that listing of individuals qualified to mint sFTM and setting financing-to-value (LTV) ratio of FTM at 90% for that purpose of minting sFTM.

New partnerships improve sentiment for FTM

A number of recent protocol updates and new partnerships also have helped to create a lift in momentum to Fantom, such as the launch of Snapsync, which enables new nodes to rapidly join the network.

Using the integration of Snapsync, time it requires for brand new nodes to synch might be reduced from 24 to seven hrs, assisting to enhance network reliability, improve scalability and make up a better decentralization.

Fantom has additionally announced that it’s presently while launching Gitcoin around the Fantom network to simplify the entire process of acquiring grants to build up within the Fantom ecosystem.

Fantom also partnered with Unmarshal and XP.Network. Unmarshal is really a Web3 infrastructure provider which will integrate its indexing services using the Fantom protocol to provide developers quick access to organized and granular on-chain data.

With the partnership with XP.Network, Fantom users can bridge nonfungible tokens (NFTs) between Ethereum (ETH), BNB Smart Chain (BNB), Elrond (EGLD), Aurora (AURORA), Tron (TRX), Avalanche (AVAX) and Velas (VLX).

Related: Crypto remittances should have allure of money without regulatory constraints — Jeremy Allaire

Did Andre Cronje return?

Take into consideration, although speculative, getting a lift FTM cost is speculation that well-known DeFi developer Andre Cronje might be adding toward DeFi development around the Fantom network.

Among rumors concerning the return of lead DeFi developer Andre Cronje, the cost from the native FTM token has risen by almost 40%. Cronje suggested numerous measures targeted at stabilizing the problem and growing the sustainability from the Fantom ecosystem in general.

— Ashley Torres (@torresamba) May 23, 2022

The speculation began when Cronje posted an fUSD optimization proposal that made to solve a significant depegging problem with the stablecoin on May 20 . A Fantom wallet that’s thought to fit in with Cronje has additionally added greater than 100 million FTM in the last two days.

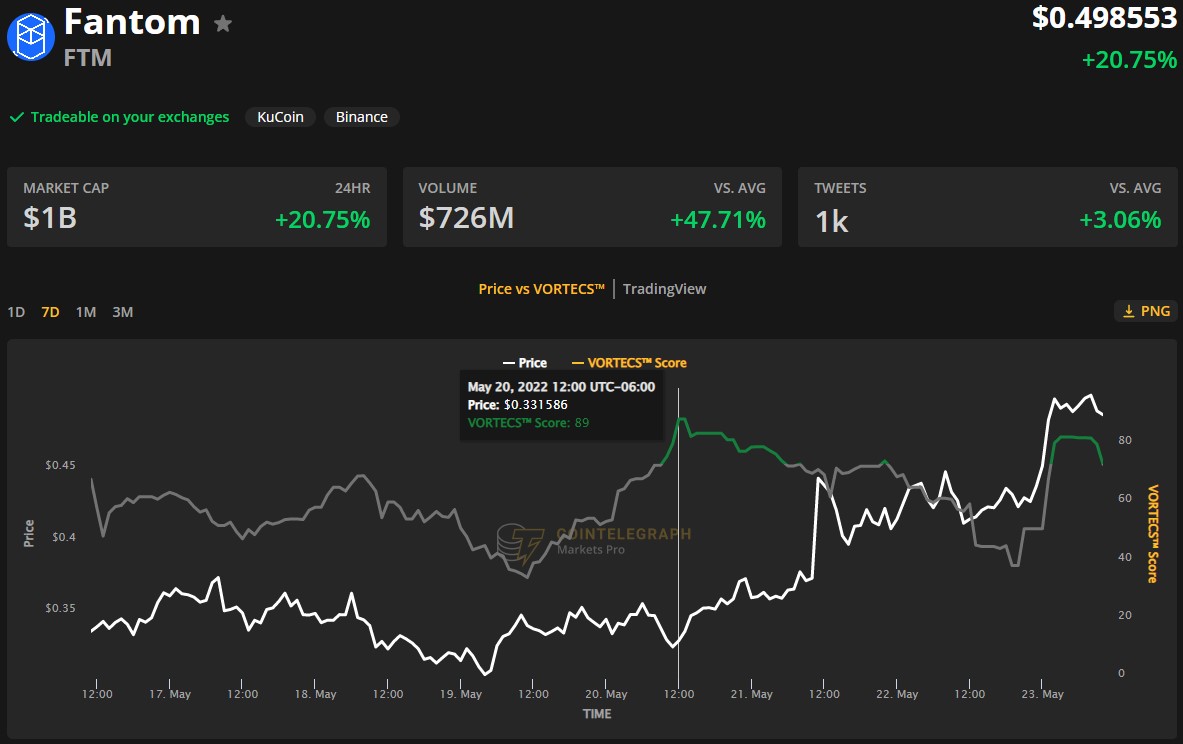

VORTECS™ data from Cointelegraph Markets Pro started to identify a bullish outlook for FTM on May 20, before the recent cost rise.

The VORTECS™ Score, only at Cointelegraph, is definitely an algorithmic comparison of historic and market conditions produced from a mix of data points including market sentiment, buying and selling volume, recent cost movements and Twitter activity.

As observed in the chart above, the VORTECS™ Score for FTM spiked to some a lot of 89 on May 20 simultaneously since it’s cost started to improve 62.3% within the next 72 hours.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.