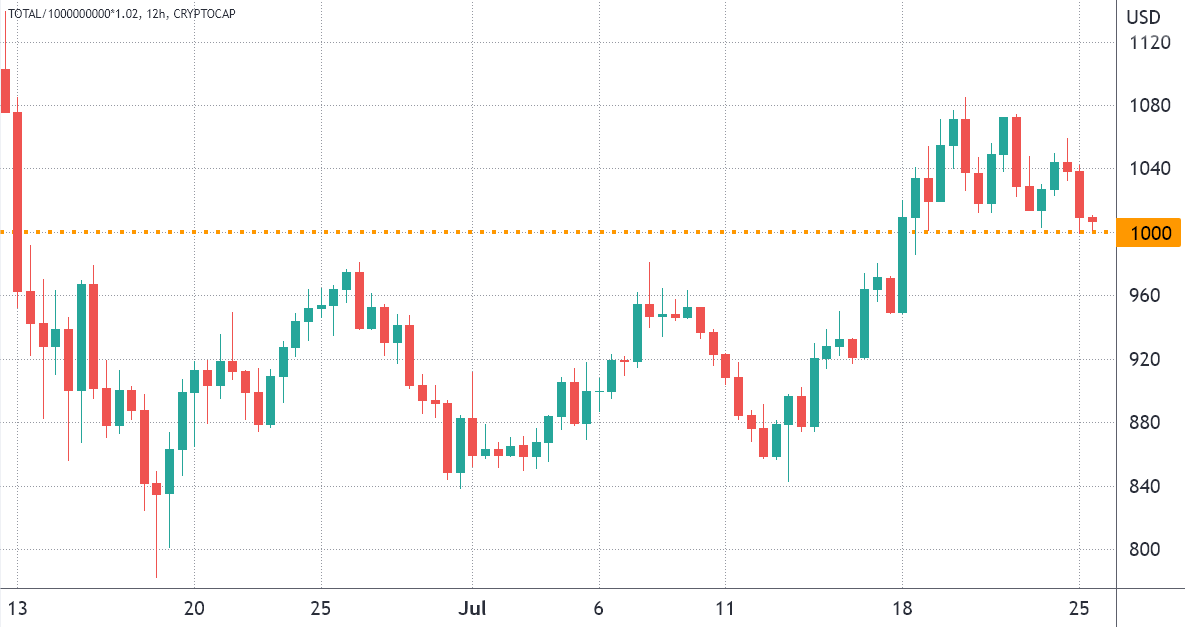

The entire crypto market capital broke above $1 trillion on This summer 18 after an agonizing thirty-five-day stint underneath the key mental level. Within the next 7 days, Bitcoin (BTC) traded flat near $22,400 and Ether (ETH) faced a .5% correction to $1,560.

The entire crypto capital closed This summer 24 at $1.03 trillion, a modest .5% negative seven-day movement. The apparent stability is biased toward the flat performance of BTC and Ether and also the $150 billion worth of stablecoins. The broader data hides the truth that seven from the top-80 coins dropped 9% or even more at that time.

Although the chart shows support in the $1 trillion level, it will require a while until investors get back confidence to purchase cryptocurrencies and actions in the U . s . States Fed might have the biggest effect on cost action.

In addition, the sit and wait mentality might be a reflection of important macroeconomic occasions scheduled for that week ahead. Generally speaking, worse than expected data has a tendency to increase investors’ expectations of expansionary measures, that are advantageous for riskier assets like cryptocurrency.

The Fed policy meeting is scheduled for This summer 26 and 27, and investors expect the U . s . States central bank to boost rates of interest by 75 basis points. Furthermore, the 2nd quarter of U.S. gdp (GDP) – the largest way of measuring business activities — is going to be released on This summer 27.

$1 trillion insufficient to instill confidence

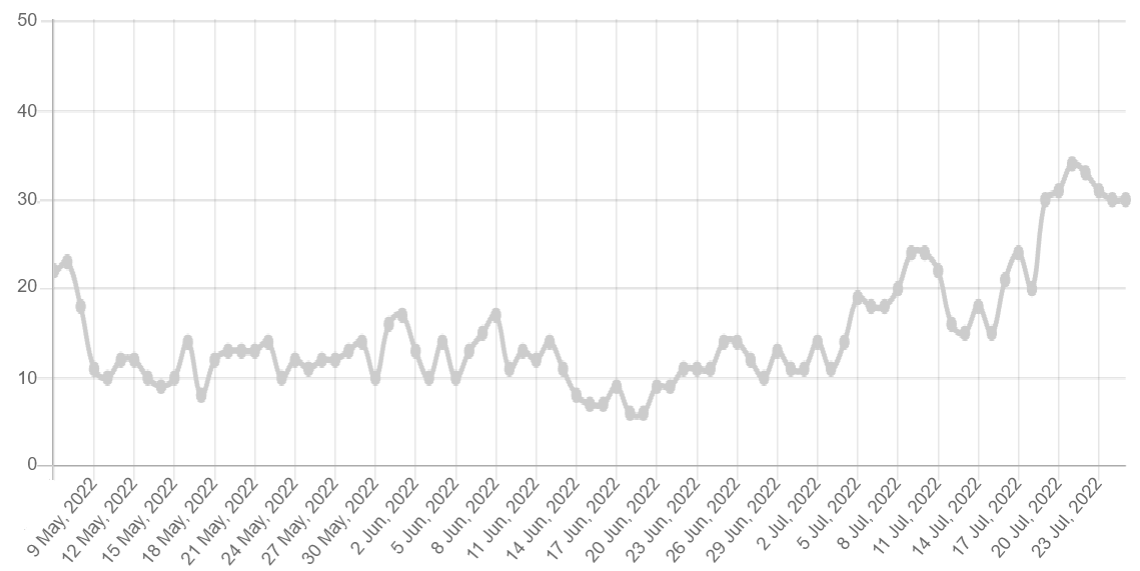

Investors sentiment improved from This summer 18, as reflected within the Fear and Avarice Index, an information-driven sentiment gauge. The indicator presently holds 30 from 100, that is a rise from 20 on This summer 18 if this hovered within the “extreme fear” zone.

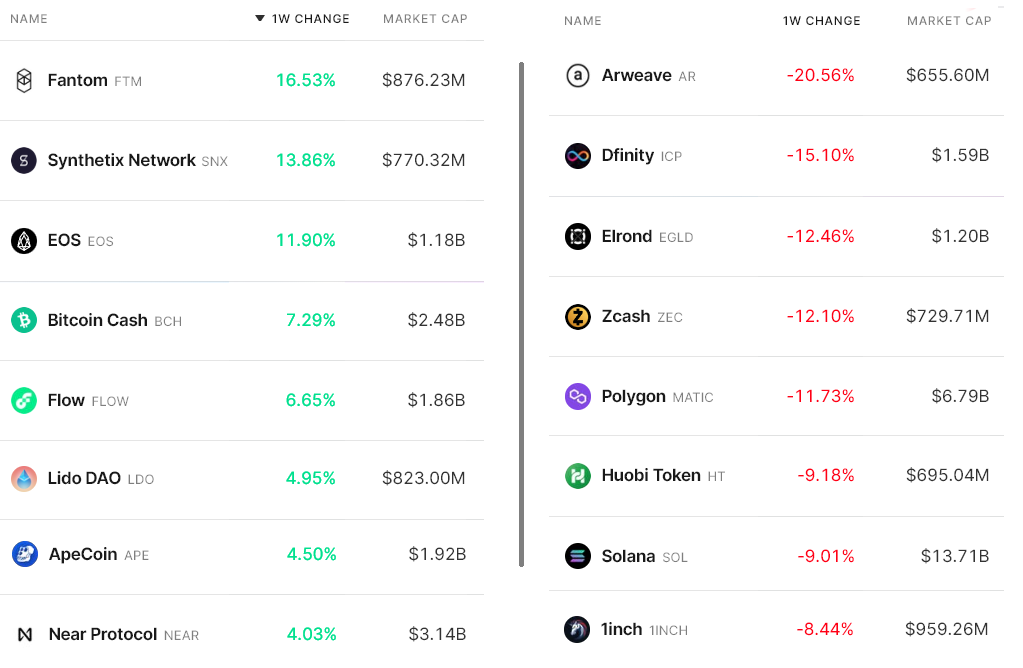

You have to observe that although the $1 trillion total crypto market capital was recaptured, traders’ spirits haven’t improved much. Listed here are the winners and losers from This summer 17 to 24.

Arweave (AR) faced a 20.6% technical correction after a remarkable 58% rally from This summer 12–18 following the network file-discussing solution surpassed 80 terabytes (TB) of information storage.

Polygon (MATIC) moved lower 11.7% after Ethereum co-founder Vitalik Buterin supported the zero-understanding Rollups technology implementation, an element presently within the works best for Polygon.

Solana (SOL) remedied 9% following the interest in the smart contract network might be negatively influenced by Ethereum’s approaching migration to some proof-of-stake consensus.

Retail traders aren’t thinking about bullish positions

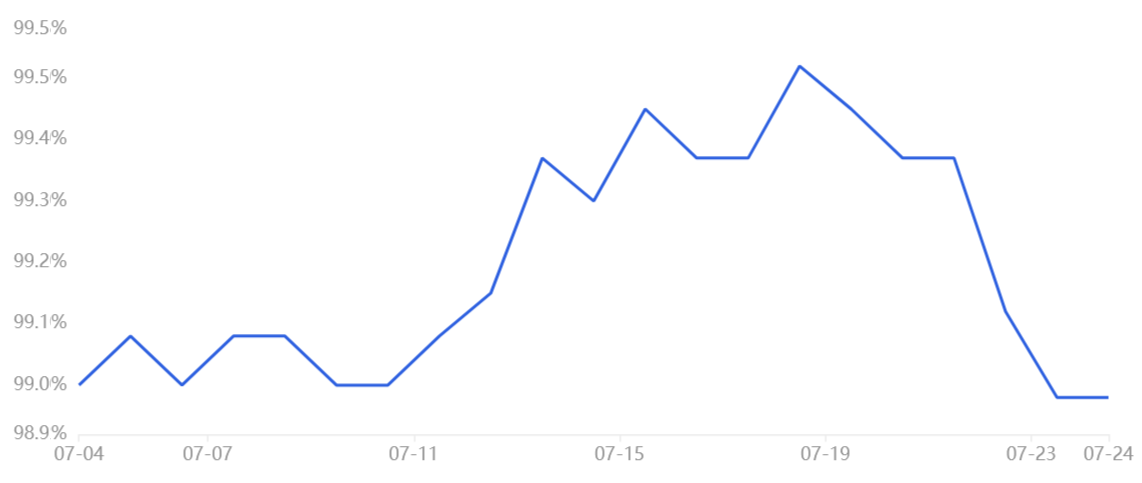

The OKX Tether (USDT) premium is a great gauge of China-based retail crypto trader demand. Its dimensions are the main difference between China-based peer-to-peer (P2P) trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100%, and through bearish markets, Tether’s market offers are flooded and results in a 4% or greater discount.

Tether continues to be buying and selling having a slight discount in Asian peer-to-peer markets since This summer 4. Not really the 25% total market capital rally durinJuly 13–20 was enough to show excessive buying demand from retail traders. Because of this, these investors ongoing to abandon the crypto market by seeking shelter in fiat currency.

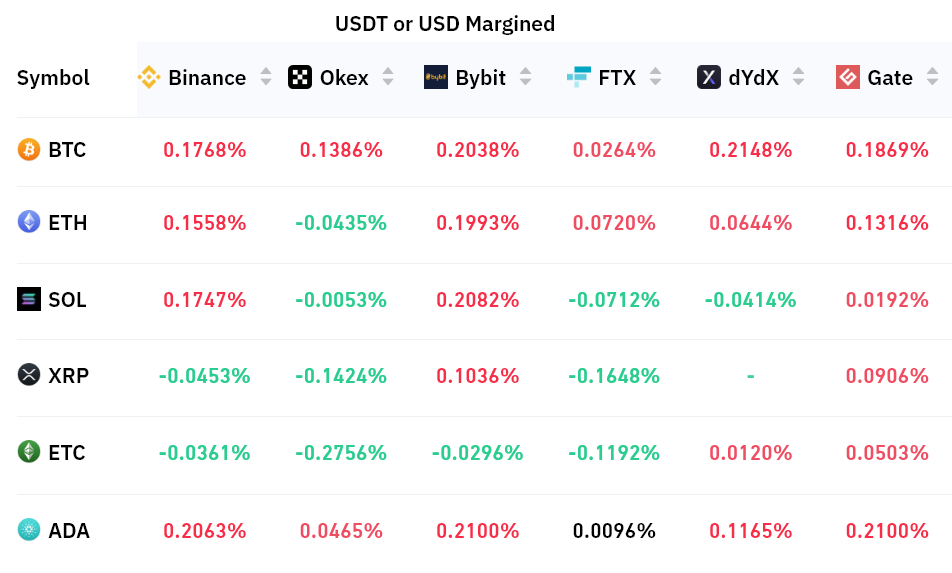

You ought to evaluate crypto derivatives metrics to exclude externalities specific towards the stablecoin market. For example, perpetual contracts come with an embedded rate that’s usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

The derivatives contracts show modest interest in leveraged lengthy (bull) positions on Bitcoin, Ether and Cardano. Still, nothing has run out of standard following a .15% weekly funding equals a .6% monthly cost, so uneventful. The alternative movement happened on Solana, XRP and Ether Classic (ETC), but it’s insufficient to boost concern.

As investors’ attention shifts to global macroeconomic data and also the Fed’s reaction to weakening conditions, your window of chance for that cryptocurrencies to demonstrate themselves like a solid alternative will get smaller sized.

Crypto traders are signaling fear and too little leverage buying, even when confronted with a 67% correction because the November 2021 peak. Overall, derivatives and stablecoin data show too little confidence in $1 trillion market capital support.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.