The S&P 500 ended its four-week-lengthy recovery a week ago after minutes in the Federal Reserve’s This summer meeting hinted the central bank’s rate hikes continues until inflation is in check. People from the Given stated there wasn’t any evidence that inflation pressures appear be easing.

Another dampener was the statement by St. Louis Given president James Bullard who stated he would support a 75 basis point rate hike in September’s Given policy meeting. This reduced hopes the era of aggressive rate hikes might be over.

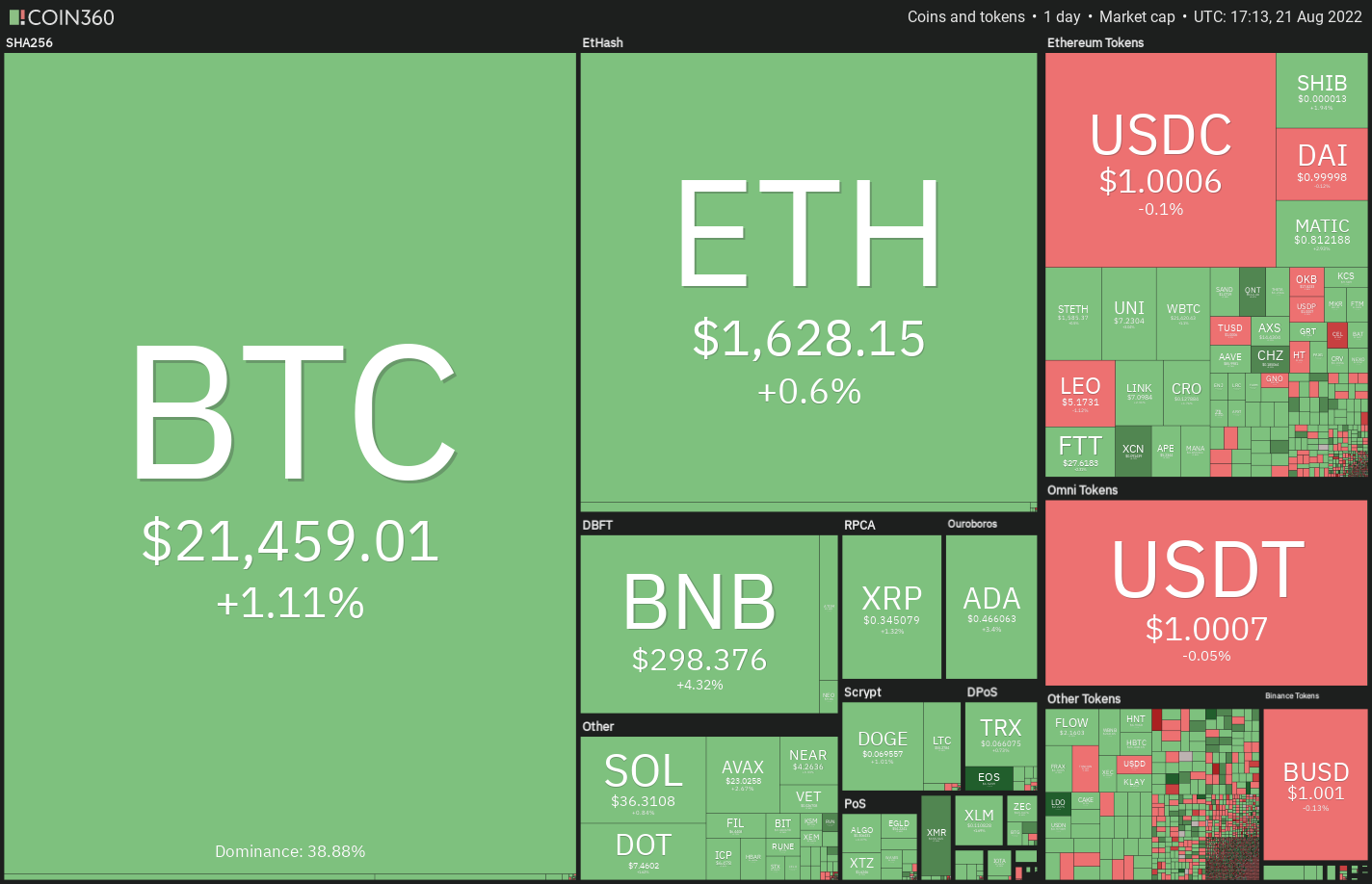

Weakening sentiment pulled the S&P 500 lower by 1.29% for that week. Ongoing its close correlation using the S&P 500, Bitcoin (BTC) also observed a clear, crisp decline on August. 19 and will probably finish a few days with steep losses.

Will bulls make use of the dips to amass at ‘abnormal’ amounts? When they do, let’s read the charts from the top-5 cryptocurrencies that could attract buyers due to their bullish setups.

BTC/USDT

Bitcoin tucked underneath the 20-day exponential moving average ($22,864) on August. 17 after which underneath the 50-day simple moving average ($22,318) on August. 19. The bulls are trying to arrest the decline in the support type of the climbing funnel.

The 20-day EMA has began to show lower and also the relative strength index (RSI) is within negative territory, indicating benefit to bears. When the cost reverses direction in the moving averages, it’ll claim that bears can sell on rallies.

That may increase the potential of a rest underneath the support type of the funnel. In the event that happens, the important support zone of $18,626 to $17,622 will come under attack.

To avert this situation, the bulls will need to push and sustain the cost over the moving averages. When they do this, the BNB/USDT pair could rise toward the resistance type of the funnel.

The buyers are strongly protecting the support type of the funnel however the downsloping moving averages and also the RSI within the negative territory claim that greater levels will probably attract selling through the bears.

When the cost turns lower in the current level or even the 20-EMA, the probability of a rest underneath the funnel increases. In the event that happens, the bearish momentum could get and also the pair could drop toward $18,626.

The very first manifestation of strength is a break over the 20-EMA. This type of move will indicate the selling pressure might be reducing. That may enhance the prospects of the rally towards the 50-SMA.

BNB/USDT

Binance Gold coin (BNB) switched lower in the overhead resistance at $338 however the bulls effectively defended the strong support at $275. This signifies an optimistic sentiment because the bulls are viewing the dips like a buying chance.

The recovery may face resistance in the 20-day EMA ($301). When the cost turns lower out of this level, the bears will again attempt to sink the BNB/USDT pair below $275. In the event that happens, it’ll claim that the happy couple may oscillate in a wide range between $183 and $338 for a while.

On the other hand, if bulls push the cost over the 20-day EMA, the happy couple could rise to $338. A rest and shut above this level could develop a bullish mind and shoulders pattern. That may begin a rally to $413 after which towards the pattern target at $493.

The 20-EMA around the 4-hour chart has began to show up and also the RSI is close to the midpoint, indicating the selling pressure might be reducing. When the cost sustains over the 20-EMA, the happy couple could rise towards the 50-SMA. A rest and shut above this resistance could increase the potential of a rally to $338.

On the other hand, when the cost turns lower and breaks underneath the 20-EMA, the happy couple could again drop towards the critical support at $275. If the level cracks, the happy couple will develop a bearish heads and shoulders pattern and drop toward $240.

EOS/USDT

EOS has created the bullish inverse mind and shoulders setup. The buyers pressed the cost over the overhead resistance at $1.46 on August. 17 however the lengthy wick around the day’s candlepower unit shows strong selling at greater levels.

The bears pulled the cost back underneath the breakout degree of $1.46 on August. 19 however the positive sign would be that the buyers didn’t permit the EOS/USDT pair to sustain underneath the 20-day EMA ($1.32). This signifies that ‘abnormal’ amounts are attracting buyers.

If bulls sustain the cost above $1.46, the positive momentum could get and also the pair may rally to $1.83. If the resistance can also be scaled, the rally could include the pattern target of $2.11.

This positive view could invalidate when the cost turns lower and breaks below $1.24. The happy couple could then decline towards the 50-day SMA ($1.17).

The rally above $1.46 on August. 17 pressed the RSI around the 4-hour chart to deeply overbought levels. This might have enticed short-term buyers to reserve profits, which pulled the cost towards the strong support at $1.24. The bulls purchased the dip for this level and also have again propelled the happy couple over the overhead hurdle at $1.46.

The happy couple could now rally to $1.56 after which towards the important resistance at $1.83. Alternatively, when the cost turns lower in the current level and breaks underneath the moving averages, it’ll claim that the happy couple could remain range-bound for any couple of days.

Related: three reasons why the Bitcoin cost bottom isn’t in

QNT/USDT

The number of greater highs and greater lows claim that Quant (QNT) is within a brief-term upward trend. The bulls purchased the drop towards the 50-day SMA ($100) and are trying to resume the up-move.

When the cost sustains over the 20-day EMA ($111), it’ll claim that the correction might be over. The QNT/USDT pair could first rise to $124 after which retest the key resistance at $133. If bulls obvious this hurdle, the happy couple could rally towards the overhead resistance zone between $154 and $162.

Unlike this assumption, when the cost does not sustain over the 20-day EMA, it’ll indicate that traders might be closing their positions on rallies. The bears will need to sink the cost below $98 to achieve top of the hands and signal the beginning of a much deeper correction to $79.

The happy couple continues to be correcting in the falling wedge pattern. The buyers pressed the cost over the resistance type of the pattern but tend to not sustain the breakout. This means that bears are active at greater levels.

When the cost sustains underneath the 50-SMA, the happy couple could slide towards the 20-EMA. It is really an important level to take into consideration. When the cost rebounds off this level, it’ll claim that rapid-term trend has switched in support of the buyers.

A rest and shut above $118 could indicate the corrective phase might be over. On the other hand, when the cost slips underneath the 20-EMA, the happy couple may drop to $100.

CHZ/USDT

Chiliz (CHZ) soared to $.23 on August. 18 which pressed the RSI deep in to the overbought territory. This might have enticed short-term traders to reserve profits which pulled the cost back underneath the breakout degree of $.20.

A small positive would be that the bulls are trying to defend the 20-day EMA ($.17) and push the cost back above $.20. When they succeed, it’ll claim that the sentiment remains positive and traders are purchasing on dips. That increases the probability of a retest of $.23. If bulls obvious this hurdle, the CHZ/USDT pair could get momentum and rally to $.26.

Unlike this assumption, when the cost does not go above $.20, it’ll claim that bears can sell on rallies. The bears is going to be during the driver’s seat when they sink the happy couple underneath the 20-day EMA. The happy couple could then decline towards the 50-day SMA ($.13).

The bulls are attempting to defend the upward trend line however the recovery is facing strong resistance in the moving averages. The moving averages completed a bearish crossover around the 4-hour chart and also the RSI is incorporated in the negative territory, indicating a small benefit to sellers.

When the cost turns lower and breaks underneath the upward trend line, the selling could intensify and also the pair may drop to $.16 after which to $.14. This type of move will indicate the bears stay in control.

Rather, when the cost breaks over the moving averages, the bulls will attempt to push the happy couple to $.21 and then challenge the resistance at $.23.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.