BNB, the native token of Binance’s BNB Chain, joined a symmetrical triangular formation on August. 10, if this first faced the climbing down trendline in the $335 resistance. The next five days happen to be challenging around $280, the precise intersection backward and forward conflicting climbing and climbing down patterns.

A choice on if the symmetrical triangular will break towards the upside or bad thing is expected by Sept. 30, once the trendlines mix. Presently holding a $45 billion total market capital, BNB Chain token has outperformed the broader altcoin market by 15% in the last three several weeks.

The most recent breakthrough in BNB Chain development was announced on Sept. 7, following the project introduced zero-understanding (ZK) proof scaling privacy technology. The testnet is anticipated for November, targeting faster finality and reduced transaction charges. Ethereum mastermind Vitalik Buterin also really wants to implement an identical solution for that Ethereum network and that he highlighted the significance of ZK at the end of 2021.

BNB Chain’s Ethereum-compatible network is completely functional, hosting decentralized applications (DApps), including decentralized exchanges (DEXs), games, collateralized loan services, social systems, yield aggregators and NFT marketplaces.

A loss of cost deposits might be a warning sign

Despite presently being 60% below its -time high, BNB continues to be the third largest cryptocurrency by market capital ranking, excluding stablecoins. Furthermore, the network holds $6.6 billion price of deposits locked on smart contracts, a phrase referred to as total value locked, in the market.

Despite BNB cost rallying 26.5% previously 3 several weeks, the network’s TVL measured in BNB tokens came by 12.5% within the same period. Usually, this data could be concerning, however it depends upon how other competitors have fared.

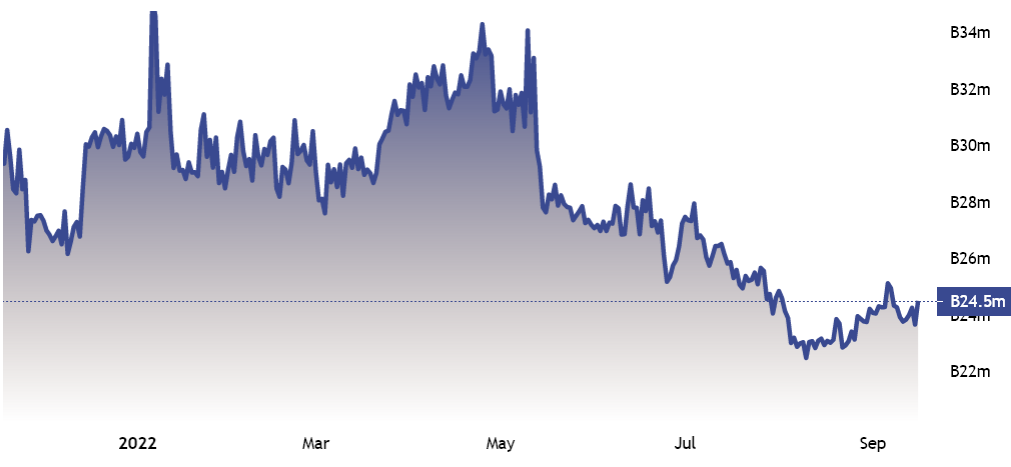

Actually, lower smart contract deposits happen to be standard over the industry. For instance, Solana’s (SOL) TVL declined by 27.5% in 3 several weeks, and Avalanche (AVAX) decreased by 36%. Even Ethereum saw a 29% decline in ETH deposits, lower to 24.two million from 34 million on This summer 17.

In dollar terms, BNB Chain’s current TVL of $6.6 billion acquired 12% within the three several weeks resulting in Sept. 16. This figure is vastly better than other Ethereum competitors, such Avalanche’s $2.2 billion or Solana’s $1.3 billion, according to data from DeFi Llama.

DApp use is rising, brought by Gameta

To verify whether BNB Chain’s TVL decline is supported by a decrease in users, investors should evaluate decentralized application (DApp) usage metrics. Some DApps, for example games and collectibles, don’t require large deposits, therefore the TVL metric does not matter in individuals cases.

PancakeSwap, BNB Chain’s decentralized exchange, has 1.75 million active addresses, and is absolutely the leader across all smart contract systems. Meanwhile, the Ethereum network only holds three DApps using more than 35,000 active addresses, namely Uniswap, OpeanSea and MetaMask Swap.

More to the point, three DApps using BNB Chain increased by 190% or greater, with Gameta to be the most promising, with more than 900,000 active addresses. BNB Chain critics will have a problem if another application besides PancakeSwap consolidates its leadership across all smart contract systems.

Knowing through the absolute figures, meaning the 12.5% TVL loss of BNB tokens and also the 14% decrease in active addresses on Binance Chain’s leading DApp, you could incorrectly conclude that BNB token is primed for any correction.

However, a far more granular analysis, together with a comparison with competitors, implies that the symmetrical triangular pattern crossing at $280 on Sept. 30 is probably a bullish trigger for BNB’s cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.