The shift from the Ethereum blockchain to some proof-of-stake (PoS) protocol opened up new possibilities for developers and investors to understand more about, such as the burning of Ether (ETH). Now, Ethereum transactions are validated through staking instead of mining.

Staking impacts the availability and cost dynamics of Ether with techniques which are diverse from mining. Staking is anticipated to produce deflationary pressure on Ether, instead of mining, which induces inflationary pressure.

The rise in the quantity of funds kept in Ethereum contracts may also push ETH’s cost in the lengthy term, because it affects among the fundamental forces that determine its cost: supply.

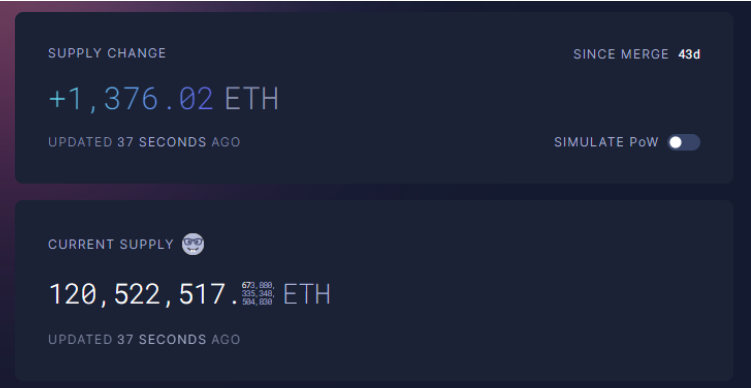

The proportion of recently issued Ether versus burned Ether has elevated by 1,164.06 ETH because the Merge. Which means that because the Merge, the majority of the recently minted supply continues to be burned with the new burn mechanism, that is likely to turn deflationary once the network sees an uptick being used.

Based on Bitwise analyst Anais Rachel, “It’s likely that ETH issued because the Merge may have been removed from circulation through the finish of the week.”

1/ The chances are all ETH issued because the Merge may have been removed from circulation through the finish of the week pic.twitter.com/WqRASUwi4i

— Anais Rachel (@Anais_Rchl) October 27, 2022

As the graph covers the 43 days because the Ethereum Merge, the tokenomics are established to turn Ether deflationary.

The reduction is due to Ethereum’s movement from proof-of-try to proof-of-stake. The entire supply difference implies that Ether continues to be inflationary, with +1,376 ETH minted because the Merge.

Ankit Bhatia, Chief executive officer of Sapien Network, described to Cointelegraph how staking impacts supply in May 2020:

“The retail market would definitely acquire ETH from exchanges like Coinbase, that will most likely provide the choice for buyers to instantly stake their purchase and additional reduce circulating supply.”

There’s proof of a rise in locked Ether. For instance, DefiLlama shows that more than $31.78 billion price of Ether is presently kept in smart contracts.

Additionally to Ethereum’s PoS-locked tokens, Token Terminal data supplies a introduction to staked tokens through the Ethereum ecosystem.

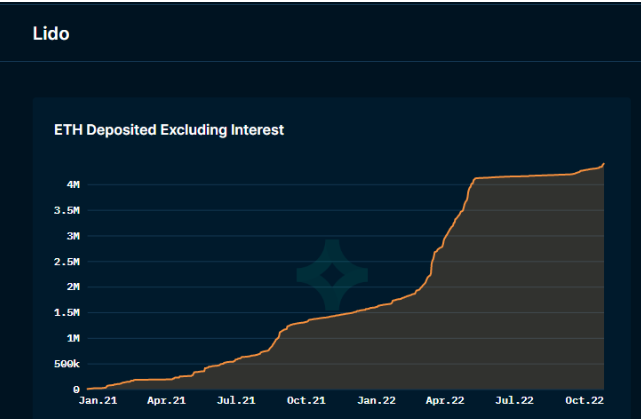

The key protocols include Uniswap, Curve, Aave, Lido and MakerDao. For instance, the entire value locked (TVL) on Lido is $6.8 billion, while MakerDao has $8 billion.

Showing an elevated curiosity about proof-of-stake, Ether holders depositing to stake are moving Lido to new heights. Lido’s TVL elevated from $4.52 billion prior to the Merge news on This summer 13 to $6.8 billion during the time of writing.

As October involves an finish, the TVL is constantly on the increase as numerous investors lock Ether.

DeFi protocols see an uptick in TVL and daily active users

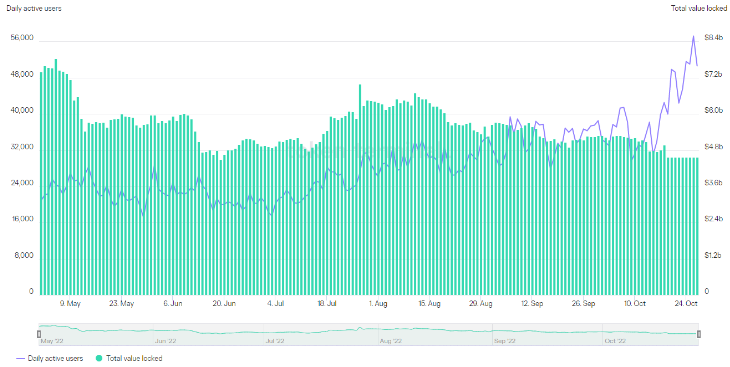

The TVL and daily active users (DAUs) of Uniswap happen to be growing with time. Generally, the increase in a protocol’s TVL is supported by increases in DAUs around the platform. Probably the most likely reason for the rise in TVL and DAUs may be the lucrative Ether staking rewards.

A rise in DAUs at Uniswap may trigger more Ether to lose because of a rise in transactions, and it assists to take more Ether from circulation as Uniswap’s TVL grows. The very best pairing on Uniswap with Ether is USD Gold coin (USDC), which presently supplies a 34-plus percent annual percentage yield.

Lucrative staking yields

Ether combined with stablecoins on Uniswap is really a best choice for liquidity providers. The pairing is generating, for the most part, 72.20% APY when searching at Ether combined with Tether (USDT).

It’s important to note that some staking platforms cope with liquid staking derivatives, including Coinbase, Lido and Frax. In such instances, the yield is up to 7% each year.

Data from EthereumPrice.org implies that Lido pays 3.9% APY, Everstake 4.05%, Kraken 7% and Binance 7.8%.

You should observe that the speed of return also varies in line with the amount invested. Usually, smaller sized amounts have greater APYs than bigger amounts. The yield also depends upon the protocol.

For instance, validators earn greater than individuals who invest on crypto exchanges and pooled staking. However, validators are needed to stake 32 ETH and also maintain their nodes, that is a reason platforms like Lido help smaller sized ETH holders earn.

The rise in Ethereum’s TVL from elevated yields, the proceed to PoS, and DAUs on top Ethereum decentralized applications may ultimately result in an Ether rally.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.