Liquid staking is continuing to grow in recognition in the last year, thanks, partly, towards the launch from the Ethereum Beacon Chain and also the lack of ability of Ether (ETH) stakers to withdraw their tokens until the entire launch of the consensus layer.

Consequently, Lido (LDO) has built itself like a leader within the liquid staking sector. Lido is among the primary staking protocols for many popular tokens also it enables token holders to earn an additional yield by putting their staked assets to operate in decentralized finance (DeFi).

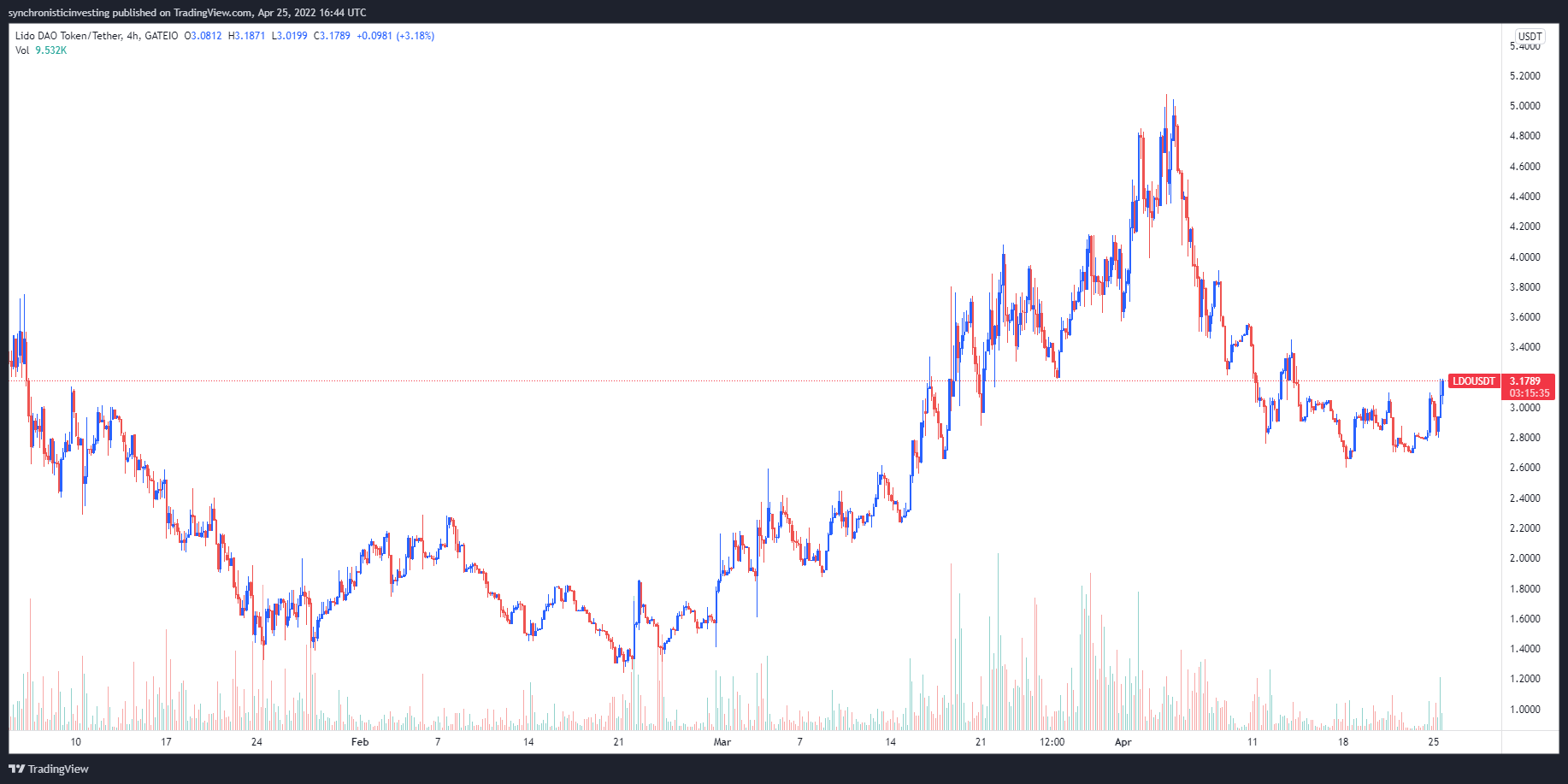

Data from Cointelegraph Markets Pro and TradingView implies that the cost of LDO trended greater through the month of March after which joined a consolidation period at the begining of April. Presently, the broader marketplace is inside a sharp downtrend, however the development of the staking sector and also the approaching Ethereum “merge” could still result in bullish outcomes for LDO.

Expanding liquid staking options

LDO cost reversed its trend toward the finish of Feb which was, partly, because of the inclusion of Polygon (MATIC) liquid staking towards the Lido protocol, that was developed along with Shard Labs.

Lido for Polygon is here now ️https://t.co/FCv36KDQj4

Stake your MATIC with Lido to have an easy staking experience.

Get began on https://t.co/usVwJcgv4Q. pic.twitter.com/ueBk2iSYeE

— Lido (@LidoFinance) March 2, 2022

During the time of writing, there’s greater than $14.5 million price of MATIC staked on Lido which is earning a 8.7% yield. The protocol presently enables tstaking of ERC-20 MATIC tokens and stakers receive stMATIC in exchange, which may be found in DeFi protocols around the Ethereum and Polygon network.

The extra new assets, plus an rise in the quantity of Ether staked on Lido, sent the entire value locked around the protocol to some record-high $20.83 billion on April 5 and presently, this figure is $18.3 billion, according to data from Defi Llama.

New partnerships and integrations increase Lido’s marketshare

Investments from institutions and integrations along with other protocols also paint a bullish picture for LDO. The work lately received a $70 million investment from Andreessen Horowitz’s (a16z) firm.

We’re very happy to welcome a16z towards the Lido family.

— Lido (@LidoFinance) March 3, 2022

Combined with the $70 million investment, a16z also says it might be staking some of their Ether holdings around the platform in an effort to reduce a few of the operational complexities for institutional investors.

Lido also taken advantage of multiple integrations throughout March and April, including staked Ether (stETH) being put into the lending pools on Aave (AAVE). Staked Solana (stSOL) seemed to be integrated on multiple platforms within the Solana (SOL) ecosystem, including Raydium, Friktion Finance and multiple protocols adding support for staked Terra (stLUNA).

Related: The numerous layers of crypto staking within the DeFi ecosystem

Enhancing decentralization could attract investors

Take into consideration that may help raise the forward outlook for LDO may be the developers’ concentrate on improving the decentralization from the protocol.

A measure within this process may be the adoption of Distributed Validator Technology (DVT), which groups validators into independent committees that propose and verify blocks together in an effort to help prevent a person validator underperforming or misbehaving.

This can help to simplify and accelerate the entire process of adding new node operators (NOs) because new operators could be combined with several majority reliable NOs to assist decrease potential risks.

Another improvement includes the opportunity to stake with different Node Operator Score, which comes from several metrics and thihelps offer an incentive to operators to keep optimal performance.

The last improvement is the development of new mechanics for example extended period-locks and providing veto legal rights to some quorum of stETH holders in an effort to mitigate the chance of governance capture to avoid unplanned changes to Lido.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.