The present crypto bear market has caused panic, fear and uncertainty in investors. The dire situation began once the global market capital of crypto dropped underneath the $2 trillion mark in The month of january 2022. Since that time, the cost of Bitcoin (BTC) has decreased by over 70% from the all-time a lot of $69,044.77, arrived at on November. 10, 2021. Similarly, the of other major cryptocurrencies for example Ether (ETH), Solana (SOL), Avalanche (AVAX) and Dogecoin (DOGE) have decreased by around 90%.

So, does history inform us anything about once the bear market will finish? We begin by analyzing what causes the 2022 bear market.

Catalysts from the 2022 bear market

There are many factors that caused the present bear run.

To begin with, the build-to the bear market began in 2021. During this time period, many regulatory government bodies threatened introducing stringent laws and regulations governing cryptocurrencies. This produced fear and uncertainty on the market. For instance, the U . s . States Registration (SEC) issued a suit against Ripple. Additionally, China banned Bitcoin mining, leading to the majority of its BTC miners getting to relocate abroad.

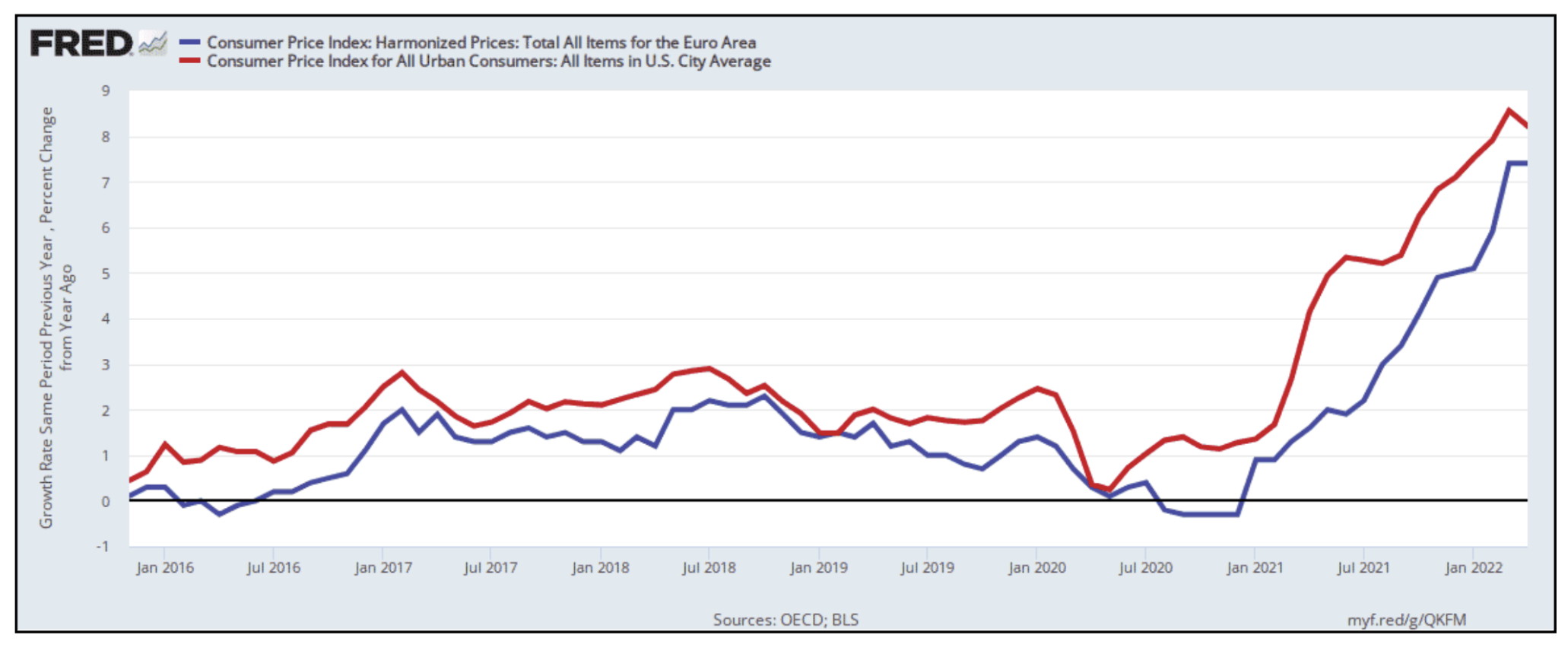

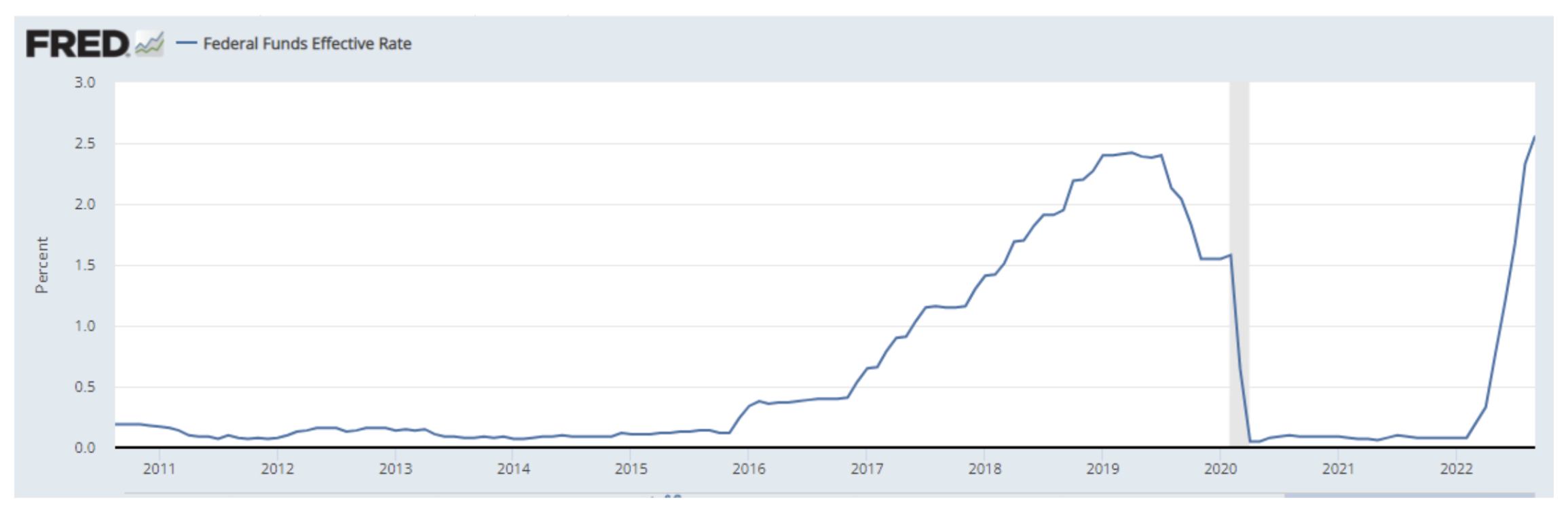

A worldwide rise in inflation and rising rates of interest instilled fear and uncertainty on the market, leading to lower crypto investment than expected. Although there’s much publicity relating towards the U . s . States’ inflation and rates of interest, other nations for example India have observed similar challenges.

Particularly, captured, the Fed announced it had become taking stringent measures to “accelerate tapering of monthly bond purchases.” Quite simply, the U . s . States planned introducing measures that slow lower its economy to manage the ever-rising inflation in the united states. The next graph shows the inflation trend from 2016 to 2022.

Essentially, to lessen the speed of inflation, the Fed elevated the government funds rate two occasions in the past year. This reduced the disposable earnings of U.S. residents, therefore dampening investment efforts in risk assets like cryptocurrencies.

Crypto analysts think that leverage was another responsible for the present bear market. Leverage entails pledging a tiny bit of money as collateral to gain access to a lot for investing. Within this situation, investors borrow from exchanges to invest in their investments on the market.

The down-side of leverage is the fact that when the cost of the asset starts to fall, the buying and selling positions liquidate, producing a cascading crash of cryptocurrency prices. This lowers investor confidence and has a tendency to inject fear and uncertainty in to the market.

While traditional markets have circuit breakers and protections, this isn’t the situation for that crypto market. Take, for instance, the current collapse of Terra, its LUNA token — now referred to as Terra Classic (LUNC) — and it is TerraUSD (UST) stablecoin. Inside the same period, other crypto firms for example Celsius, Three Arrows Capital and Voyager Capital declared personal bankruptcy.

Signs the bear marketplace is nearing an finish

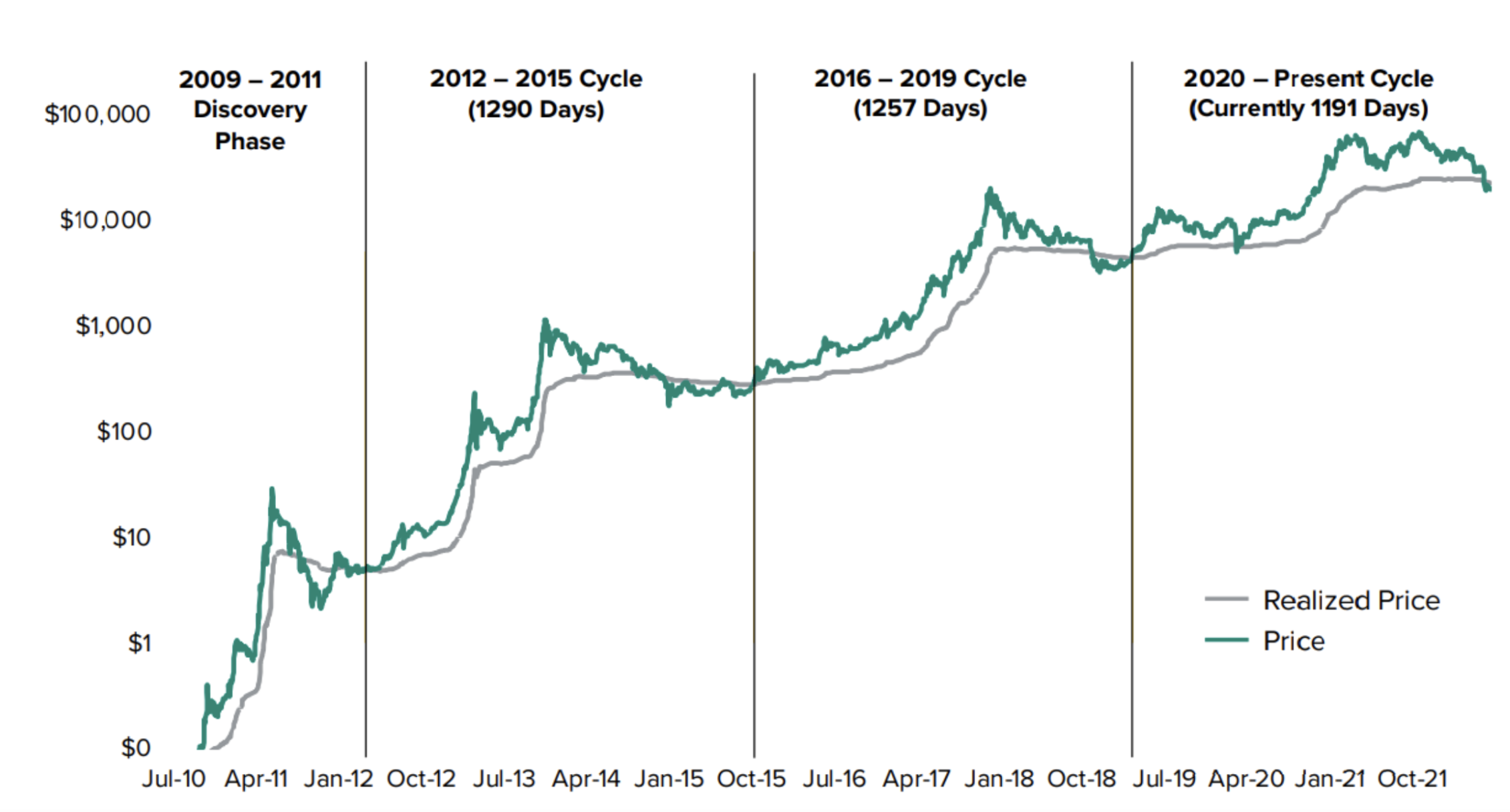

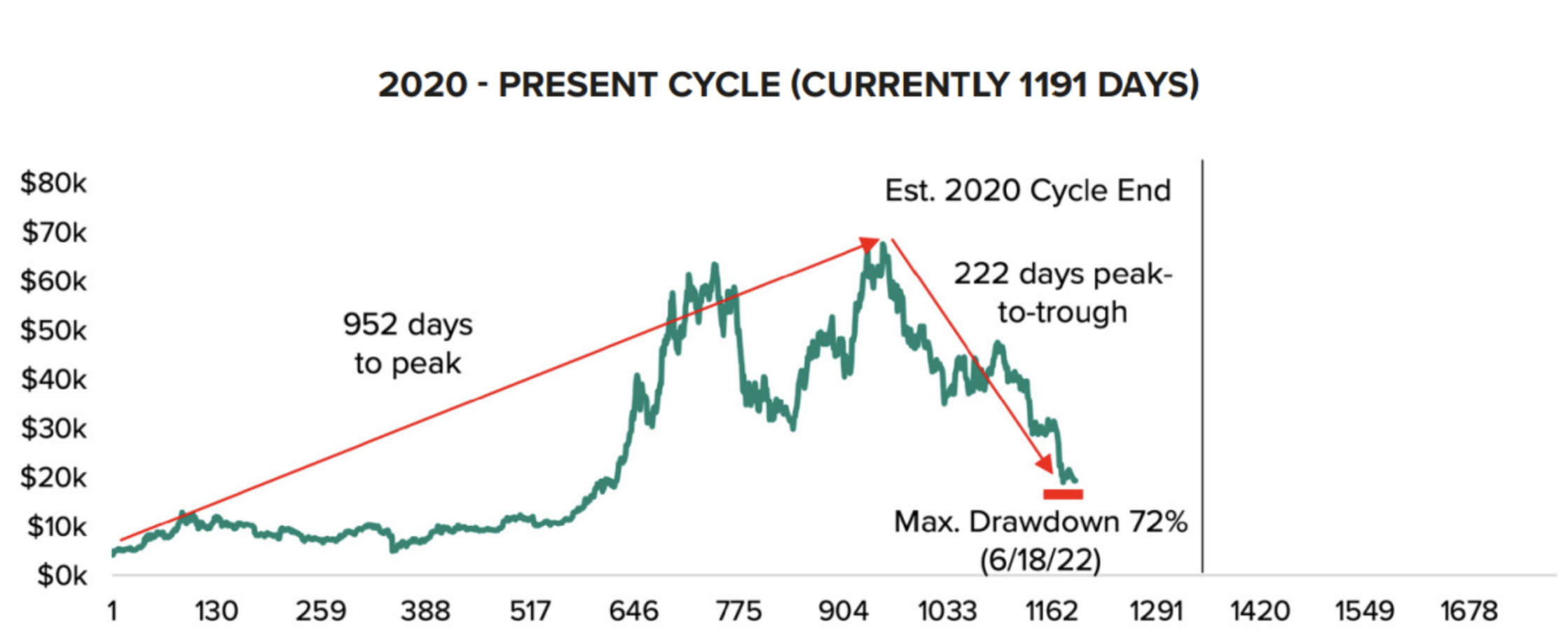

Analysts study market cycles to calculate whenever a bear market can come for an finish. Generally, market cycles include four phases: accumulation, markup, distribution along with a mark-lower. For Bitcoin, the marketplace cycle occurs over 4 years, or 1,275 days. The final phase usually pertains to the bear market.

Based on Grayscale, the crypto bear market commences once the recognized cost of Bitcoin surpasses its market cost. Grayscale defines recognized cost as:

“The amount of all assets in their purchase cost or recognized market capital, divided through the market capital from the asset which supplies a stride of the number of positions have been in or from profit.”

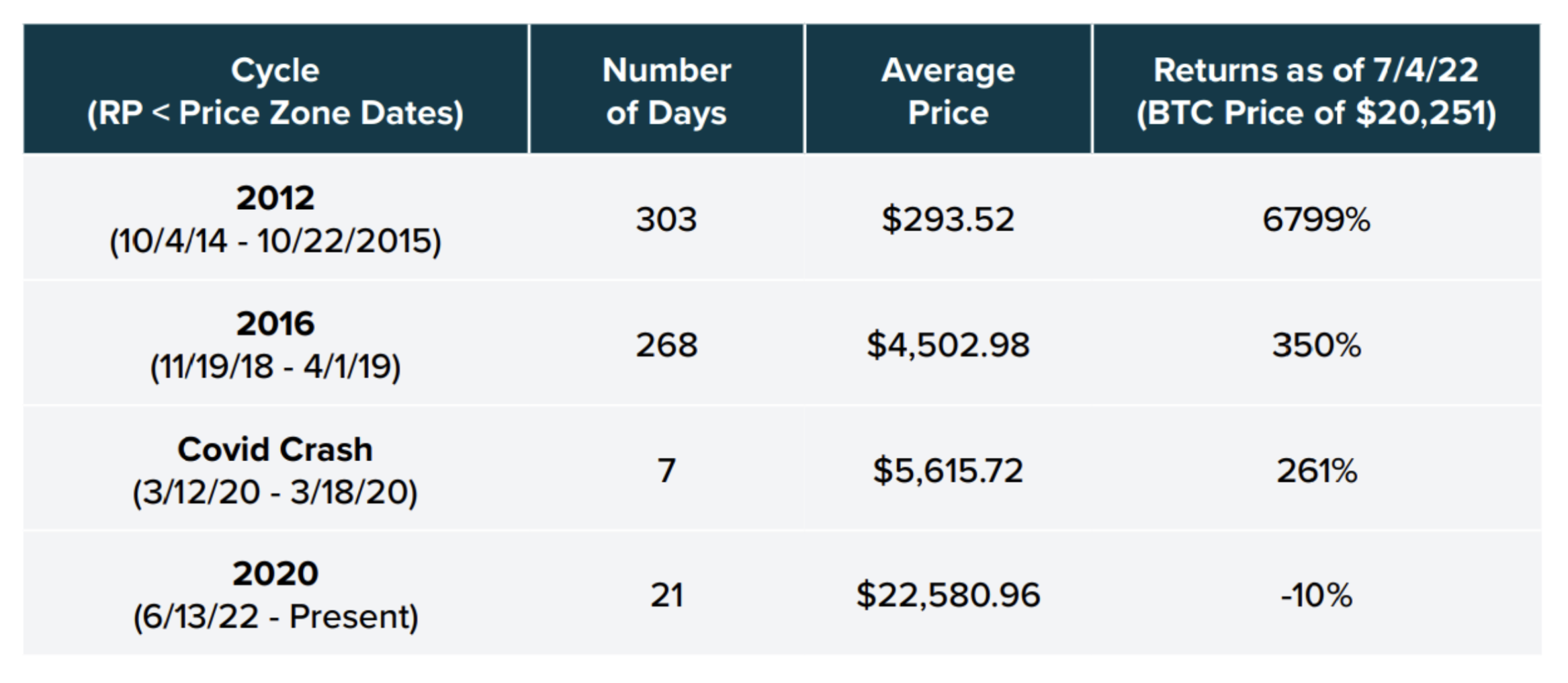

The recognized cost of BTC surpassed the marketplace cost on June 13, 2022. The table below shows the costs of Bitcoin when its market cost was more than the recognized one.

It’s interesting to notice that by This summer 12, the cycle had completed 1,198 days. Because the entire cycle takes 1,725 days, with that date there have been four several weeks before the recognized cost would mix over the BTC market cost.

However, in the finish from the four several weeks, Bitcoin would want another 222 days to achieve its previous all-time high. Which means that from This summer, it might take as many as 5 to 6 several weeks for that bear sell to finish. The graph summarizes the expected trajectory of the present crypto cycle.

When the market cycle requires a similar structure because the 2012 and 2016 cycles, and when Grayscale’s findings are accurate, then your bear market could finish between November 2022 and December 2022.

Related: Exactly why is the crypto market lower today?

How lengthy Bitcoin traders expect the bear sell to last

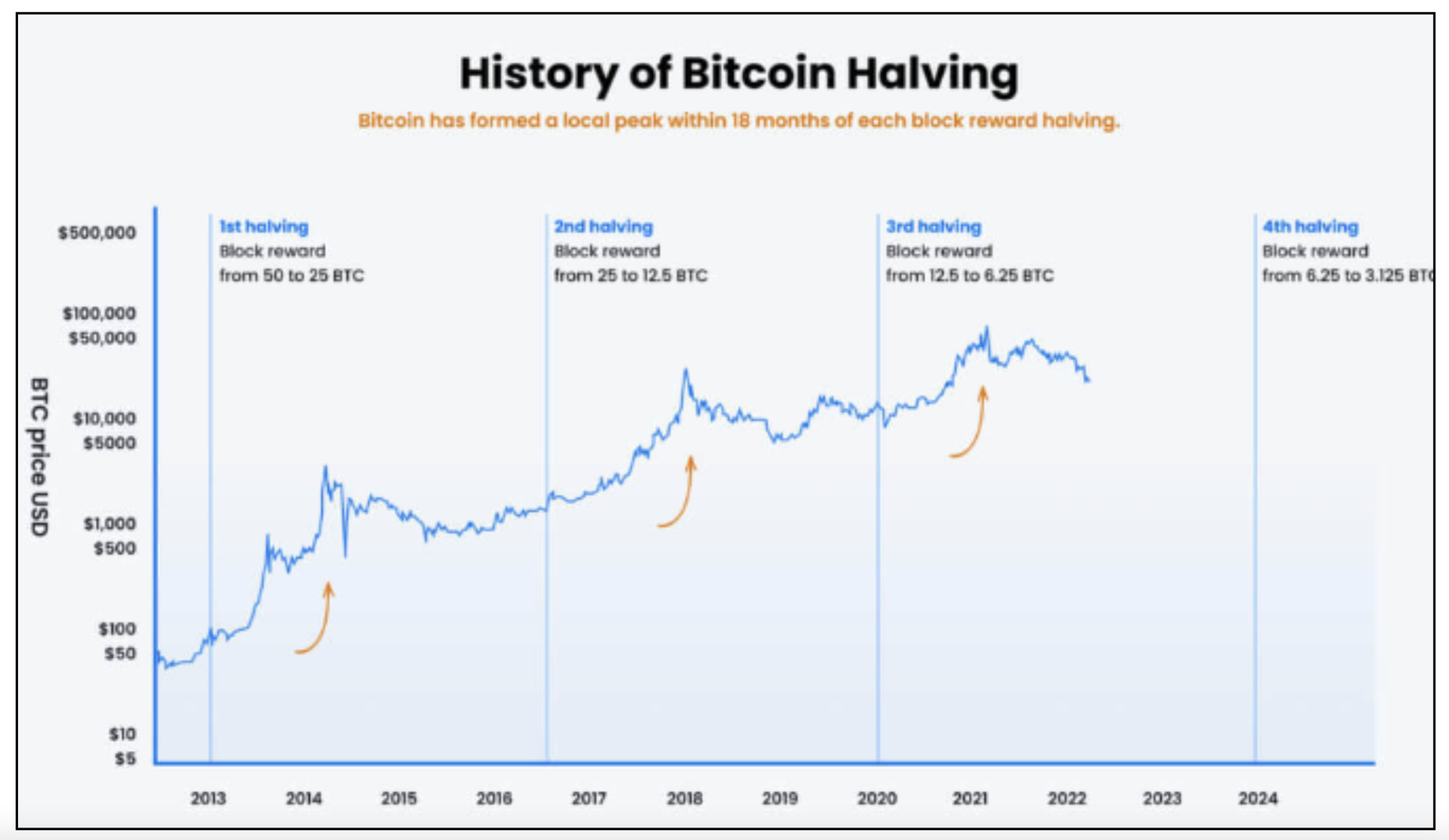

Bitcoin maximalists have a tendency to look toward the Bitcoin halving being an indicator to calculate the following bull run. Analyzing history, BTC has created an optimum within 18 several weeks of every Bitcoin block reward halving.

Previously, Bitcoin’s halving has preceded crypto bull runs, as suggested for the above mentioned graph. So, BTC maxis who contend the halving schedule directly impacts the bullish or bearish nature of Bitcoin might be correct.

The 2022 bear marketplace is unique because of several reasons. First, key macroeconomic variables for example high rates of interest and soaring inflation elevated its impact. Too, the Terra-LUNA crash and leverage through the entire crypto ecosystem led to the start of the bear run.

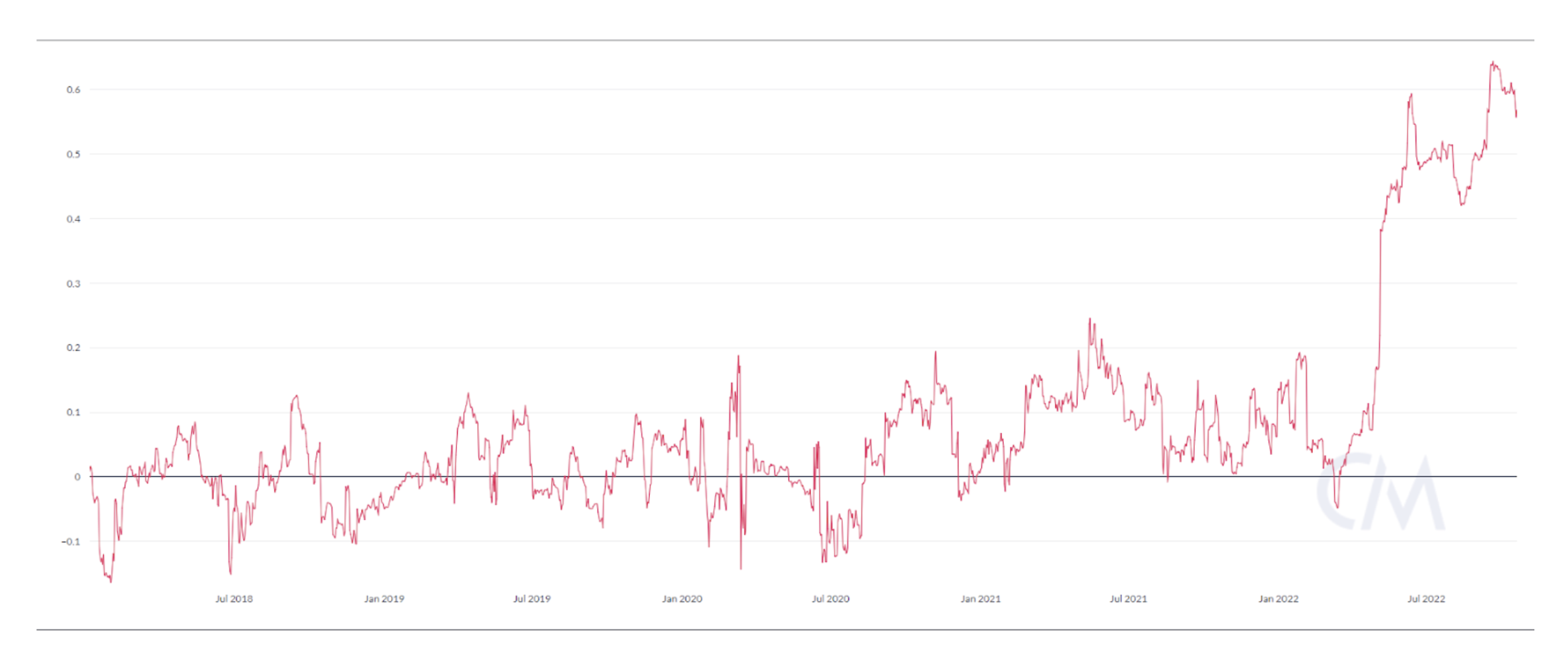

Remarkably, this is actually the first bear market by which there’s a correlation between the stock exchange and Bitcoin, having a correlation rate well over .6 in This summer 2022, according to Gold coin Metrics data. It’s also the very first time that the need for BTC has fallen underneath the previous cycle peak, with the need for BTC falling below $17,600.

The contrasting situations between your 2021 crypto bull run and also the 2022 bear market have baffled crypto investors. Analysts think that the present bear market will finish between November 2022 and December 2022, having a possible bull run beginning between your finish of 2024 an earlier 2025.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.