Fantom (FTM) is renowned for its speed and affordable layer-1 blockchain. Like other blockchains (for instance, Solana (SOL) and Avalanche (AVAX)) that scale much better than their counterpart, it’s been dubbed an “Ethereum killer.” After raising $40 million in funds, Fantom launched its mainnet in December 2019. Since that time, it’s grown to get probably the most popular blockchains, relaxing in the very best 10 blockchains by total value locked (TVL) with $1.3 billion in TVL.

Fantom’s high-throughput blockchain is definitely an open-source smart contract platform. It’s scalable and EVM-compatible, meaning you are able to deploy and run your Ethereum decentralized applications (DApps) on Fantom. Its structure enables the support because of its decentralized finance (DeFi), apart from managing digital assets and DApps.

The Fantom consensus mechanism is definitely an adapted form of proof-of-stake, and it is known as Lachesis. It’s been made to provide high-speed transactions, low charges and almost instant finality because of the aBFT formula. aBFT can scale to a lot of nodes worldwide inside a permissionless, open-source atmosphere, supplying a good degree of decentralization.

The Fantom blockchain is operated by its native FTM token, and if you think maybe within the project and wish to increase your FTM stack, you can look at staking Fantom to earn passive earnings.

What’s Fantom staking?

Staking is creating a blockchain safer by locking up an investor’s digital assets for some time. This security is supplied by validators who validate transactions using their staked tokens, which becomes a fiscal incentive to allow them to behave based on the protocol’s rules.

By staking FTM, investors positively take part in securing its network while earning passive earnings, i.e., FTM rewards. Staking implies that tokens must be secured for a while however, they it’s still relaxing in the owners’ wallets, only they are able to access and unlock their anytime.

How you can stake FTM

The minimum stake add up to operate a validator is 500,000 FTM to avoid Sybil attacks on its consensus mechanism. Sybil attacks are malicious attacks which involve falsifying multiple identities to achieve an undue advantage inside a network. Because the validator’s needed amount is comparatively high, it might be simpler to delegate FTM to some validator.

A couple of Fantom staking strategies may be used:

- Fluid staking: Investors can secure their FTM token from two days to one year for much better returns. The reward varies based on the entire staking period the more FTMs are staked, the greater the reward rate.

- Liquid staking: Investors can mint sFTM for improved Return on investment when liquid staking. They may also stake farmed tokens, take part in liquidity mining, farm LP rewards and much more.

- Custodial staking: Investors may take FTM on the centralized exchange (CEX) like Binance or Coinbase. The staking reward is 1%.

To stake on Fantom, users can follow these easy steps:

- Have no less than 1 FTM to stake

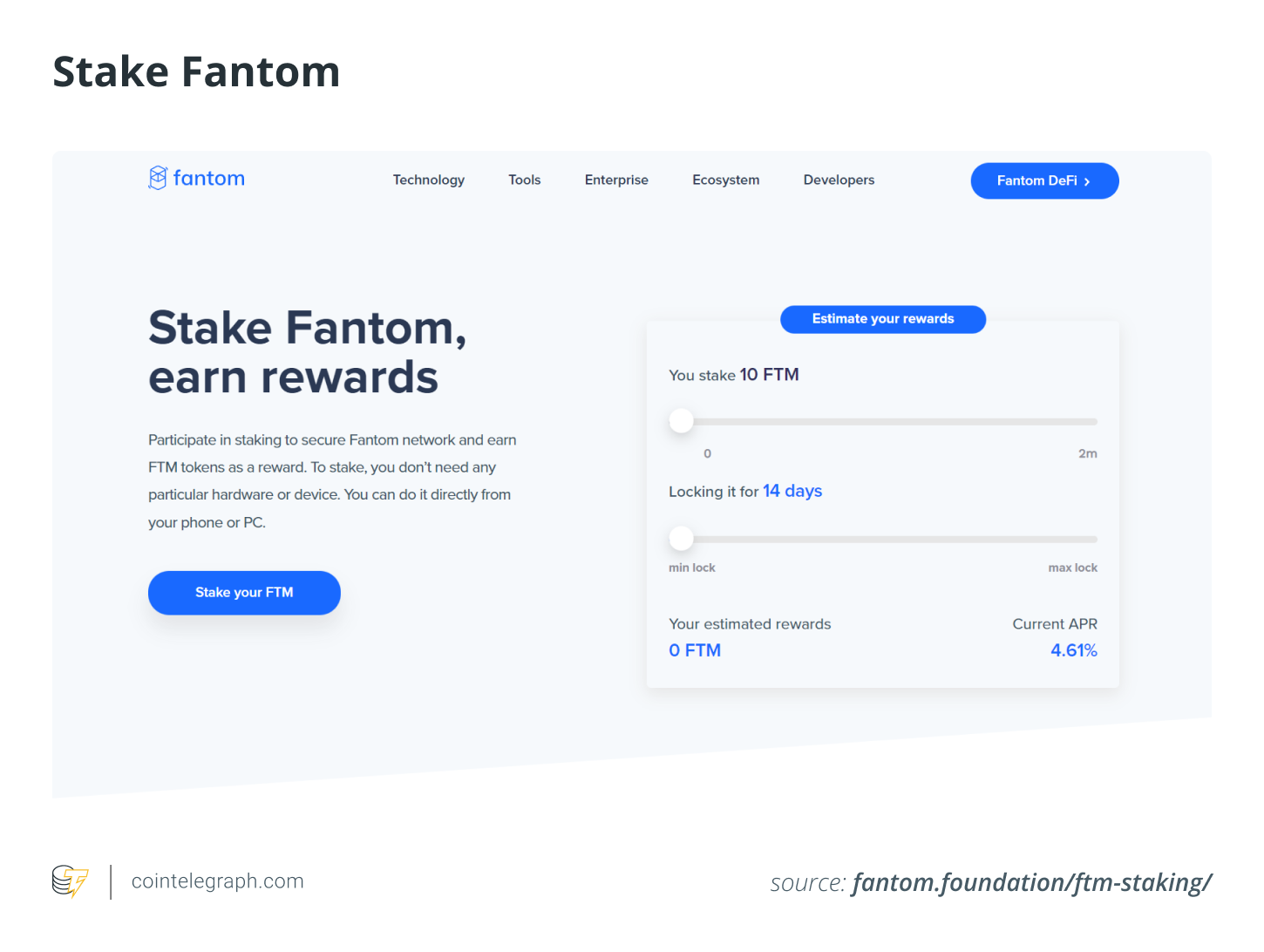

- Visit the Fantom staking page and click Stake your FTM

- You are able to sign in having a compatible wallet, like MetaMask. You are able to open the wallet out of your computer or perhaps your mobile phone. You may create a brand new wallet or access a current one utilizing a mnemonic or seed phrase.

- Deposit your FTM by transferring them from your exchange or any other wallet for your Fantom Opera wallet address.

- Click “Staking.”

- Give a delegation by selecting a validator as well as an amount.

- Select your lock-up period and ensure.

There’s a couple of options with regards to optimal Fantom wallets. The Fantom Opera network is really a second-layer and EVM-compatible blockchain, meaning which you can use any wallet that actually works for Ethereum, for example MetaMask, the Coinbase Wallet or perhaps a cold wallet like Ledger.

After creating a free account on Fantom, you may also download your Fantom wallet (fwallet) by hitting the “Create Wallet” button:

Where you can stake FTM?

Apart from its native blockchain network, Fantom could be staked across many platforms, including decentralized exchanges (DEX) and custodial blockchains. Here we’ll consider the places to stake Fantom so that you can decide the most appropriate.

How you can stake Fantom on Ledger

Staking via a hardware wallet like Ledger works via a smart contract interaction, like other transactions. It’s sufficient to stake in the Fantom fWallet by signing Fantom FTM Ledger Nano S application. Then, make use of the “Stake” food selection in your account.

How you can stake Fantom on Coinbase

In September 2021, Fantom announced support for that Fantom network around the Coinbase Wallet. Coinbase Wallet users have access to and employ the Fantom network and interact with Fantom DApps. Users can connect their Coinbase Wallet account for their Fantom fWallet and conduct activities for example stake FTM and produce rewards.

How you can stake Fantom on Binance

To stake FTM on Binance, you need to deposit a handy amount around the exchange, go to Binance Earn and select the appropriate product for you personally usually, it’s a secured duration of 30, 60, or 4 months. You may choose a far more extended staking period for greater returns as much as 14%.

How you can stake Fantom on Kucoin

Much like Binance, you have to deposit your FTM token on Kucoin and visit Kucoin Earn. Then click “Subscribe” to choose the merchandise that best suits you better, according to rewards and also the time you need to lock your assets.

Could it be safe to stake FTM?

It’s safe to stake FTM since the validator node cannot access your staked tokens make certain to not lose your mnemonic phrase or private key. However, as with other proof-of-stake blockchains, you risk losing a small fraction of your stake when the validator isn’t trustworthy and misbehaves. It’s far better to select trustworthy Fantom validators who also have active communities, websites and Twitter accounts.

How you can stake other tokens on Fantom

Fantom supplies a flexible and dynamic ecosystem enabling the staking of countless DeFi tokens to earn passive earnings in your investment. To make use of the following systems to stake their native tokens, you’ll need a MetaMask or other wallet pointed out above attached to the Fantom Opera network. Within this situation, Fantom staking functions just like a CEX, for example Binance, being a marketplace where non-native cryptocurrencies are traded.

Here are the most widely used tokens which are based and could be staked on Fantom:

- Spookyswap may be the greatest DEX on Fantom, with $777 million TVL and BOO being its native token, which may be glued with FTM for optimum liquidity and also to yield farm. To stake BOO, purchase the tokens within an exchange or swap them in Spookyswap connect your bank account to Fantom Opera to see your positions and begin earning.

- BeethovenX is really a community-driven DEX, an automated market maker (AMM) along with a DeFi powerhouse. Controlled by BEETS native token and living around the Fantom Opera and Optimism chain, it yields an APR of 31%. To stake Beets, after depositing some FTM, connect your bank account to Fantom Opera and stick to the procedure to select a validator and also the locking time.

- QiDao is definitely an autonomous and community-governed protocol that sits on Fantom and enables you to definitely borrow stablecoins with zero interest upon your crypto assets utilized as collateral. Loans are compensated and paid back in miTokens (stablecoin soft pegged towards the USD).

- Scream is yet another decentralized lending protocol operated by Fantom, much like platforms like Compound (COMP) and Aave (AAVE). Users who stake SCREAM tokens can earn around 58% APR, while for liquidity providers, the rewards is often as high as 82% APR.

How you can operate a Fantom node

Validators run full nodes and therefore are an essential part from the Fantom network. By managing a full node, validators have fun playing the consensus to improve security and generate new blocks. There are several technical needs and skills that need considering to operate a Fantom full node, and it may be more appropriate for any technical operator.

Following would be the needs essential to operate a Fantom full node:

- Minimum requirement: 500,000 FTM

- Maximum validator size: 15x the self-stake amount

- Minimum hardware needs: AWS EC2 m5.xlarge with four vCPUs (3.1 GHz) and a minimum of 4.5 TB of Amazon . com EBS General Purpose SSD (gp2) storage (or equivalent).

- Rewards: presently ~13% APY (Normal APY on self-stake + 15% of delegators’ rewards). APY varies according to staked %. For up-to-date APY, look into the Fantom Foundation website.

One step-by-step help guide to managing a full-node

- Users can operate a node on their own hardware or make use of a cloud provider. Among the big cloud providers, e.g., Amazon . com AWS, is suggested.

- They are able to generate a non-root user.

- Install the needed building tools install Go after which Opera.

- Register their Fantom validator node on-chain. To get this done, users need to produce a validator wallet that becomes the validator’s identity within the network, needed to authenticate, sign messages, etc.

- Run their very own node. To get this done, they have to restart their node in validator mode, then close the Opera window by typing “exit.” Then they have to mind to your window where they began their node using the following command:

(validator)$ nohup ./opera –genesis $NETWORK –nousb –validator.id ID –validator.pubkey 0xPubkey –validator.password /path/to/password &

Users can refer to Fantom’s instructions for full specifications and details regarding how to operate a validator node.

How much cash are you able to make staking Fantom?

You can generate 5.01% when you purchase the minimum lock-up period (fourteen days) and also the minimum amount. The utmost APY is presently 15.31% for that maximum lock-up duration of one year.

The FTM staking rewards calculator will estimate just how much could be earned by staking Fantom.

FTM and many crypto tokens have came by over 90% throughout the 2022 bear market therefore, staking will grow the amount of your tokens although not always the general value. It is also worth thinking about that staking and locking your tokens up could make your funds illiquid and exiting a situation difficult.

Buy a licence with this article. Operated by SharpShark.