Flow (FLOW) logged its best daily performance on August.4 after becoming the most recent blockchain to support Instagram’s nonfungible token (NFT) features.

Insta-made FLOW rally

Meta Chief executive officer Mark Zuckerberg announced on August. 4 that Instagram had expanded its NFT support to 100 more countries in Africa, the Asia-Off-shore, the center East and also the Americas. Consequently, more users can publish digital collectibles minted around the Flow blockchain on Instagram.

Our prime-profile integration helped FLOW surge 54% to achieve an intraday a lot of $2.83 an expression. Interestingly, the token’s massive upside move supported an increase in the daily buying and selling volumes, confirming a few pounds behind the bullish trend.

Like every blockchain native asset, the good and the bad in FLOW’s demand are associated with the adoption of their parent chain. Generally, FLOW works as a legal tender inside the Flow’s proof-of-stake ecosystem for an additional purposes:

- Staking

- Staking rewards

- Transaction charges

- Account storage deposits

- Collateral for any stablecoin and DeFi products

- Participation in protocol governance and ecosystem development

That explains the token’s bullish reaction to Instagram’s adoption.

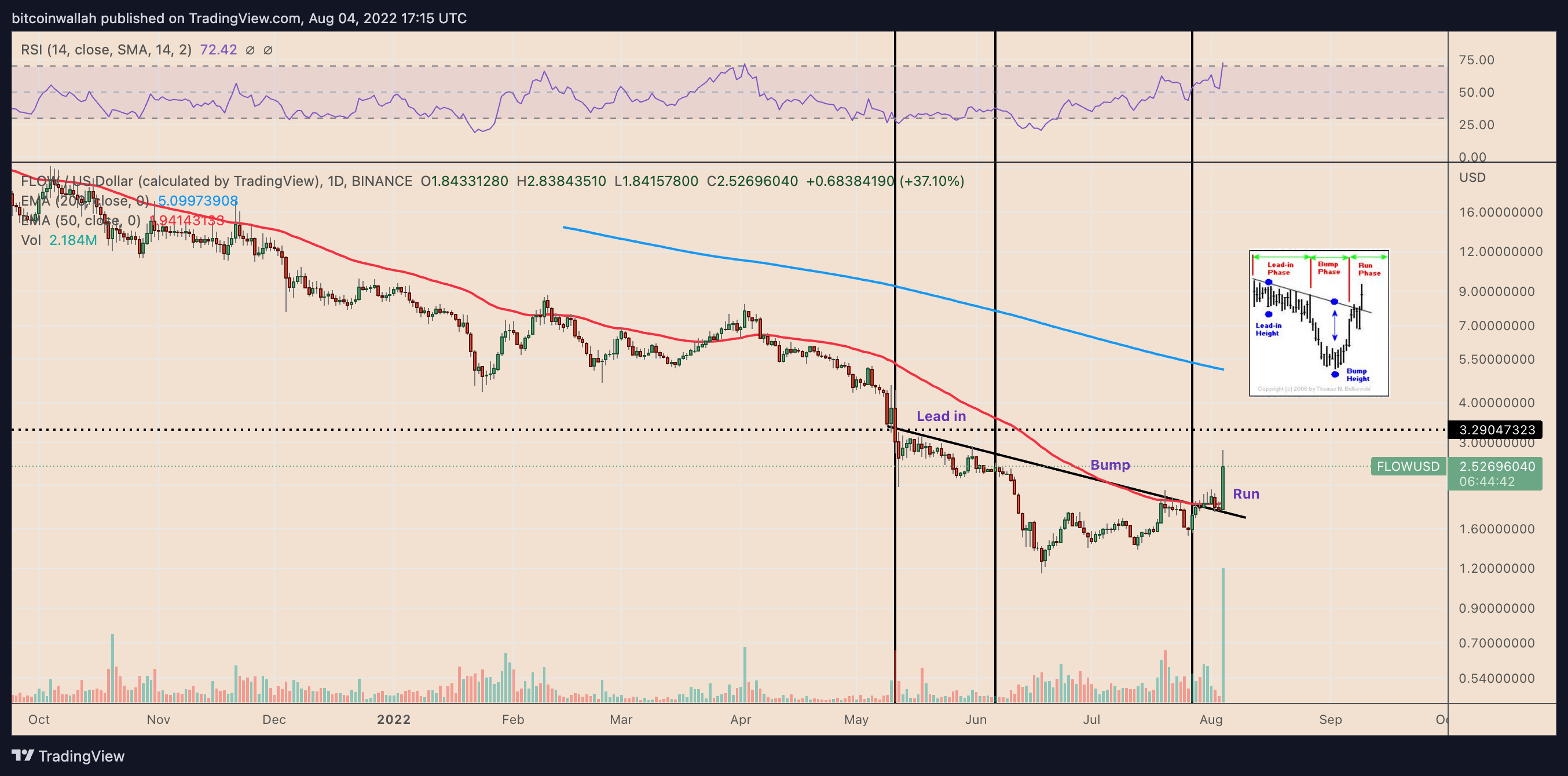

Another 30% gains ahead?

Theoretically speaking, FLOW eyes another 30% rally from the current cost levels.

FLOW’s recent cost trends have the symptoms of colored a bullish pattern known as the “Bump-and-Run-Reversal (BARR) bottom” on its daily chart. Now, the token has joined an outbreak stage using its upside target close to the level in which the BARR bottom’s formation started around $3.20.

Based on veteran analyst Tom Bulkowski, BARR patterns are “surprisingly good performers,” having a 76% possibility of meeting its profit target. That raises FLOW’s possibility to rise another 30% to $3.20, further based on strong fundamentals.

Around the switch side, FLOW’s latest bull run has pressed its daily relative strength index (RSI) above 70, or overbought territory, which implies increased sell-off risks.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.