A clear, crisp rebound within the Polygon (MATIC) market within the last four several weeks has elevated its cost by 200% when measured from the June 2022 bottom of $.31. And today, the token is showing indications of undergoing another major market rally.

MATIC exchange balance hits nine-month low

Particularly, the MATIC supply held by all crypto exchanges fell to 802.15 million on March. 26, its cheapest level since The month of january 2022. The plunge came as part of a wider downtrend which has observed over 600 million MATIC departing exchanges within the last four several weeks, data on Santiment shows.

A declining crypto balance across exchanges is regarded as bullish through the market since traders typically withdraw their from buying and selling platforms when they would like to contain the tokens lengthy-term.

The MATIC chart above shows an identical although erratic negative correlation between its cost and offer on exchanges. Consequently, a time period of loss of MATIC reserves at exchanges has in the past coincided by having an upward trend in cost and the other way around.

Therefore, the most recent plunge in MATIC supply across exchanges shows more upside for that token within the coming days.

Reddit using Polygon to mint collectible NFT avatars

More cues for any potential MATIC cost rally range from news of Polygon’s adoption by mainstream fintech companies.

Particularly, Nubank, a Brazilian neobank bank supported by Warren Buffett’s Berkshire Hathaway, selected Polygon to construct its native Web3 ecosystem. Because the March. 20 announcement, MATIC’s cost has rallied by nearly 12% and it was buying and selling for $.95 by March. 26.

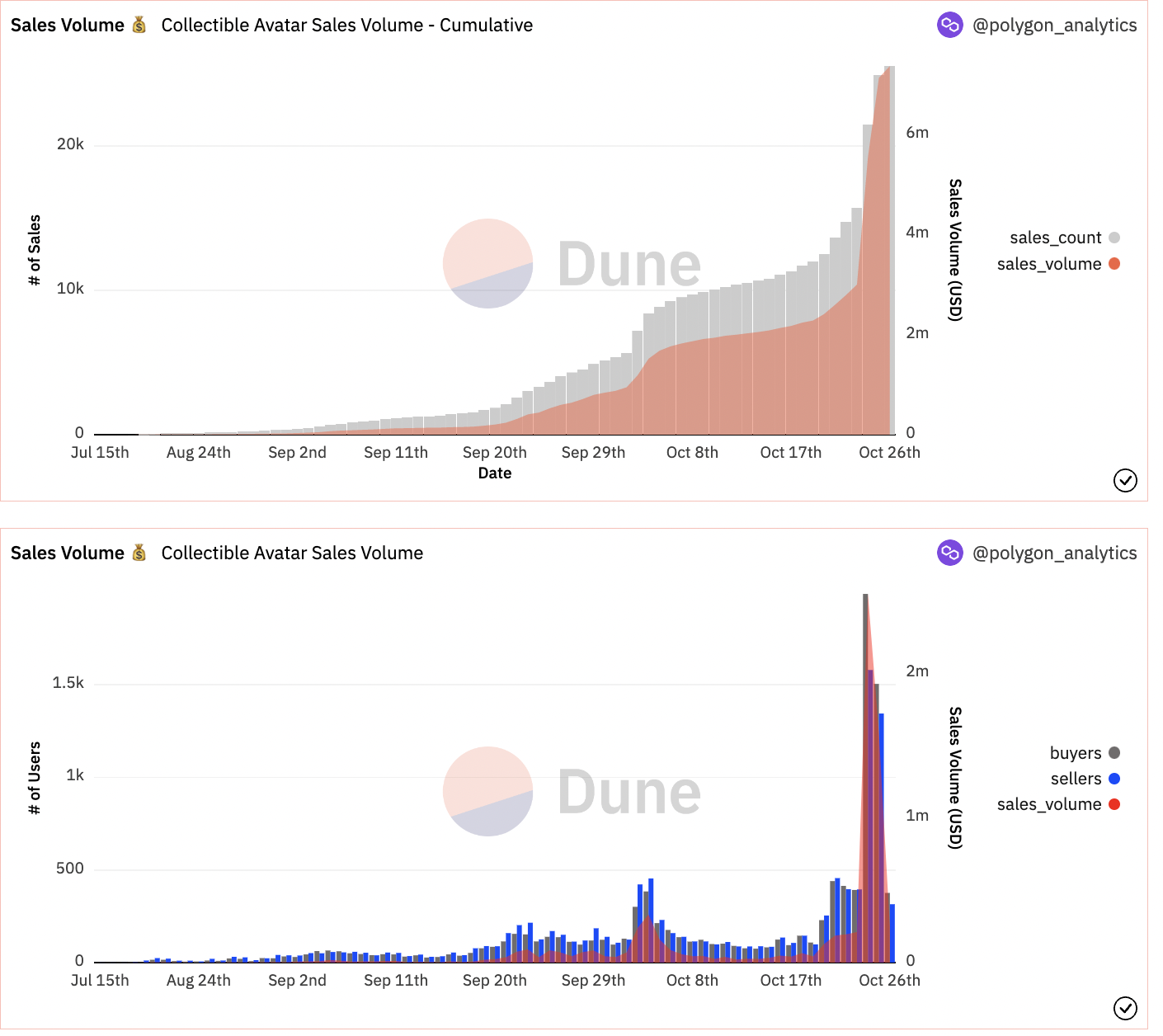

In addition, the huge MATIC output from exchanges coincides using the soaring buying and selling and purchasers volume of Reddit nonfungible token (NFT) avatars. These digital collectibles are minted as NFTs around the Polygon blockchain.

Theoretically speaking, MATIC has damaged from a bullish continuation pattern, dubbed a bull flag, whose profit target sits almost double the amount token’s current valuation, as proven below.

MATIC also shows similar strength against Bitcoin (BTC), based on a technical setup shared by Kaleo, a completely independent market analyst.

“The predominate structure is really a HTF [greater time-frame] flag dating back May of ’21 that appears ready for an additional leg greater,” the analyst authored while citing the chart below.

“I’m expecting a little retrace before breaking out / ongoing greater,” he added.

Related: Bitcoin will shoot over $100K in 2023 before ‘largest bear market’ — Trader

The MATIC/BTC setup could propel the happy couple to .000065 BTC by early 2023 in comparison to the current cost of .0000458 BTC, a 30% cost rally.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.