The Korean Financial Supervisory Service (FSS) has announced that it’ll be standardizing the means by which virtual asset risks are assessed.

According to some local news report, it is because it’s presently difficult to safeguard investors because of the many different ways that risk is measured for every virtual asset exchange. As the FSS’s standardization attempts are still within their infancy, whenever a legal framework for virtual assets continues to be established, it will likely be expected that the uniform evaluation system could be implemented for those exchanges.

On Wednesday, Stablenode’s chief operating officer Doo Wan Nam tweeted that the meeting had place in the Korean National Set up building with representatives from Korean exchanges and officials concerning the Terra (LUNA) and UST issues. The exchanges, based on Doo, stated the problem was undesirable and they would try everything easy to safeguard traders on their own platforms.

There would be a meeting at Korean National Set up building with heads of Korean exchanges and politicians concerning the $LUNA $UST incident.

The exchanges stated what is happening using the incident is unfortunate and can try to safeguard traders on their own platforms. pic.twitter.com/Tubv4as95X

— Doo StableNode @Lisbon (@DooWanNam) May 25, 2022

Heraldcorp reported on Wednesday which do Kwon, the cofounder of Terraform Labs, has contacted five South Korean exchanges to relist when LUNA 2. goes live. However, because LUNA has become under analysis following its failure, many other platforms in Columbia are remaining obvious, except Upbit.

Chief executive officer Kwon’s “Terra Ecosystem Restoration Plan” is to produce new coins and provide them to investors who’ve lost money. “Let us call the present Terra blockchain network “Terra Classic,” and also the present Luna blockchain, “Luna Classic,” and make up a new Terra blockchain,” Chief executive officer Kwon tweeted on May 18.

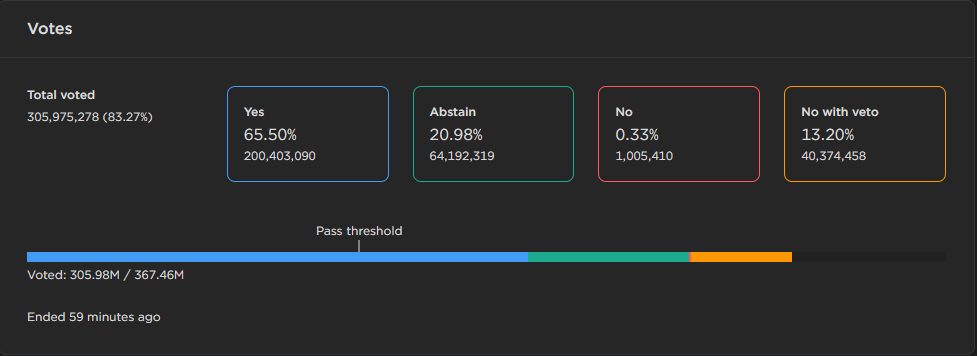

A lot of the community, or 65.5%, supported Kwon’s plan. Just 13.2% opposed the fork election. Around 20% of respondents abstained from voting. On Friday, in line with the information within the proposal, Terra 2. is anticipated to visit survive mainnet. Following this launch, LUNA 2. coins is going to be tradeable. In the pre-determined proportion, new tokens is going to be airdropped to existing stakeholders from the network. However, the majority of the coins goes via a vesting period.

The program to relaunch the Terra blockchain and make LUNA 2. tokens continues to be approved by on-chain voters. This can result in the introduction of a brand new blockchain which will airdrop tokens proportionally to individuals who have been impacted by the abrupt fall from the UST algorithmic stablecoin.

6/ Token distribution details are available in the governance proposal, but in summary:

● Community pool: 30%

● Pre-attack $LUNA holders: 35%

● Pre-attack aUST holders: 10%

● Publish-attack $LUNA holders: 10%

● Publish-attack $UST holders: 15%— Terra Operated by LUNA (@terra_money) May 25, 2022

Binance, a cryptocurrency exchange, has tossed the weight behind the “Terra Rebirth.” The firm stated it’s collaborating using the Terra team around the recovery plan, which targets givin affected users its platform “with the perfect treatment.”

The Terra community just passed a election to ‘Rebirth Terra Network’.

We’re working carefully using the Terra team around the recovery plan, planning to provide impacted users on Binance with the perfect treatment. Stay tuned in for more updates.

— Binance (@binance) May 25, 2022

The questionable $40 billion meltdown of Terra continues to be the topic of much debate within the Korean and global crypto community. Reported by Cointelegraph, Korean exchanges handled the collapse diversely, using the National Assembly’s Political Matters Committee convening Terraform Labs co-founder Do Kwon for any parliamentary hearing concerning the issue.

Related: Exchanges show initial support to Terra revival by listing new LUNA token

Now, the blunt 30-year-old South Korean who frequently calls his critics “poor” has been known as onto explain this month’s $40 billion crash of the project he once known as “the earliest and many broadly used algorithmic stablecoin around.”