Bitcoin (BTC) fell below $30,000 the very first time in ten several weeks on May 10 as turmoil at Blockchain protocol Terra ongoing.

Bitcoin cost bounces at $29,700

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD plumbing lows of $29,731 on Bitstamp.

The very first trip underneath the $30,000 mark since This summer 2021, overnight BTC cost performance came among both declining stock markets and fresh difficulties for Terra’s U.S. dollar stablecoin, TerraUSD (UST).

As Cointelegraph is constantly on the report, UST saw a panic attack involving mass selling now, which culminated in Terra having its giant 750 million BTC reserves to support its USD peg.

Initial liquidity steps to mitigate the outcome from the threat demonstrated inadequate, however, and UST subsequently fell to lows of $.67, based on data from CoinMarketCap.

Simultaneously, BTC/UST on major exchange Binance started behaving erratically, reaching highs in excess of $42,000 while other Bitcoin dollar markets battled to preserve $30,000.

That has caused an enormous boost in BTCUST (Not Bitcoin valued in dollars, but valued within the UST stablecoin). pic.twitter.com/Xn7qcy4VMZ

— Blockchain Backer (@BCBacker) May 10, 2022

Rumors of the full meltdown at Terra spread quickly on social networking. Nevertheless, the firm’s vocal co-founder, Do Kwon, continued to be calm after announcing the mass BTC liquidity injection.

Kwon retweeted a listing of the problem from Jose Macedo, Founding Partner at Delphi Ventures, who contended that Terra’s contingency measures would ultimately result in greater decentralization from the crypto industry’s largest decentralized USD stablecoin.

“Haters will criticise this for centralisation and they are right, for the time being. @LFG_Reserve made $UST better quality, but additionally temporarily more centralised,” he authored on May 9.

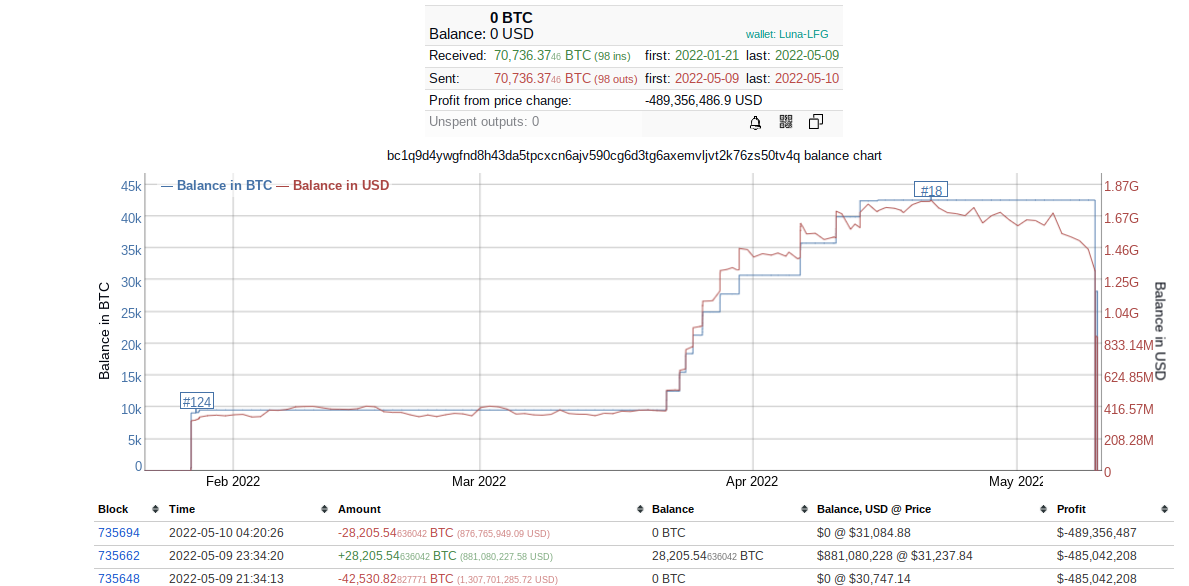

Data from on-chain monitoring resource BitInfoCharts meanwhile confirmed the moves, the wallet balance of Terra nonprofit, the Luna Foundation Guard (LFG), going from 70,000 BTC ($2.23 billion) to BTC.

LFG recommended that does not all of the formerly owned BTC have been offered, and promised to update the city.

$35,000 up for grabs

BTC/USD nevertheless were able to get over its very own collapse to trade at near $32,000 during the time of writing on May 10.

Related: Pro traders adopt a hands-off approach as Bitcoin cost explores new lows

Some were even prepared to “purchase the dip,” included in this El Salvador, with President Nayib Bukele confirming purchasing 500 BTC in an average cost of $30,744.

“I’m not sure how deep the markets are likely to correct, being an additional outlier from the LUNA UST peg is playing it’s area of the drop,” Cointelegraph contributor Michaël van de Poppe reacted overnight.

“All I understand, would be that the UST peg is really a temporary shock and I am presuming we’ll trade around $35K within the next 24-48 hrs for Bitcoin.”

The “shock” had still not resolved during the time of writing, as UST traded at 8% below USD parity. Terra’s LUNA token what food was in $32 after loss of blood 50 plusPercent of their value in 24 hrs.

A Twitter survey by popular commentator Benjamin Cowen revealed nearly all over 12,000 respondents thought that the peg would ultimately be restored.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.