Lido DAO (LDO) cost edged greater on August. 3, mainly because of similar upside moves elsewhere within the crypto market along with a rising excitement around Ethereum’s network upgrade in September.

Around the daily chart, LDO’s cost arrived at an intraday a lot of $2.40 each day after bottoming out in your area at $1.84. The sharp upside reversal amounted to almost 30% gains per day, suggesting traders’ strengthening bullish bias for Lido DAO.

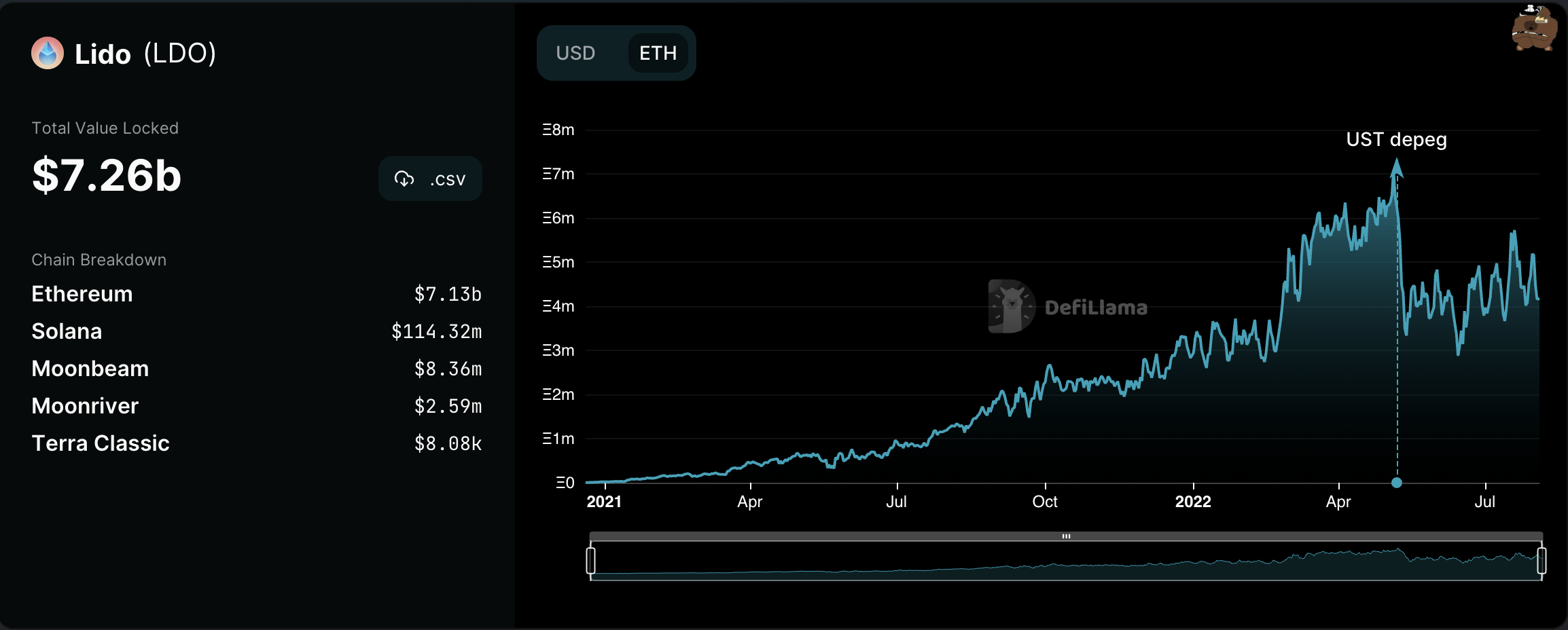

Lido DAO is really a liquid staking solution for Ethereum by total value deposited. Quite simply, it enables users to have fun playing the running of Ethereum’s approaching proof-of-stake (PoS) chain in return for daily rewards.

Ethereum’s Ether (ETH) token has rallied by greater than 90% since mid-June partly because of buzz around its blockchain’s PoS upgrade known as the Merge, expected in September.

Lido DAO, the greatest Merge staking serve provider, has taken advantage of the fad concurrently, with LDO, its governance token, rallying nearly 500% within the same period.

Particularly, the entire quantity of Ether staked in to the Merge smart contract—also known as ETH 2.0—via Lido has surged from three.38 million on June 13 to 4.16 million on August. 3, based on DeFi Llama.

Charts hint at LDO cost rally ahead

In addition, LDO’s technicals appear skewed towards the upside because of its “bull flag.” This technical pattern typically seems throughout an upward trend, once the cost consolidates lower in the climbing down funnel following a strong upside move.

LDO continues to be developing an identical pattern. Around the daily chart, the token’s cost continues to be reversing course after having a strong upward trend that capped around $2.66 on This summer 28.

Consequently, the Lido DAO token now eyes a rest above its current climbing down funnel range, like the upside move that adopted its bull pennant formation in This summer.

Usually, the bull flag’s profit target involves attend length comparable to how big the prior upward trend, known as “flagpole,” or $4 by September, up 65% from August. 3’s cost.

Bull flag failure scenario

Around the switch side, a bull flag’s possibility to achieve its upside target is around 67%, according to research conducted by Samurai Buying and selling Academy. Therefore, LDO’s bull flag could fail if it is cost breaks below the pattern’s lower trendline.

Related: ETH may consolidate as Merge excitement wears off, states expert

The trendline coincides having a support confluence comprised of $1.91‚ which capped LDO’s upside moves at the end of This summer, and also the 20-day exponential moving average (20-day EMA the eco-friendly wave within the chart below) around $1.80.

Thus, a bear flag breakdown, or perhaps a break underneath the support confluence, might have LDO eye the 50-day EMA (the red wave) near $1.43 since it’s downside target.

This level coincides using the .236 Fib line around $1.42, which offered like a cost floor in Feb and could.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.