Passive earnings possibilities are among the greatest allures the cryptocurrency ecosystem since it gives investors a simple chance to develop their portfolio size whatever the day-to-day cost action.

The most recent token to obtain a bump in the cost after announcing the approaching implementation of staking is Chainlink (LINK), the decentralized oracle network that gives important off-chain information required for the correct functioning of smart contracts.

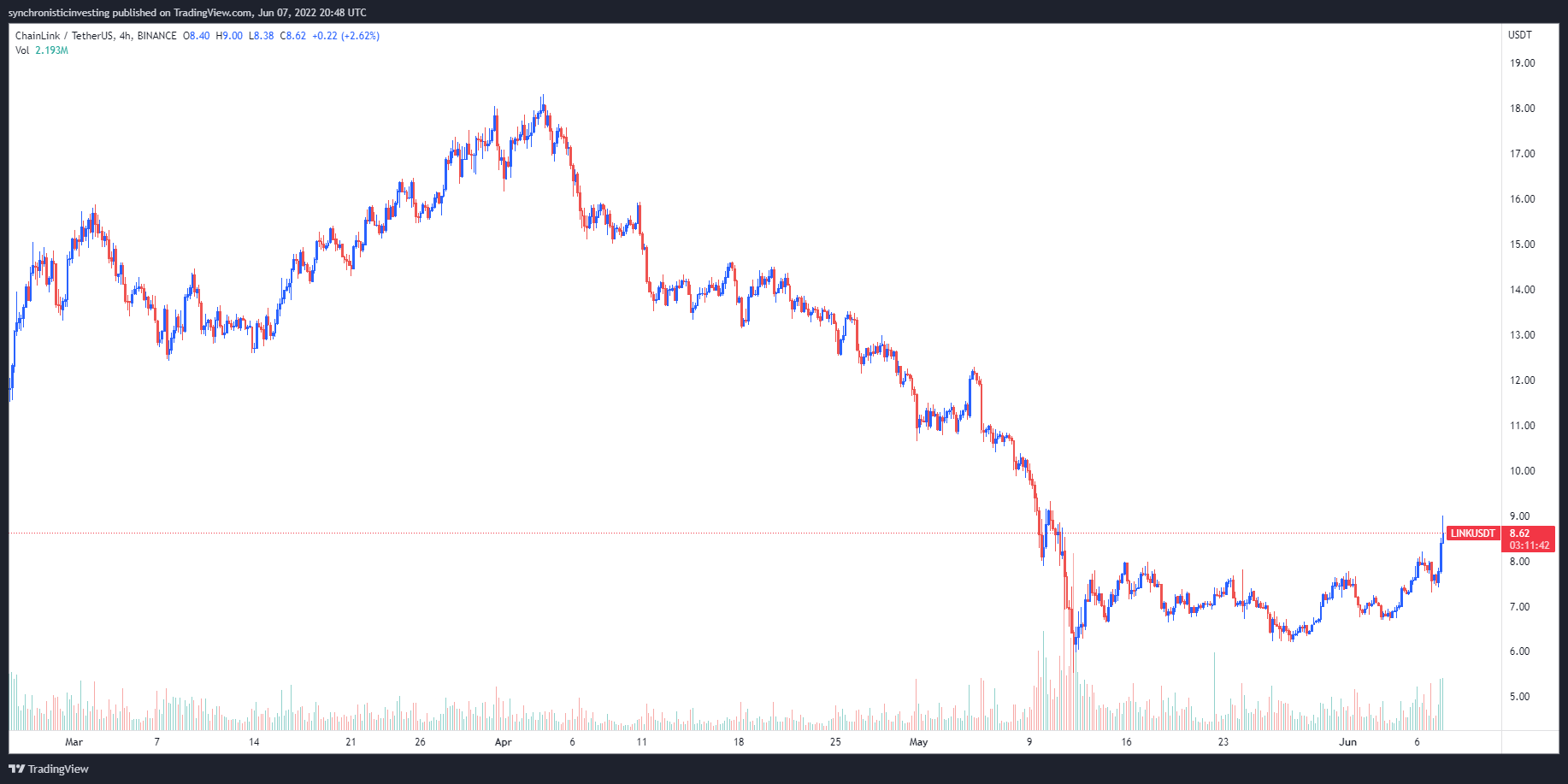

Data from Cointelegraph Markets Pro and TradingView implies that since bouncing off a minimal of $6.67 on June 4, the cost of LINK has elevated 35% hitting a regular a lot of $9.00 on June 7.

Here’s a glance at exactly what the new developments within the Chainlink ecosystem that may be backing in June 7’s cost rally.

Staking LINK continues to be years within the making

The opportunity to stake LINK is a searched for-after capacity for quite some time now because Chainlink has consistently been the biggest oracle project within the entire cryptocurrency ecosystem.

Staking marks the beginning of #Chainlink Financial aspects 2., a brand new era for that lengthy-term security and sustainability of oracle systems.

Within this update, we define the lengthy-term goals, roadmap, and initial implementation of staking within the Chainlink Network.https://t.co/WJkoUzPA0i

— Chainlink (@chainlink) June 7, 2022

Based on the announcement released by Chainlink, the overarching objective of staking around the network “is to provide ecosystem participants, including node operators and community people, the opportunity to boost the security guarantees and user assurances of oracle services by backing all of them with staked LINK tokens.”

By staking LINK, the power for nodes to get jobs and produce charges around the Chainlink network is going to be enhanced as the ecosystem in general may benefit from your “increase in cryptoeconomic security and user assurances.”

Staking not just introduces a motivation to supply reliable data, however it enables for any penalty mechanism for underperforming nodes who fail to offer the objective of consistently generating accurate oracle reports and delivering these to specific destinations on time.

Greater community participation

Another advantage of presenting staking is it can help encourage a bigger quantity of the Chainlink community to obtain directly associated with the network by staking Connect to offer the performance of oracle systems.

Getting good individuals associated with community monitoring directly helps you to boost the decentralization from the Chainlink network and enables “a robust status system and slashing mechanism.”

Adding staking can also be likely to increase network adoption with time as new causes of rewards and a rise in the quantity of protocol charges which are produced by non-emission-based sources further attracts more participants.

Related: Chainlink launches cost eats Solana to supply data to DeFi developers

Evidence of reserves

The brand new roadmap also introduces Chainlink Evidence of Reserves (PoR).

#Chainlink Evidence of Reserve (PoR) enables #DeFi projects to ensure off-chain and mix-chain asset reserves through automated audits according to cryptographic truth.

Find out how PoR helps secure mix-chain assets, stablecoins, wrapped tokens, and much more https://t.co/qZRj7oExsz

— Chainlink (@chainlink) June 6, 2022

With PoR, the cryptocurrency holdings of the company can be simply audited with an automated procedure that leverages the transparency of blockchains, smart contracts and oracles.

This real-time auditing of collateral makes sure that user money is protected against “unforeseen fractional reserve practices along with other fraudulent activity from off-chain custodians.” By doing this, PoR helps you to bring a greater amount of transparency towards the crypto ecosystem in general also it addresses a few of the greatest complaints about how exactly the present economic climate operates.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.