The cost of Litecoin (LTC) could skyrocket by as much as 200% by This summer 2023, coinciding with its halving event, reducing miner block rewards by 50%.

Litecoin has bottomed out?

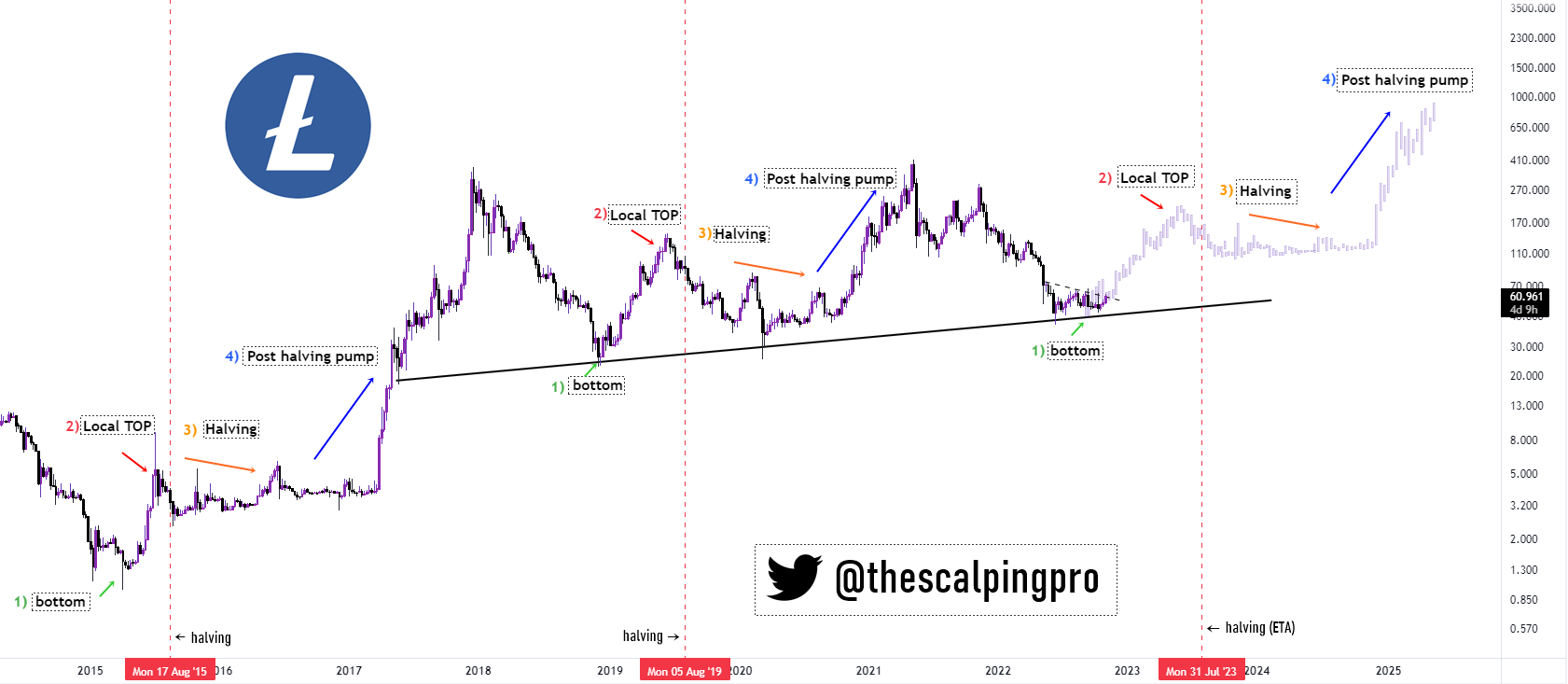

Litecoin has gone through two halvings since its launch in October 2011. The first happened in August 2015, which reduced its block reward from 50 LTC to 25 LTC. The second happened in August 2019, which slashed the 25 LTC reward to 12.5 LTC.

Interestingly, each Litecoin halving event happened following a volatile LTC cost cycle, namely a massive cost pump, adopted with a similarly massive correction, a cost bottom, and recovery to some local top.

Following the Litecoin halvings, LTC’s cost remedied from the local top, established another bottom and adopted it with another massive cost rally to a different record high, as proven below,

Litecoin’s third halving is scheduled to happen between This summer 2023. Meanwhile, market analysts happen to be mentioning that LTC’s cost is undergoing exactly the same pre-halving trajectory as prior to the 2011 and 2019 occasions, now within the bottoming-out stage.

The Scalping Pro, a completely independent market analyst, added a serving of MACD and RSI momentum indicators to aid the bullish outlook. Momentum indicators determine an asset’s oversold and overbought conditions to calculate potential trend reversals.

On the weekly time-frame, LTC’s RSI and MACD have switched very oversold, which coincided with market bottoms in front of the previous halving occasions. Thus, the analyst views it a powerful cue for an additional major LTC cost rally.

#LTC x RSI + MACD (1W) 2/5

Everytime WEEKLY RSI joined the oversold zone with MACD crossover underneath the zero line

It’s marked #Litecoin bottom in the past.

Past preformance –

2015 ~ +36246%

2019 ~ +1333%

2022 ~ ??? pic.twitter.com/fRbY4VAkuf— Mags.eth (@thescalpingpro) November 2, 2022

Will LTC cost achieve $180 by This summer 2023?

Litecoin could see a brand new local top whether it has indeed bottomed out near $40 in June 2022.

Related: Research report outlines why the crypto market may be near a reversal

Drawing Fibonacci retracement graphs between Litecoin’s pre-halving correction peaks and bottoms highlights the probability of testing the .236 and .382 Fib lines his or her upside targets.

For example, this year, Litecoin established its local top in the .236 Fib line near $10 in This summer, six several weeks after bottoming out near $1.31.

In 2019, LTC cost created its local top in the .382 Fib line near $340 in June after bouncing from around $21 in December 2018.

In the present scenario, Litecoin’s .236 and .382 Fib lines coincide with roughly $130 and $180, correspondingly.

These levels turn into potential local tops if Litecoin confirms $40 since it’s bottom. Quite simply, one hundredPercent-200% cost rally by This summer 2023 when measured in the current cost levels.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.