As economic conditions keep getting worse, finance experts are more and more placing the culprit in the ft from the U . s . States Fed following the central bank was slow to reply to rising inflation in early stages.

Finance industry is presently experiencing their worst stretch of losses in the recent past, also it doesn’t appear that there’s any relief around the corner. May 24 saw the tech-heavy Nasdaq fall another 2%, while Snap, a well known social networking company, shed 43.1% of their market cap in buying and selling on May 23.

Earlier this handful of several weeks happen to be absolutely brutal for that markets… 8 consecutive days of red candle lights within the #SPX, #NASDAQ and #BTC… no significant bounces pic.twitter.com/hgU2VwIoxh

— Crypto Phoenix (@CryptoPheonix1) May 24, 2022

A lot of the current turmoil again returns towards the Given, that has launched into a pursuit to raise rates of interest so that they can get inflation in check, markets be damned.

Here’s what several analysts say about how exactly this method could engage in and just what this means for that cost of Bitcoin (BTC) continuing to move forward.

Will the Given tighten before the markets break?

Regrettably for investors searching for brief-term relief, economist Alex Krüger thinks that “The Given won’t stop tightening unless of course markets break (not even close to that) or inflation drops significantly as well as for *many* several weeks.”

Among the primary issues affecting the psyche of traders is always that the Given has yet to stipulate what inflation will have to seem like to allow them to place their feet from the rate-hike gas pedal. Rather, it really reiterates its goal “’to see obvious and convincing evidence inflation is originating down’ towards its 2% target.”

Based on Krüger, the Given will “need to determine Y/Y [year-over-year] inflation drop .25%–0.33% typically each month until September” to satisfy its objective of getting lower inflation towards the 4.3%–3.7% range through the finish of the season.

If the Given neglect to meet its PCE inflation target by September, Krüger cautioned about the chance that the Given could initiate “more hikes *than what’s priced in*” as well as begin going through the purchase of mortgage-backed securities included in a quantitative tightening campaign.

Krüger stated:

“Then markets would start shifting to a different equilibrium and dump hard.”

A setup for double-digit sustained inflation

The Fed’s responsibility for that market conditions seemed to be discussed by millionaire investor and hedge fund manager Bill Ackman, who recommended that “The best way to prevent today’s raging inflation is by using aggressive financial tightening or having a collapse throughout the economy.Inches

In Ackman’s opinion, the Fed’s slow reaction to inflation has considerably broken its status, while its current policy and guidance “are setting us up for double-digit sustained inflation that may simply be forestalled with a market collapse or perhaps a massive rise in rates.”

Because of these 4 elements, interest in contact with stocks continues to be muted in 2022 — a well known fact evidenced through the recent loss of stock values, mainly in the tech sector. For instance, the tech-heavy Nasdaq index has become lower 26% around the year.

Using the cryptocurrency sector being highly tech-focused, you will find that weakness within the tech sector has converted to weakness within the crypto market, a pattern that may persist until there’s some type of resolution to high inflation.

Related: Bitcoin cost returns to weekly lows under $29K as Nasdaq leads fresh US stocks dive

How could Bitcoin fare entering 2023?

According to Krüger, the “base situation scenario for approaching cost trajectory is really a summer time range that begins with a rally adopted with a drop to the lows.”

Kruger stated:

“For $BTC, that rally would take cost to the beginning of the Luna dump (34k to 35.5k).”

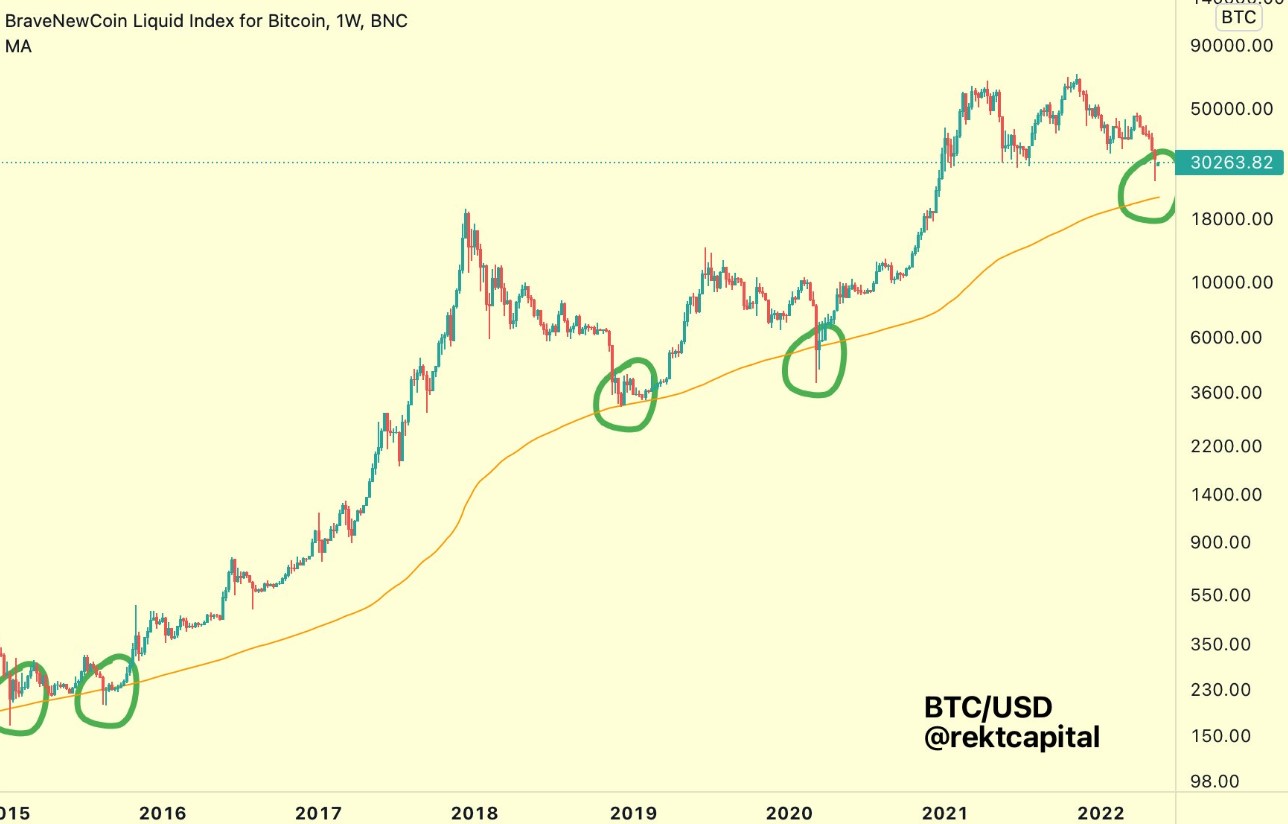

Crypto trader and pseudonymous Twitter user Rekt Capital offered further understanding of the cost levels to keep close track of for any good access point continuing to move forward, posting the next chart showing Bitcoin in accordance with its 200-day moving average.

Rekt Capital stated:

“Historically, #BTC has a tendency to bottom at or underneath the 200-MA (orange). The 200-MA thus has a tendency to offer possibilities with outsized Return on investment for $BTC investors (eco-friendly). […] Should BTC indeed achieve the 200-MA support… It might be wise to concentrate .”

The general cryptocurrency market capital now is $1.258 trillion, and Bitcoin’s dominance rates are 44.5%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.