Terra (LUNA) has stepped considerably after witnessing a FUD attack on its native stablecoin TerraUSD (UST).

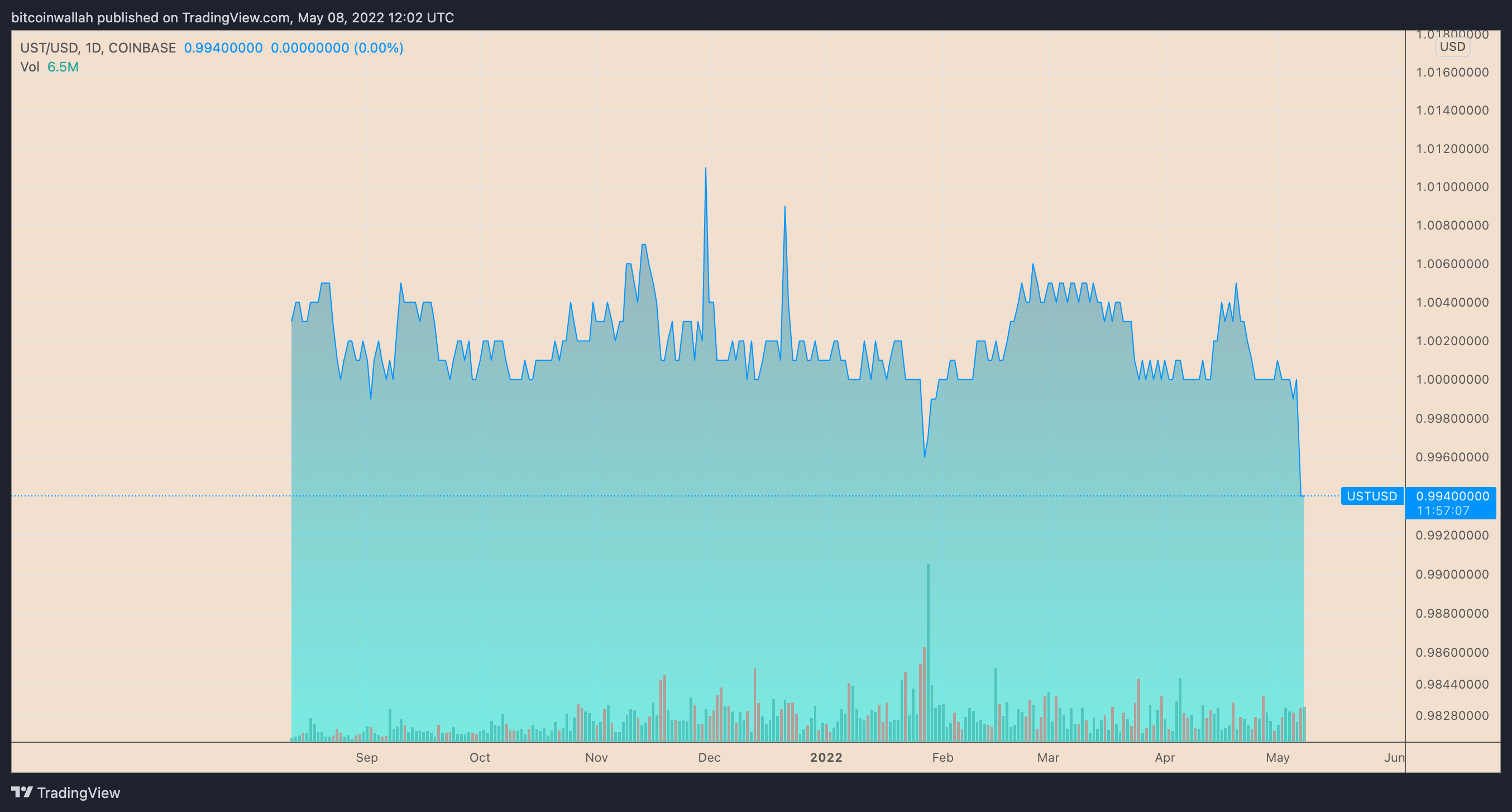

The LUNA/USD pair dropped 20% between May 7 and could 8, hitting $61, its worst level in three several weeks, following a whale mass-dumped $285 million price of UST. Because of this selloff, UST briefly lost its U.S. dollar peg, falling to as little as $.98.

Excessive LUNA supply

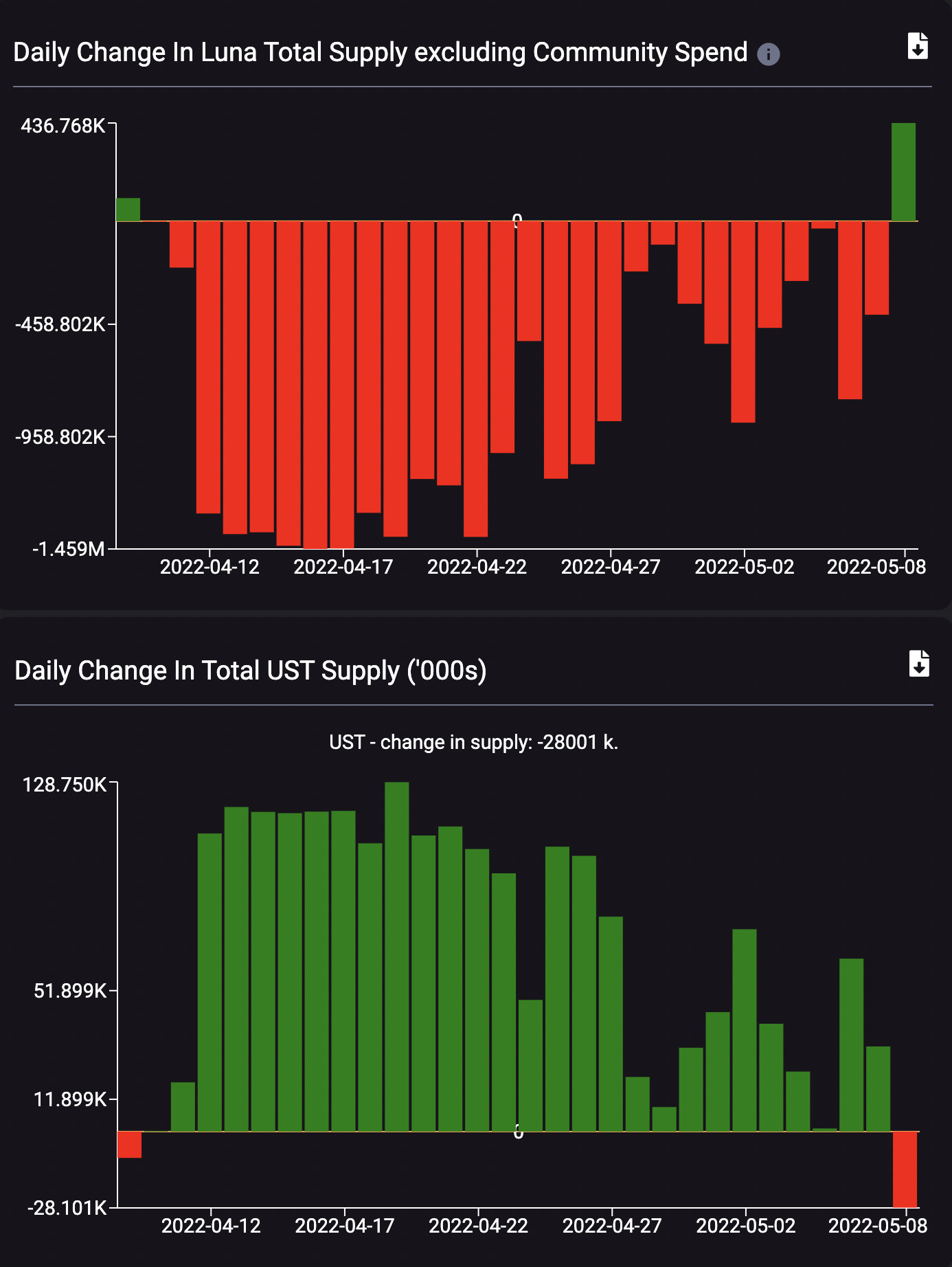

LUNA works as a collateral focal point in maintain UST’s dollar peg, based on Terra’s elastic financial policy. Therefore, when the need for UST is above $1, the Terra protocol incentivizes users to lose LUNA and mint UST. On the other hand, when UST’s cost drops below $1, the protocol rewards users for burning UST and minting LUNA.

Therefore, during UST supply reduction, LUNA’s valuation should decrease. Similarly, when UST’s supply expands, LUNA’s valuation increases, notes Will Comyns, a investigator at Messari.

The chart below shows a continuing downtrend within the daily UST supply, coinciding having a relative rise in daily LUNA supply. On May 8, UST’s market went through contraction the very first time in 2 several weeks, shedding by 28.a million below zero. Concurrently, LUNA’s supply expanded by over 436.75 million above zero.

The unnecessary daily supply against what seems to become a lowering or stable market demand might have pressed LUNA’s cost lower.

More discomfort for Terra ahead?

Terra’s ongoing cost decline motivated LUNA to retest an assistance confluence composed of their 50-day exponential moving average (50-day EMA the red wave) near $56 along with a multi-month upward sloping trendline.

Interestingly, the climbing trendline is really a rising wedge pattern in conjugation with another upward trending line above. Rising wedges are bearish reversal setups, so their occurrence on Terra’s weekly chart suggests more bad thing is probable.

Usually of technical analysis, an increasing wedge breakdown pushes the cost lower up to the utmost distance between your structure’s lower and upper trendline.

Related: Luna Foundation Guard acquires additional 37,863 BTC included in reserve strategy

Thus, if LUNA breaks below its wedge from the current support confluence, supported by a rise in volumes, its cost would risk falling close to $22.50, lower over 60% from today’s cost.

On the other hand, a rebound in the support confluence might have LUNA positioned for any run-up toward the wedge’s upper trendline — above $130, a brand new record high.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.