Magic Internet Money (MIM), an american dollar-pegged stablecoin from the Abracadabra ecosystem, joins the growing listing of tokens losing their $1 value among an untimely crypto winter. The sudden de-pegging from the MIM token commenced roughly on Next Month, 7:40 pm ET, which saw the token’s cost drop to $.926 in only three hrs.

Terra’s LUNA and TerraUSD (UST) dying spiral not just affected the investors but additionally were built with a negative effect on numerous crypto projects, including Abracadabra’s MIM token ecosystem — as alleged by Twitter handle @AutismCapital.

Citing an insider scoop, AutismCapital claimed that Abracadabra accrued $12 million in bad debt as a result of Terra’s sudden downfall “because liquidations could not happen quick enough to pay for the protocol’s MIM liabilities.”

There exists a scoop from our affiliate autists: MIM (Magic Internet Money) might be nearly insolvent. MIM is among the bigger stablecoins, having a market cap of ~$300M.

We can not think that a task known as Magic Internet Money continues to be acting irresponsibly either.

Details:

— Autism Capital (@AutismCapital) Next Month, 2022

Daniele Sestagalli, the founding father of Abracadabra, however, refuted the claims of insolvency by making certain to possess enough funds to repay the piling financial obligations — that has been related to the falling MIM prices. Sestagalli mentioned:

“[The Abracadabra] Treasury has more income compared to debt and $CRV are valuable for that protocol.”

Doubling lower on his stance, Sestagalli further openly shared the treasury address holding $12 million in assets while asking concerned investors to ensure exactly the same using on-chain data.

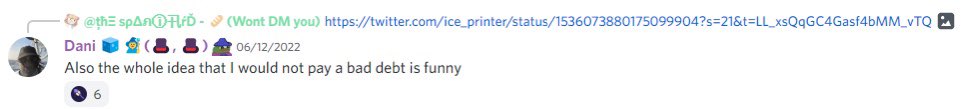

However, Autism Capital alleged that Sestagalli’s bad debt was produced 5 days ago and shared the below screenshot showing his conversation comparable on MIM’s Discord group.

While the chance of insolvency is constantly on the threaten the Abracadabra protocol, through either the MIM treasury ongoing to dump in value or even more bad debt produced, investors are encouraged to keep an eye on market fluctuations and do their very own research (DYOR) prior to making investment decisions.

Related: USDD stablecoin falls to $.97, DAO inserts $700M to protect the peg

5 days ago, on June 13, Stablecoin protocol USDD’s cost dipped to $.97 on major crypto exchanges.

1/ And it is beginning$USDD is presently just 92% collateralized through the Reserves (even thinking about $TRX funds) ⚠️

Should you take away $TRX, as it happens collateralization ratio is presently 73%

Also, the 140M $USDT aren’t actually USDT, but jUSDT pic.twitter.com/fKYaIQEd1D

— Res ®️ (@resdegen) June 12, 2022

Propose throughout the market fluctuations, the Tron DAO Reserve announced it received 700 million USD Gold coin (USDC) to protect the USDD peg. Because of the fund infusion, they behind the stablecoin described the collateralization ratio of USDD has become boosted to 300%.