Polygon (MATIC) become the very best-performing asset one of the top-ranking cryptocurrencies on November. 3 because the market’s attention switched towards the latest Instagram and JPMorgan bulletins.

Polygon in high-profile partnerships

Particularly, Meta, parents company of Instagram, named Polygon since it’s initial partner because of its approaching nonfungible token (NFT) tools that permit users to mint, showcase then sell their digital collectibles off and on the social networking platform.

Meanwhile, banking giant JPMorgan used Polygon to conduct its first live trade (worth about $71,000) on the public blockchain, marking a concrete step toward integrating cryptocurrencies into traditional financial frameworks.

MATIC, a software application and staking token inside the Polygon blockchain ecosystem, rose over 13% to $.985 following the bulletins, supported by an uptick in daily buying and selling volume.

MATIC’s upside move came as part of a wider recovery rally over the crypto sector that began in mid-June. MATIC’s cost has rebounded by greater than 200%, a pattern which will likely sustain within the coming several weeks.

MATIC’s cost gets near cup-and-handle breakout

The very first cue for MATIC’s bullish continuation develops from a classic technical setup.

Around the daily chart, MATIC has colored a cup-and-handle setup, which comprises a U-formed recovery adopted with a downward drifting funnel. The token has become eyeing a decisive breakout over the pattern’s neckline range (the red bar within the chart below) to achieve $2.89, its primary upside target.

Usually of technical analysis, just one cup-and-handle pattern’s target is measured after adding the space between your cup’s bottom and neckline towards the potential breakout point. Consequently, MATIC has become eyeing a 200% cost rally through the finish of Q1 2023.

Essentially, MATIC’s demand can keep growing, given Polygon’s growing NFT projects launched by mainstream companies.

Related: Warren Buffett-backed neobank picks Polygon for Web3 token — MATIC cost eyes 100% rally

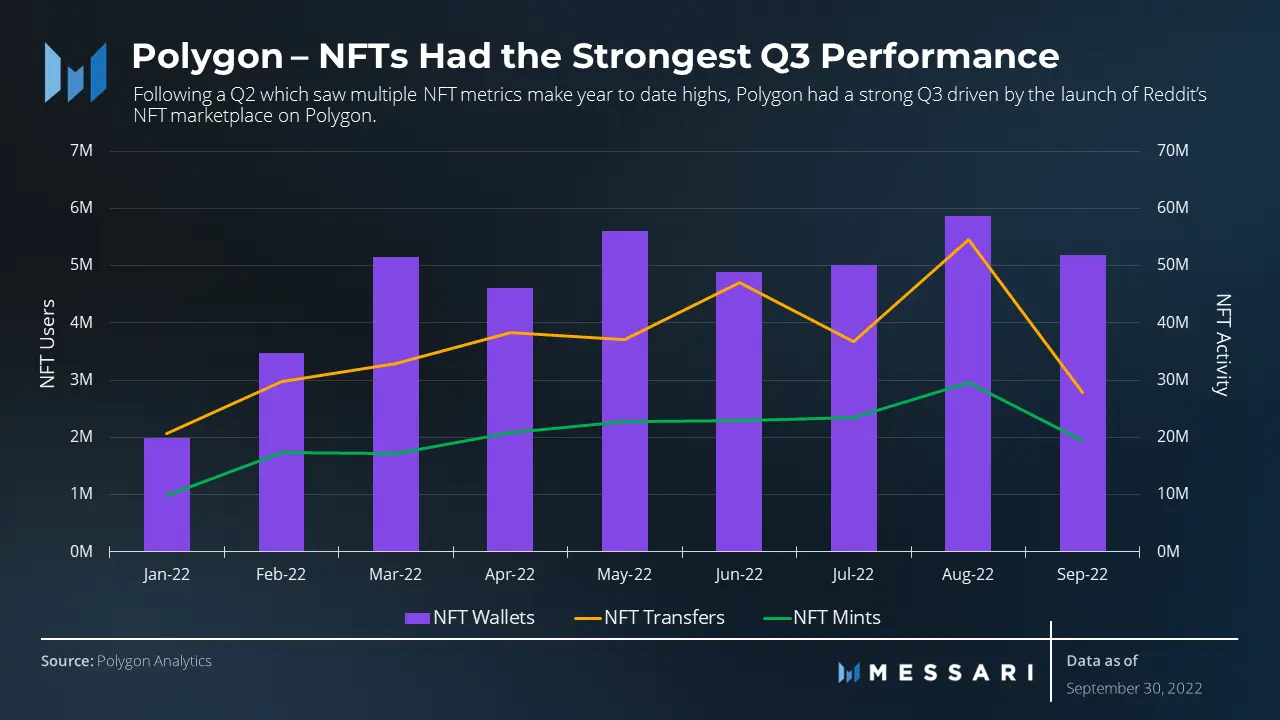

For example, Polygon’s listing of prominent NFT partners includes names such as Disney, Robinhood and Starbucks. In addition, Polygon were built with a strong Q3, in which its quantity of active wallets arrived at an archive a lot of six million, mainly driven by the launch of Reddit’s NFT marketplace on its blockchain.

However, macro risks still threaten the continuing crypto market recovery, which might hurt Polygon despite its growing partnerships with big-big brands. That being stated, a powerful pullback in the cup-and-handle pattern neckline range could invalidate the bullish setup altogether.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.