The metaverse sector is witnessing its very-own housing crisis moment, because of massive declines within the prices of their virtual lands in 2022, brought by waning users’ interest along with a crypto bear market.

Land sales plunge 85% in 2022

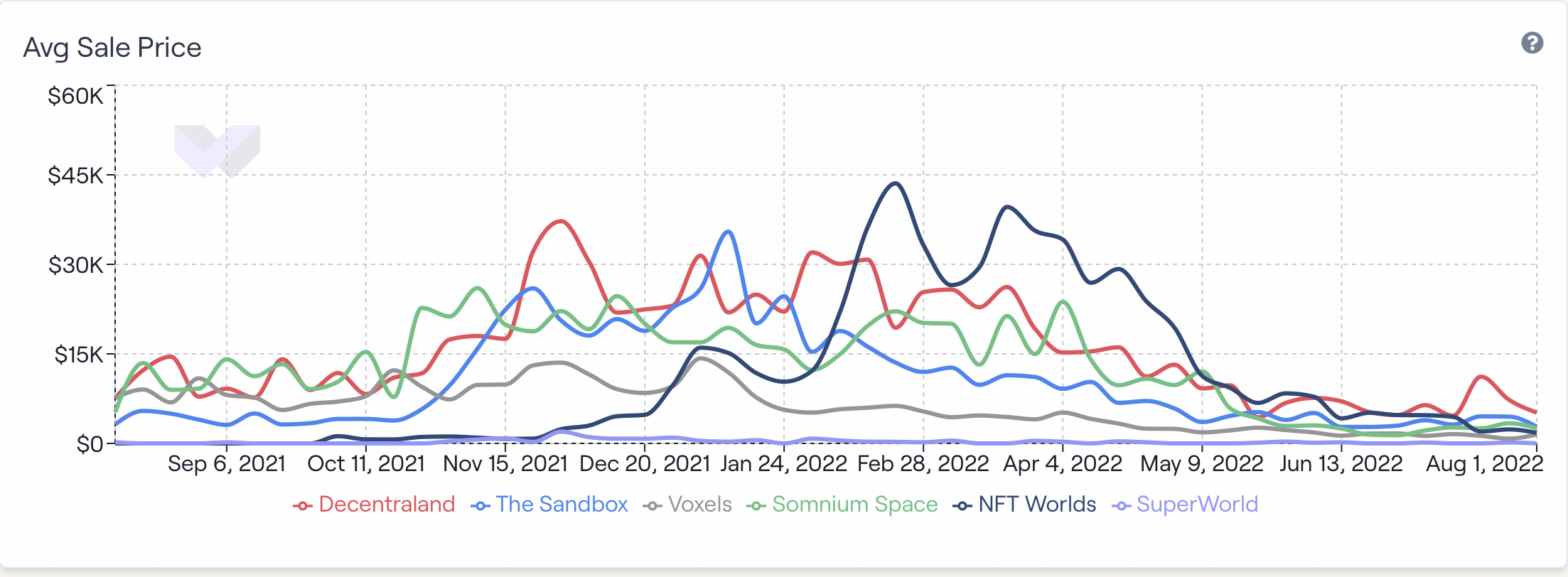

Particularly, metaverse projects built around the Ethereum blockchain, including the Sandbox and Decentraland, have observed substantial declines within their valuations along with other key metrics, data from WeMeta shows.

For example, the typical cost of lands offered across Decentraland peaked at $37,238 in Feb 2022. But because of August. 1, their costs had dropped to typically $5,163. Similarly, the Sandbox’s average purchase cost dropped from circa $35,500 in The month of january close to $2,800 in August.

Overall, the typical cost per parcel of virtual lands over the six major Ethereum metaverse projects dropped from roughly $17,000 in The month of january close to $2,500 in August, or perhaps a 85% decline.

Declining metaverse volumes

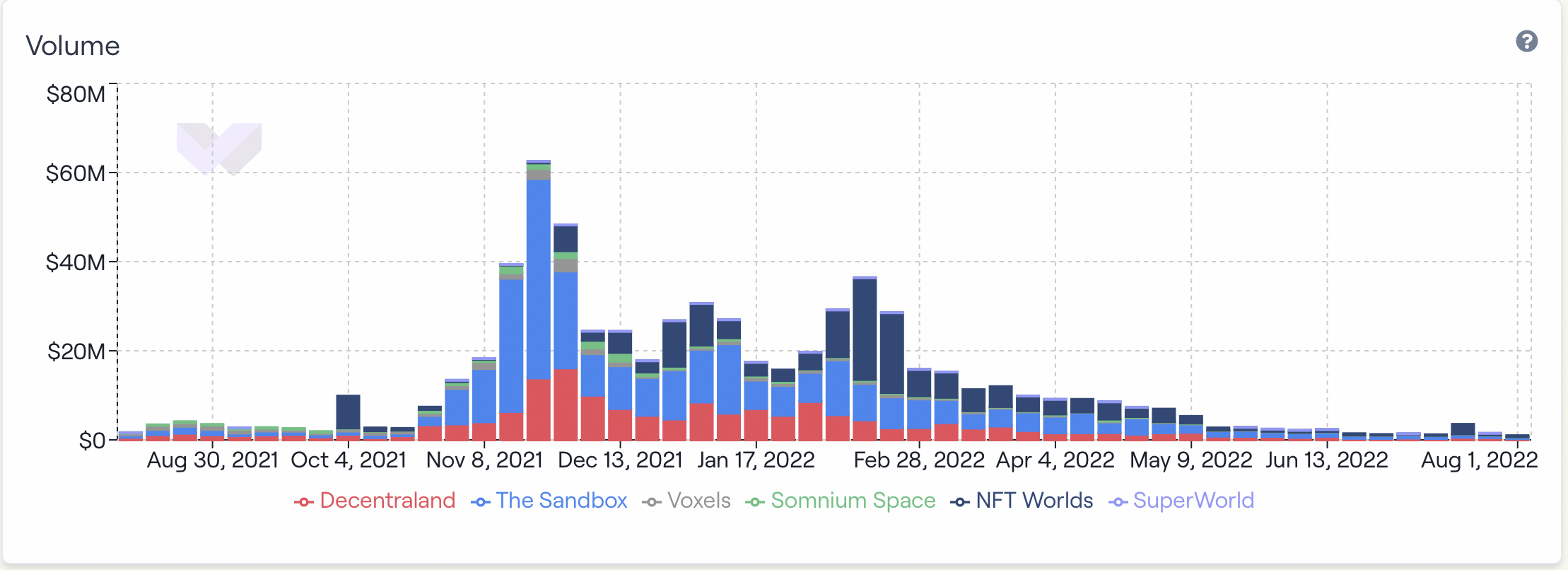

Poor land purchase volumes further indicate dampening user curiosity about metaverse projects.

On the weekly average, the amount, addressing the quantity of lands (derived in currency) traded, has dropped from the peak of $1 billion in November 2021 to roughly $157 million in August 2022.

Concurrently, the marketplace valuations from the Metaverse tokens in circulation have dipped by greater than 80%, brought further with a broader retreat over the cryptocurrency sector because of unfavorable macroeconomic conditions.

For example, the marketplace valuation of Decentraland’s MANA tokens in circulation dropped from $10 billion in November 2021 to $2 billion in August 2022. Similarly, Sandbox’s SAND‘s internet capital arrived at $8.4 billion close to $1.78 billion within the same period.

fricking metaverse housing bubble just sprang who would’ve thought https://t.co/4OZKoi5fH4

— lil t the based god (@fauxzus) August 7, 2022

Metaverse ETF also takes ahit

Meanwhile, the Roundhill Ball Metaverse exchange-traded fund (METV) is tanking alongside blockchain-focused metaverse projects. The ETF gives investors contact with companies which have been employing metaverse within their growth strategy,

Around the daily chart, METV has dipped by nearly 45% from the record a lot of $17.11 in November 2021, using the companies its stock portfolio, including Meta (formerly referred to as Facebook) and Snap, reporting substantial second-quarter losses.

Nevertheless, corporations, investment capital funds, and equity investors pour over $120 billion in to the metaverse sector between The month of january and could 2022, greater than double the amount $57 billion invested throughout 2021, based on a recent McKinsey report.

Related: Facebook’s metaverse will ‘misfire,’ states Vitalik Buterin

Regardless of the loss of the metaverse market, however, McKinsey believes the area may become a $5 trillion sector by 2030, noting that e-commerce will probably realize an industry impact which is between $2 trillion and $2.6 trillion alone, adopted by academic virtual learning sector that may have an effect of $180 billion to $270 billion.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.