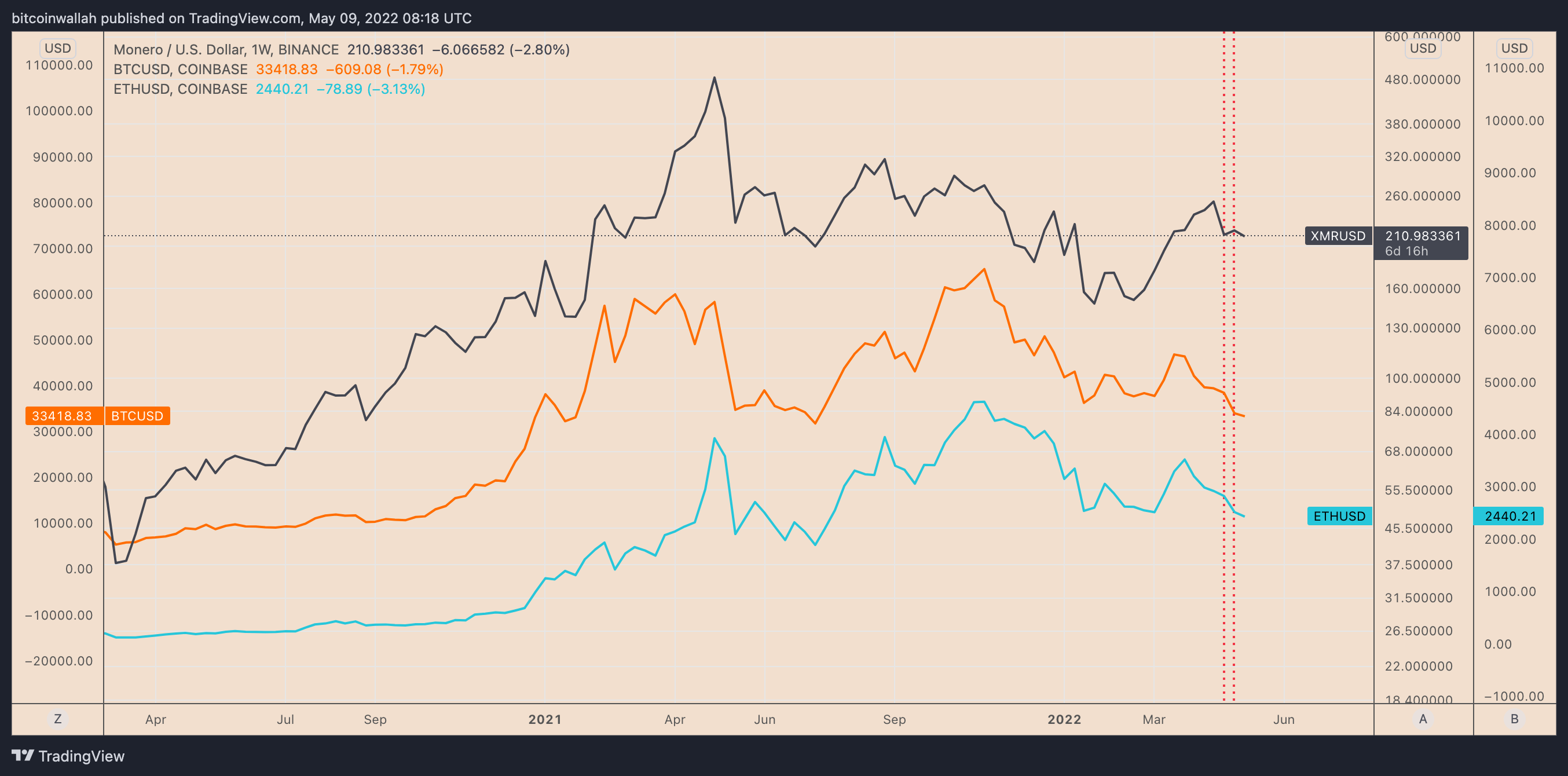

Monero (XMR) has proven an unexpected resilience from the Federal Reserve’s hawkish policies that pressed the costs on most of their crypto rivals — such as the top dog Bitcoin (BTC) — lower a week ago.

XMR’s cost closed the prior week 2.37% greater at $217, data from Binance shows. Compared, BTC, which generally influences the broader crypto market, finished a few days lower 11.55%. The 2nd-largest crypto, Ether (ETH), also stepped 11% within the same period.

As the crypto market easily wiped off $163.25 billion from the valuation a week ago, lower nearly 9%, Monero’s market cap elevated by $87.seven million, suggesting that lots of traders made the decision to find safety within this privacy-focused gold coin.

XMR near critical support

Monero began the brand new week having a selloff, with XMR plunging by over 3Percent close to $208 on May 9.

The decline introduced the token near its key support level — the 50-week exponential moving average (50-day EMA the red wave within the chart below) near $214. The wave also coincides with another cost floor — the .618 Fib type of the Fibonacci retracement graph attracted in the $38-swing low towards the $491-swing low.

Interestingly, XMR’s cost drop belongs to a pullback move that started April 21 from about $290. Consequently, the reversal towards the downside surfaced among a falling wedge breakout whose upside target comes to be with $490.

That could cause either of the outcomes: XMR breaks below its support confluence around $214 to check the wedge’s upper trendline as support (that also coincides using the token’s 200-week EMA near $161.50) Or even the token rebounds in the support confluence and continue its move for the wedge’s technical upside target near $490.

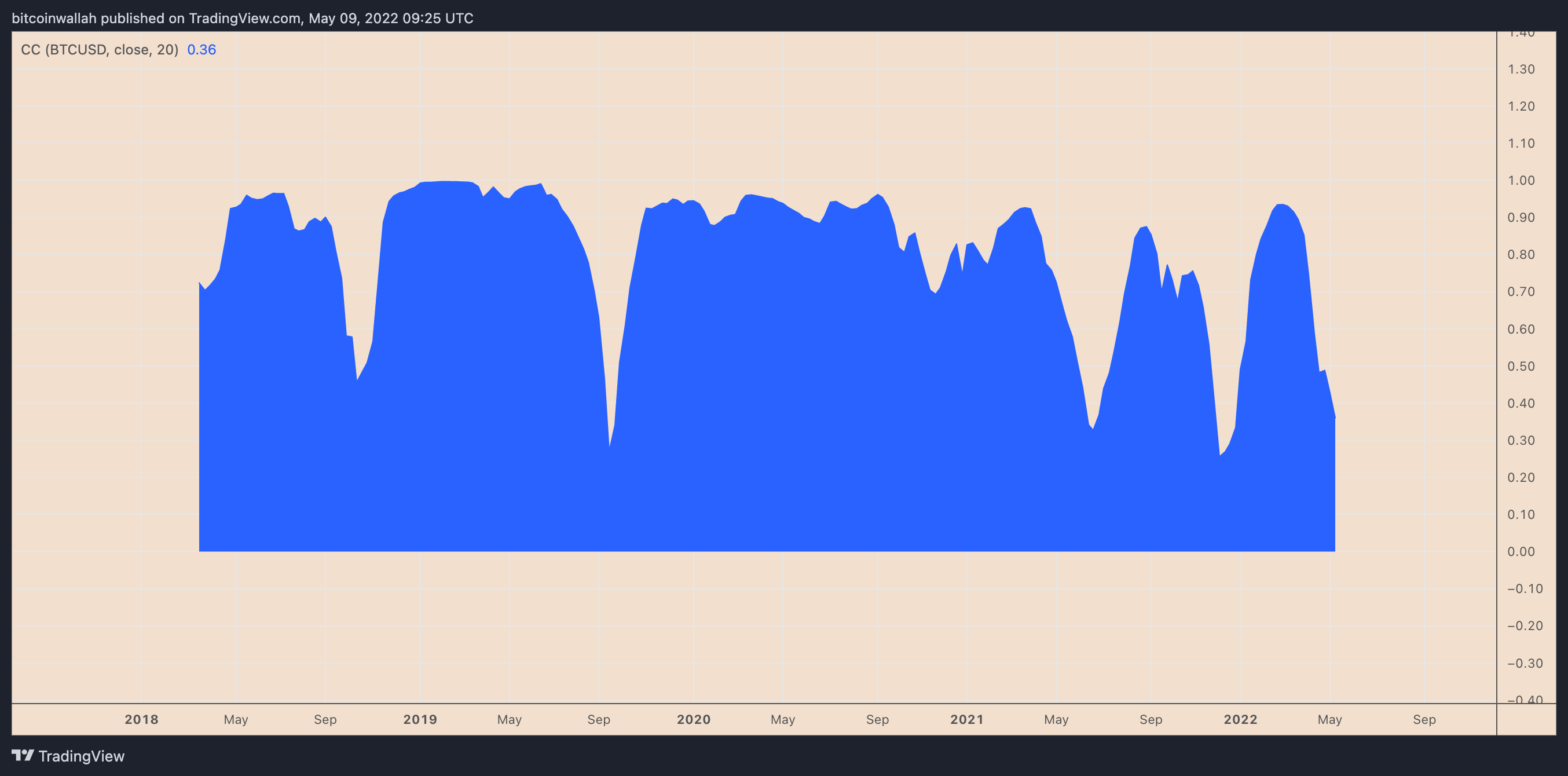

The general crypto market trend looks biased towards bears inside a greater rate of interest atmosphere. This, along with Monero’s erratic but consistent positive correlation with Bitcoin, may ultimately weigh XMR lower, producing a decline toward the wedge’s top around $160 in Q2, lower about 20% from today’s cost.

Strong XMR fundamentals

XMR’s bearish setup often see a time period of cost spikes as Monero inches nearer to its tentative hard fork, scheduled for This summer 16.

Related: Making crypto conventional by improving crypto crime investigations worldwide

A testnet version of the identical technical upgrade expects to be released on May 16, based on Monero’s GitHub publish. They behind the work has confirmed the hard fork would improve Monero’s network security while cutting charges.

#Monero includes a network upgrade (hardfork) on This summer 16th 2022 at block 2668888.

Privacy and gratifaction is going to be improved!

The update includes:

Ring sizes increases from 11 to 16 View tags to speedup wallet/node sync

Multisig fixes

Bulletproof+

+more!#xmr $xmr pic.twitter.com/jZ5ouk1uqo— John Foss (@johnfoss69) April 17, 2022

Meanwhile, interest in Monero expects to increase greater in 2022 because of its commitment of supplying anonymity. For example, XMR become a range of crypto among ransomware attackers, having a CipherTrade study showing a 500% increase within the token’s usage in 2021.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.