The turmoil surrounding crypto exchange FTX and Mike Bankman-Fried (SBF) reaffirmed regulators’ belief about the requirement for stricter oversight over the crypto ecosystem. Seeking investor protection against an identical fallout, New You are able to Attorney General (NYAG) Letitia James suggested prohibiting crypto investments in defined contribution plans and individual retirement accounts (IRAs).

Inside a letter addressed towards the people from the U.S. Congress, James requested legislation that will bar U . s . States citizens from purchasing cryptocurrencies and digital assets utilizing their funds in IRAs and defined contribution plans for example 401(k) and 457 plans. However, market research from October 2022 demonstrated that just about 50% of U.S.-based investors need to see crypto be a a part of their 401(k) retirement plans.

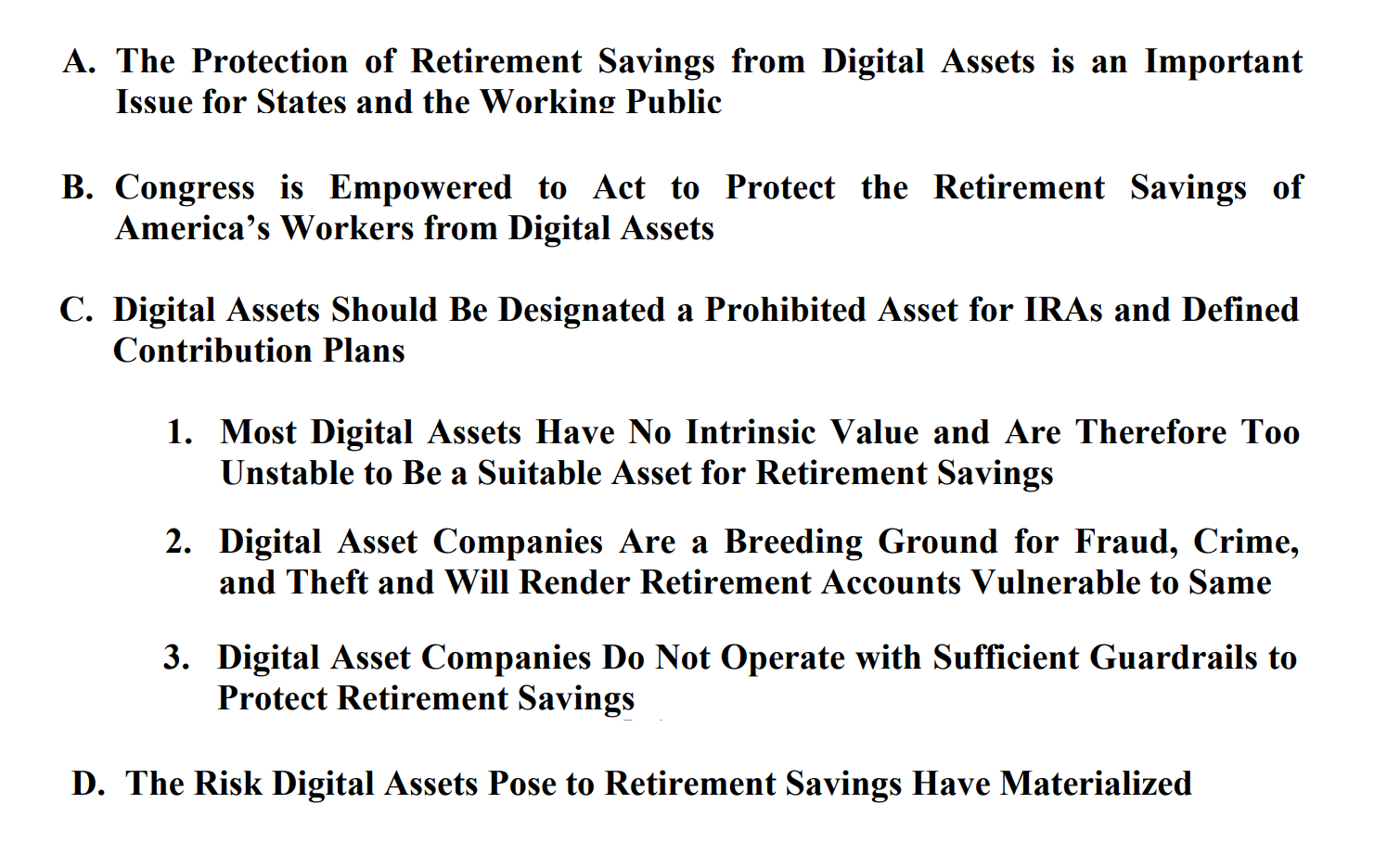

James further pitched the rejection of two functions — the lately suggested Retirement Funds Modernization Act and financial freedom Act of 2022 — which are targeted at allowing investments in digital assets. While highlighting SBF’s participation in managing a Ponzi Plan and misappropriating users’ funds, James jotted lower four primary reasons explaining her call to exclude digital assets from IRAs and defined contribution plans, as described below.

First of all, the NYAG stated the significance of protecting retirement funds within the lengthy term. Next, she highlighted Congress’ historic obligation to safeguard the retirement funds of U.S. citizens. James used narratives including frauds and insufficient guardrails as her third need to stop crypto investments. The ultimate concern was round the volatility and custodial and valuation uncertainties.

However, the NYAG clarified that there’s a among digital assets and blockchain technology. She does think that U.S. citizens ought to be permitted to buy stakes in openly traded blockchain-based companies in retirement accounts.

An instantaneous measure in connection with this could be adding subparagraphs to existing laws and regulations — 26 U.S. Code § 408: Individual retirement accounts and 29 U.S. Code § 1104: Fiduciary responsibilities — for prohibiting digital assets investments.

Related: US Senate committee schedules FTX hearing for 12 ,. 1, CFTC mind to testify

U . s . States senators Elizabeth Warren, Tina Cruz and Richard Durbin requested Fidelity Investments reconsider its Bitcoin (BTC) offering to retirement savers, stating:

“The recent implosion of FTX, a cryptocurrency exchange, makes it abundantly obvious digital asset industry has serious problems.”

A Fidelity spokesperson told Cointelegraph that the organization “has always prioritized operational excellence and customer protection.”