Crypto finance company Nexo is at risk of losing 1 / 2 of its valuation of their native token through the finish of 2022 as doubts about its potential insolvency grow on the market.

Is Nexo too centralized?

For that unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging the firm offers unregistered securities to investors without alerting them concerning the perils of the lending options.

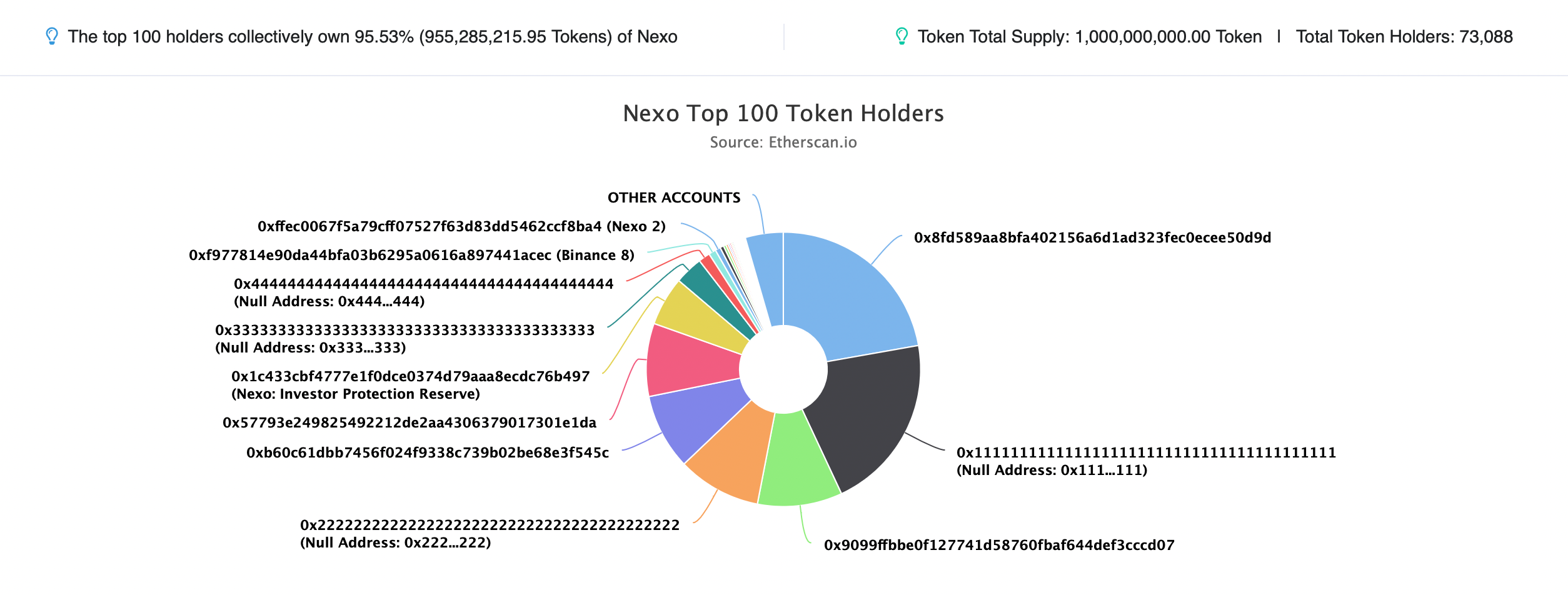

Particularly, regulators in Kentucky accused Nexo to be insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” By This summer 31, Nexo had 959,089,286 NEXO in the reserves — 95.9% of tokens around.

“This is a huge, big, serious problem just because a very fundamental market analysis shows that Nexo could be not able to monetize a substantial slice of these tokens,” noted Mike Burgersburg, a completely independent market analyst and author from the Dirty Bubble Media Substack, adding:

“Given this, the real worth of the $NEXO tokens on Nexo’s balance sheet is probably near to $.”

NEW: “IS NEXO NEXTO?”

Based on condition regulators, Nexo is insolvent without counting $NEXO tokens on their own balance sheet.

This is actually the same situation Celsius Network was in… and fundamental market analysis suggests real worth of their $NEXO is ~$ https://t.co/txt1kOSydH

— dirtybubble.usd (@MikeBurgersburg) September 28, 2022

Comparisons with Celsius

Burgersburg also alleged that Nexo faces insolvency risks since it holds most NEXO’s token supply on its platform. He came comparisons to Celsius Network, a now-defunct crypto finance company that owned greater than 50% of their native token, CEL.

Celsius wound up holding over 90% from the total CEL tokens in circulation after attracting deposits and collateral from customers. This made CEL very illiquid and, thus, volatile. Quite simply, CEL grew to become a deeply imperfect asset for patching Celsius’ troubling balance sheets.

“NEXO token is much more illiquid compared to bankrupt Celsius Network’s CEL token,” cautioned Burgersburg, noting the token’s average daily buying and selling volume involves under 1% of their market capital.

However, a Nexo spokesperson denied the allegations, clarifying the data they presented to Kentucky regulators was for among the Nexo Group’s entities.

“We will tell you that on the consolidated basis, NEXO tokens represent under 10% from the company’s total assets,” they told Cointelegraph, adding:

“That, in exchange, exceeds the organization liabilities even if excluding their internet position in NEXO tokens.”

Why Nexo holds greater than 90% from the NEXO supply, the firm’s spokesperson reported the token’s financial aspects and utility, stating that they’ve created natural incentives for clients to have their tokens around the platform.

“In accessory for earning greater rates of interest on their own digital asset balances by holding NEXO tokens around the Nexo platform, clients may use NEXO tokens as collateral, earn interest in it and exchange them on the Nexo platform,” they described, adding:

“The same holds true for that tokenomics of companies concentrating on the same value propositions for example FTT, BNB and CRO, held predominantly on FTX, Binance and Crypto.com, correspondingly.”

NEXO cost might get rocky

The worry, uncertainty and doubt all around the rumors of market volatility or stringent regulation against crypto lending platforms could create negative investment sentiments toward NEXO. Regrettably, the token’s technical setup suggests exactly the same.

Related: Nexo acquires stake in US chartered bank

Particularly, NEXO’s cost continues to be developing what seems to become an climbing triangular on its longer-time-frame charts since June 12. Climbing triangles are thought bearish continuation patterns inside a downtrend, making NEXO prone to extreme cost declines.

Through the rule of technical analysis, an climbing triangular resolves following the cost breaks below its lower trendline and continues falling within the same direction until it reaches the amount that’s in more detail comparable to the triangle’s maximum height.

This setup is highlighted within the chart below.

When the pattern confirms, the cost of NEXO could fall toward $.47, lower about 50% from the current cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.