Solana (SOL) risks a substantial cost correction within the coming days because of a vintage bearish reversal setup.

A 35% SOL cost correction ahead?

Around the three-day chart, SOL’s cost continues to be painting a rising wedge, confirmed by two climbing, converging trendlines and falling buying and selling volumes in parallel.

Rising wedges typically lead to breakdown, resolving following the asset’s cost break underneath the lower trendline. When the cost follows the breakdown scenario, it might fall up to the utmost distance between your wedge’s lower and upper trendline.

SOL is way from the breakdown but trades inside a falling wedge range, as proven within the chart below. The token eyes an instantaneous pullback in the wedge’s upper trendline using its interim downside target sitting in the lower trendline around $45.

It’ll risk falling toward $30 when the cost breaks underneath the lower trendline while associated a boost in buying and selling volumes. In short, a 35% cost visit September.

On the other hand, a bounce in the lower trendline might have SOL eye an instantaneous rebound toward the wedge’s apex point around $53.50.

A decisive breakout over the upper trendline would invalidate the bearish reversal setup, if SOL increases towards the 50-3D exponential moving average (50-3D EMA the red wave) near $58.

$SOL daily close above $45

Joined 25% size (bear market size)

stop with close under $42 otherwise targeting $56-60 https://t.co/US0ucViHN6 pic.twitter.com/xo7zfDGMrZ

— Pentoshi (leading cattle to butcher) (@Pentosh1) August 13, 2022

Battling FUD

Solana’s rising wedge breakdown setup seems because it battles a flurry of negative occasions, including repeated network outages, centralization concerns and a prevalent exploit that targeted Solana wallets.

Nonetheless, SOL rallied nearly 40% in August, mirroring other crypto assets that acquired around 11% month-to-date typically.

Part of Solana’s gains also after its team rapidly clarified that Slope, a Web3 wallet provider, was exclusively accountable for the $8 million exploit of crypto wallets, including Solana’s.

After an analysis by developers, ecosystem teams, and security auditors, it seems affected addresses were at some point produced, imported, or utilized in Slope mobile wallet applications. 1/2

— Solana Status (@SolanaStatus) August 3, 2022

Similarly, Solana released its first “Validator Health Report” on August. 10 as a result of accusations that it is network is heavily centralized. It reported that Solana’s proof-of-history (PoH) blockchain has over 1,900 block-producing nodes worldwide.

Nearly 88% of individuals nodes are run by independent entities, the report added.

Furthermore, in May, Solana developers centered on applying the first stages of the Mainnet Beta v1.10 series, introducing QUIC and excellence of Service (QoS) packets by stake weight and fee prioritization to protect the network against potential outages.

Related: Is the SOL safe? What we should know of the Solana hack Discover now available on the market Report

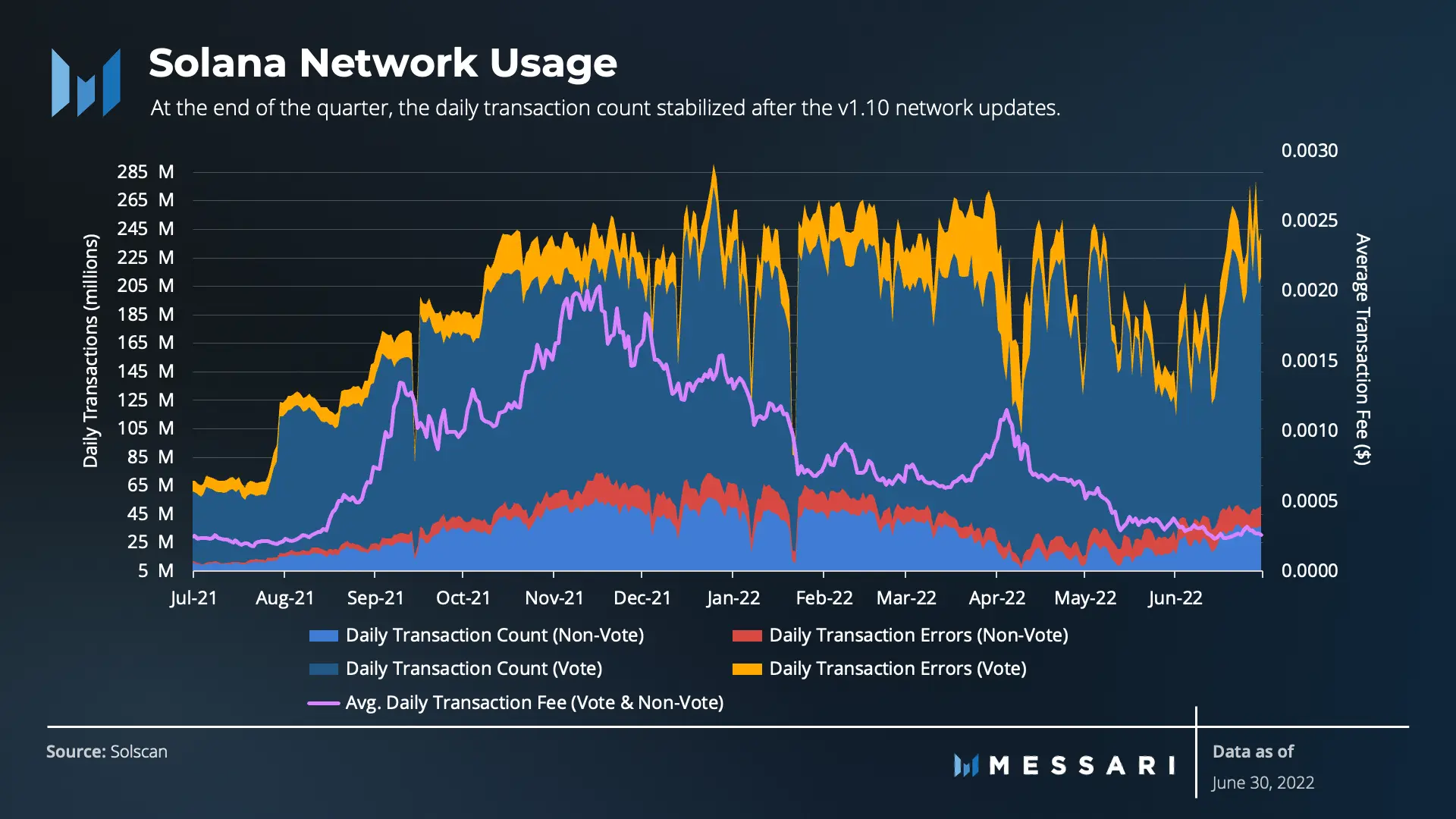

“It seems the network demonstrated indications of stabilization publish-v1.10 as lower transaction charges happened and also the daily transaction count reversed the popularity between the center of May and also the finish of June,” noted James Trautman, a investigator at Messari, in the Solana Q2 report.

Solana’s transactions per second (TPS) also improved, from as little as ~700 during network outages to any or all-time highs above 3,000 after v1.10 started to unveil. Trautman added:

“If implementations of v1.10 and subsequent versions still drive stability together with effective ecosystem growth strategies, fundamentals will probably relocate an optimistic direction, and network value may too.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.