Cointelegraph Research conducted an initial-of-its-kind survey querying over 2,000 global crypto funds and certificates to achieve a look to their investment allocations during 2021. Laptop computer was conducted via email between March 2021 and December 2021. The 200 funds that responded with each other managed roughly $1.2 billion in cryptocurrency and blockchain investments.

Interestingly, the research discovered that 20 surveyed asset allocators curently have contact with Dash within their portfolio, including Valkyrie, Parallax Digital, Block Ventures, INDX Capital yet others. Yet another 40 funds reported they wanted to purchase Dash throughout the next 12 several weeks, and 70% of respondents requested to get the outcome of Cointelegraph’s Dash investment thesis report.

Download the entire report, filled with charts and infographics

Dash aims to resolve the blockchain scaling problem while remaining decentralized by mixing the proof-of-work and proof-of-stake consensus mechanisms. Based on Cointelegraph Research, Dash’s average transaction fee in 2021 was $.005, in contrast to Ethereum’s $21.90 and Bitcoin’s $10.30. Users can usually benefit from Dash’s instant transactions when having to pay at retailers in a number of countries, and it is staking rewards and historic financial performance in contrast to other assets happen to be impressive. 2022 marks an essential milestone in Dash’s evolution, because the mainnet launch of Dash Platform will enable developers and users to embrace the advantages of decentralized applications.

Cointelegraph Research’s new report analyzes Dash and it is primary functionalities and developments recently. The cryptocurrency has been utilized for everyday payments since its launch in 2014, utilizing technological advancements to supply users with secure transactions and store-of-value features. The report provides information for investors and potential users wishing to understand more about Dash. Additionally to covering Dash’s vision and general features, the report features a deep dive into its tokenomics and its cost performance and regulation. The report also discusses how Dash is constantly on the innovate, getting started out a scalable payment means to fix a Web3 ecosystem.

Using its launch, Dash desired to offer digital payment methods to clients around the world. It tries to set itself aside from other cryptocurrencies with easy, secure, fast payment technology. Along with retail partners on several continents, Dash offers quick access to digital cash for payment purposes.

Popular features of Cointelegraph’s Dash report

Cointelegraph Research’s 80-plus-page report explores Dash’s improvements like a payment solution additionally to the role being an investment asset. Along with Allnodes, Staking Rewards, CryptoRefills, CoinRoutes, IntoTheBlock, Bitwise, Santiment and Rekt Capital, Cointelegraph Research is definitely the details and figures regarding every aspect of Dash, such as the ways to purchase it. The report describes how Dash’s masternode solution helps enhance the network’s scalability as well as sheds some light around the regulatory atmosphere for this along with other cryptocurrencies within the world’s largest jurisdictions.

Exclusive interviews with Fred Pye, Leah Wald, Michael Holstein yet others highlight Dash’s recent partnerships and offer further insights about how it could be considered a promising technology in the realm of cryptocurrencies.

Within the report, Mark Mason, Dash’s marketing and business development manager, informs Cointelegraph Research that “Dash makes everyday payments simple by removing reliance upon banks or organizations. You are able to send anywhere of Dash to anybody, anytime, anywhere straight to the recipient instantly without counting on a centralized authority.”

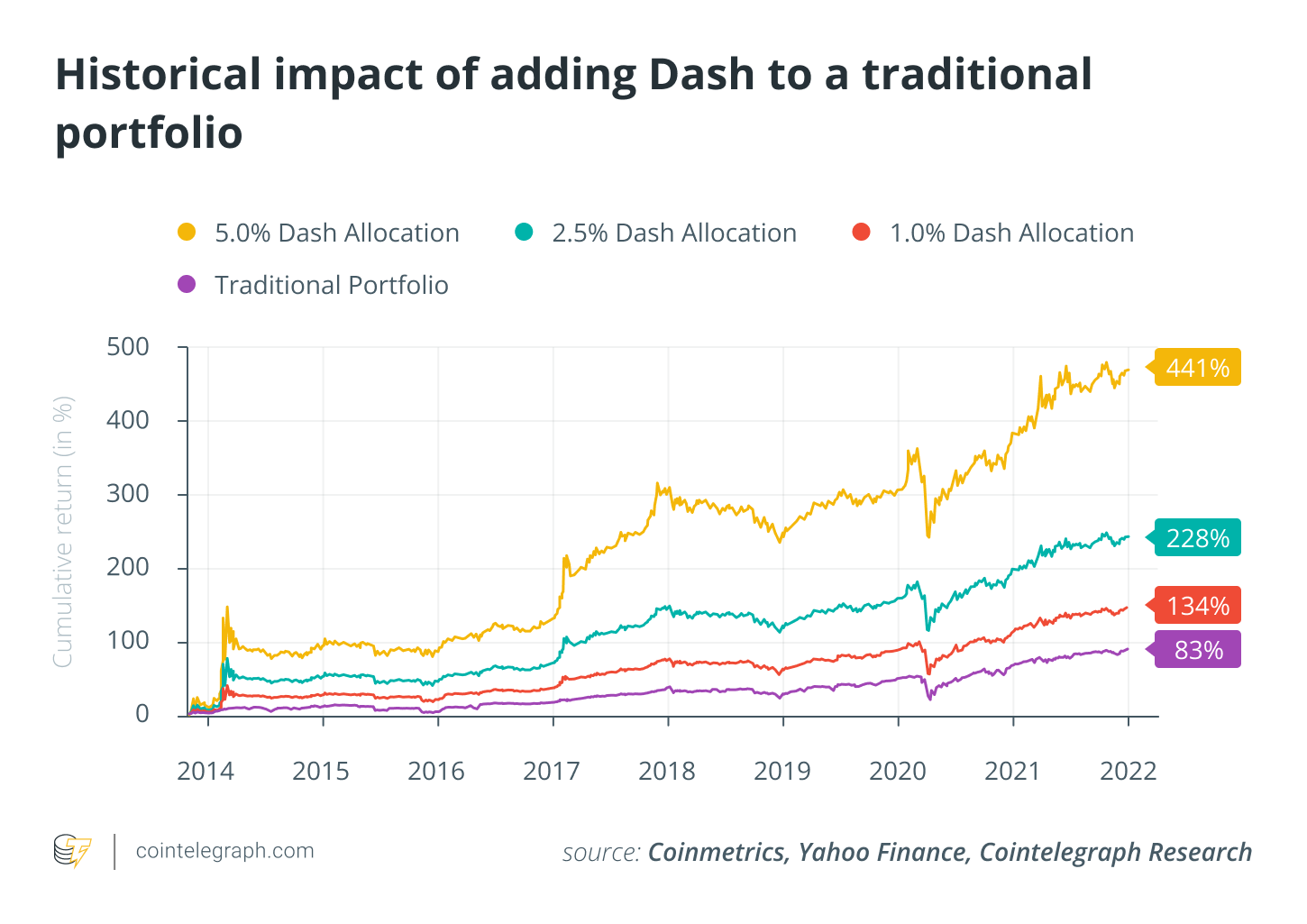

Furthermore, Cointelegraph Research’s new study implies that anywhere of Dash can improve a conventional equity and bond portfolio, thinking about not just cumulative return but the Sharpe ratio. Low correlation to traditional asset classes for example equities and gold may also offer benefits for investors’ risk management.

Institutional curiosity about Dash?

In 2021, Valkyrie launched the very first controlled financial vehicle targeted at institutional investors thinking about Dash. The Valkyrie Dash Trust enables investors to achieve contact with the cryptocurrency without getting to bother with child custody and security. Other providers, for example 3iQ Corp — Canada’s largest digital asset investment fund manager, using more than 2.5 billion CAD ($1.9 billion) in assets under management — can also be thinking about launching similar products.

Fred Paye, chairman and Chief executive officer of 3iQ Corp, commented on Dash within an exclusive interview for that report: “Dash is very innovative, because it combines fight-tested historic security with a few important evolutions in privacy, technical efficiency and incentive mechanics from the traditional Bitcoin model.”

This information is for information purposes only to represent neither investment recommendations, investment analysis nor an invite to purchase or sell financial instruments. Particularly, the document doesn’t function as a replacement for individual investment or any other advice.