Polkadot (Us dot) looks prepared to extend its ongoing cost recovery as a result of classic bullish pattern developing on its daily chart.

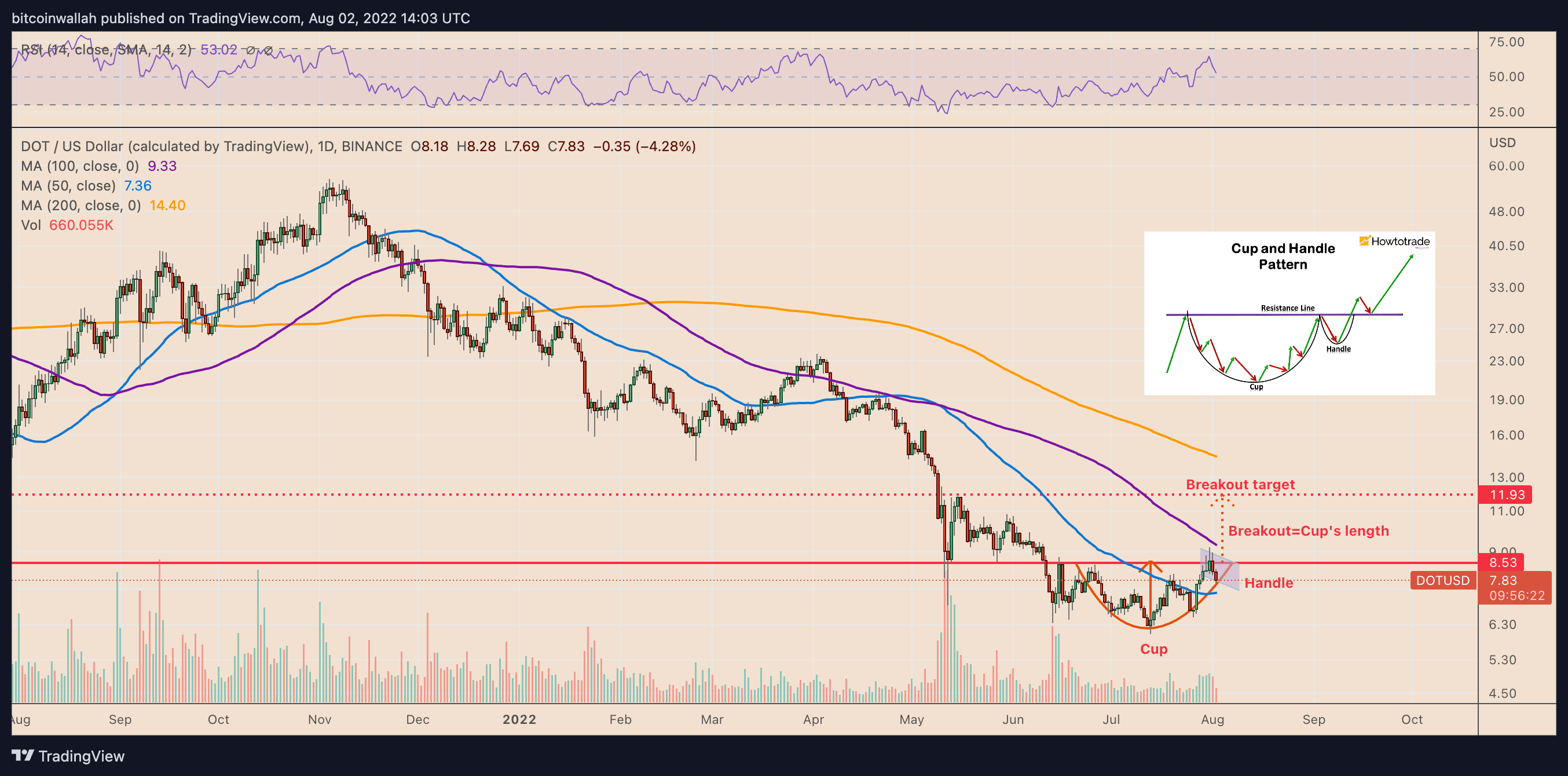

Us dot paints “cup and take care of” pattern

Particularly, Us dot continues to be developing a “cup and take care of” pattern since mid-June, confirmed by its cost crashing and recovering inside a rounding, U-formed trajectory (cup), adopted by the introduction of a buying and selling range around the right-hands side (handle).

Cup and take care of patterns are usually bullish continuation setups that form throughout an upward trend. However in rare cases, they seem in the finish of the downtrend, resulting in a bullish cost reversal. Consequently, the potential of Us dot ongoing its cost recovery appears high.

Thus, in the technical perspective, Us dot initially eyes an outbreak above its cup and handle’s resistance line near $8.50.

A decisive close over the resistance line, i.e., an outbreak move supported by a boost in volume, might have Us dot eye roughly $12 since it’s upside target by September, up greater than 50% from August. ‘s cost.

Polkadot cost breakdown setup

However, DOT’s route to $12 risks exhaustion because of the existence of key technical resistance levels halfway.

For example, the Polkadot token could encounter its 100-day simple moving average (100-day SMA the crimson wave) near $9.50 simply to withdraw toward $8.50. This outlook takes cues from DOT’s cost retreat on This summer 31 in the same wave resistance (highlighted with a circle sign below).

Meanwhile, a failure underneath the cup’s curvy support could invalidate the bullish cup and take care of setup altogether.

Consequently, Us dot could risk a long cost correction toward $6.25, that has been becoming support since June 13 against multiple downturns. In short, Us dot could visit nearly 20% from August. 2’s cost for the most part by September.

Polkadot network metrics show stability

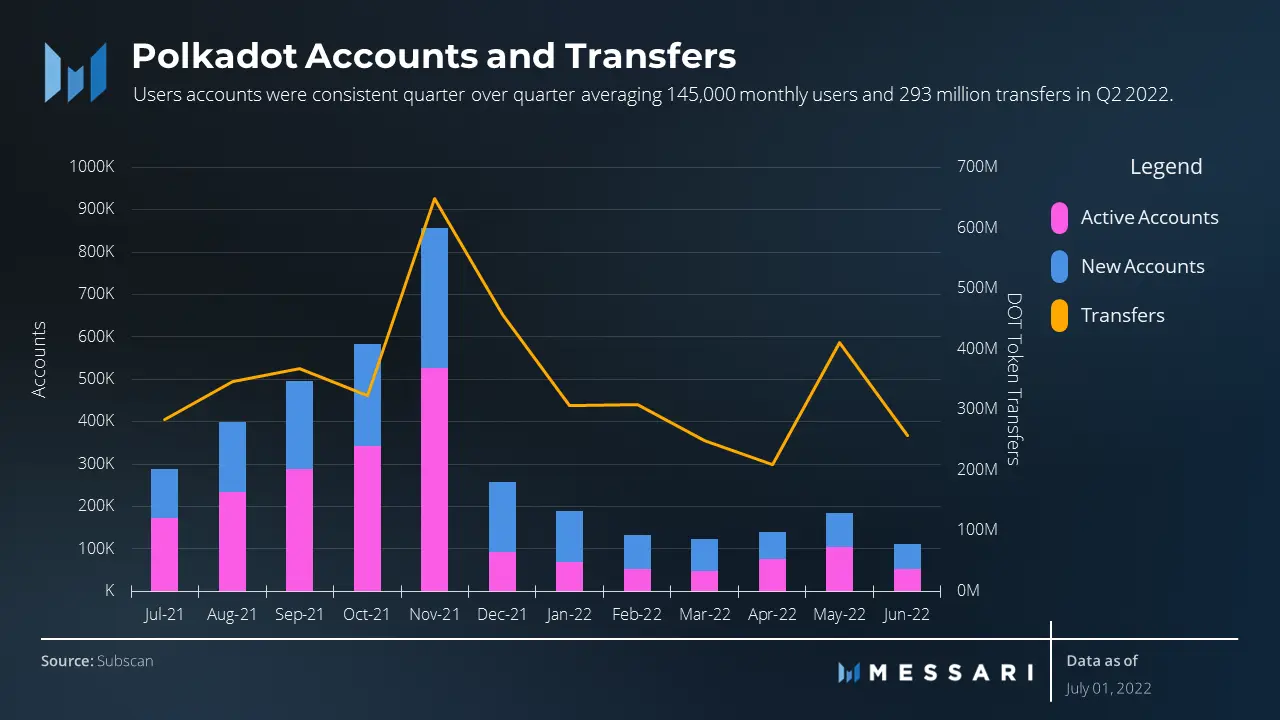

Combined with the broader market, Polkadot possessed a sharp loss of its market capital mainly because of macroeconomic turbulences. By August. 2, the project’s internet valuation was $7.92 billion versus its record a lot of $55.51 billion in November 2021.

Compared, Polkadot’s network metrics are healthier. For instance, it saw 145,000 monthly users in Q2/2022 versus 149,000 monthly users in Q1/2022, based on Messari’s quarterly Us dot report in This summer.

Similarly, Us dot transfers continued to be almost exactly the same quarter over quarter, averaging 293 million monthly in Q2 versus 288 million in Q1. Interestingly, the height accounts and transfers’ readings in November 2021 were due to inaugural parachain auctions.

Stable network activity underlines a consistently organic interest in Us dot tokens. Nevertheless, it remains substantially lower all-time-highs, meaning Polkadot will have to do more to draw in new projects because of its parachain-enabled network.

XCM launch and grant

Nicholas Garcia, a investigator at Messari, states that Polkadot could gain in adoption using its Mix-Consensus Message Format (XCM). This lately-launched tool enables parachains to relay messages to each other.

Related: Polkadot’s founder announces steps toward full decentralization with new governance model

“Developing new functionality and employ cases will showcase the strength of the network and could reignite user interest and activity,” Garcia noted, adding:

“Polkadot must continue onboarding parachains and connecting all of them with XCM.”

The Web3 Foundation, which oversees grants on Polkadot, approved 415 projects at the end of This summer, varying from development tooling and wallets to smart contracts and interface development. The move ensures further potential interest in Us dot.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.