Polygon (MATIC) arrived at high cost levels this This summer 14, each day after you have selected for that Wally Disney Company’s benchmark business development program.

MATIC’s cost surged 22.5% to $.657 an expression, its greatest level inside a month. By doing this, the token also rose above its 50-day exponential moving average (50-day EMA the red wave), a curvy level of resistance that were capping MATIC’s upside attempts since The month of january 2022.

Polygon enters the Walt Disney World

MATIC’s move upside made an appearance synchronous concentrating on the same intraday recovery actions observed elsewhere within the crypto market.

Nevertheless, Polygon fared much better than the majority of its top-ranking rivals, such as the cryptocurrencies Bitcoin (BTC) and Ether (ETH).

And fundamentally of MATIC’s better performance may be the Wally Disney Company.

The multinational media and entertainment conglomerate announced six companies that might be joining its 2022 Disney Accelerator to construct augmented reality (AR), nonfungible tokens (NFTs) and artificial intelligence (AI) solutions.

Polygon went to Wally Disney’s list, thus becoming the only real blockchain platform to possess done this ever. Consequently, MATIC, Polygon’s native utility and staking token, rallied much better than the majority of its rival digital assets.

HUGE for $MATIC

Every single day seems like another prominent Web 2 . 0 platform embracing what’s coming, and Polygon is definitely involved, especially with regards to NFTs. Excited to determine the things they prepare up https://t.co/MDNBkivZDd

— N03LVentures (@N03LVentures) This summer 13, 2022

Key MATIC R/S switch ahead

Polygon now tests a resistance confluence, based on an assistance-switched-resistance selection of $.61–$.67 along with a Fibonacci retracement line near $.63, for any potential breakout in This summer.

A decisive move over the confluence might have MATIC pursue a run-up toward the .618 Fib line near $1.11, supplying the token also closes above its 50-3D (red) and 200-3D (blue) EMAs. That will mean almost an 80% jump from June 14’s cost level.

#MATIC Is Prepared For Any +80% PUMP.

Bullish Climbing Triangular. $MATIC #CRYPTO #BTC pic.twitter.com/I3g1x98T2u

— TAnalyst (@AurelienOhayon) This summer 14, 2022

On the other hand, a pullback in the confluence would risk crashing MATIC toward the $.29–$.35 area, much like the way it retraced downward in June.

Related: 3 key metrics suggest Bitcoin and also the wider crypto market have further to fall

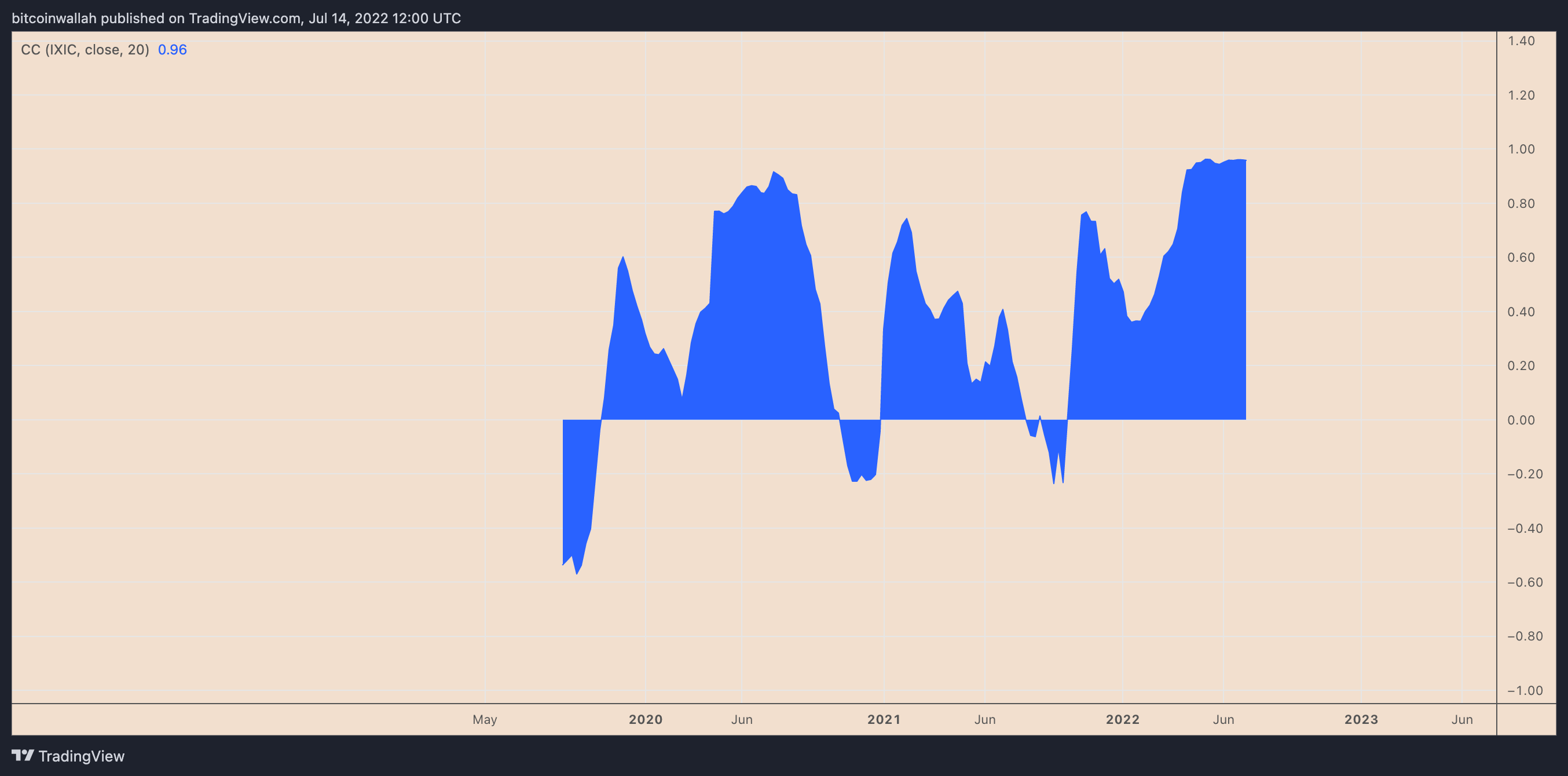

MATIC may also erase its recent gains because of greater inflation. Particularly, the crypto markets similar to their traditional finance counterparts have responded negatively to some persistently rising U.S. consumer cost index.

On This summer 13, the latest inflation data arrived at its four-decade a lot of 9.1%. Consequently, investors anticipate the Fed will raise benchmark rates with a full percentage point, with Atlanta Given President Raphael Bostic saying the option “is within play.”

SinglePercent rate hike in This summer would risk putting downward pressure around the entire crypto market, including Polygon.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.