The rapid boost in share of stablecoins like Tether (USDT) within the cryptocurrency market may indicate an approaching crypto upside, based on analysts in the American investment bank JPMorgan Chase.

The proportion of stablecoins within the total crypto market price continues to be increasing, reaching new historic highs in mid-June, JPMorgan strategists believe. Brought by JPMorgan crypto market analyst Nikolaos Panigirtzoglou, the analysts provided their industry insights within the bank’s new investor note distributed to Cointelegraph.

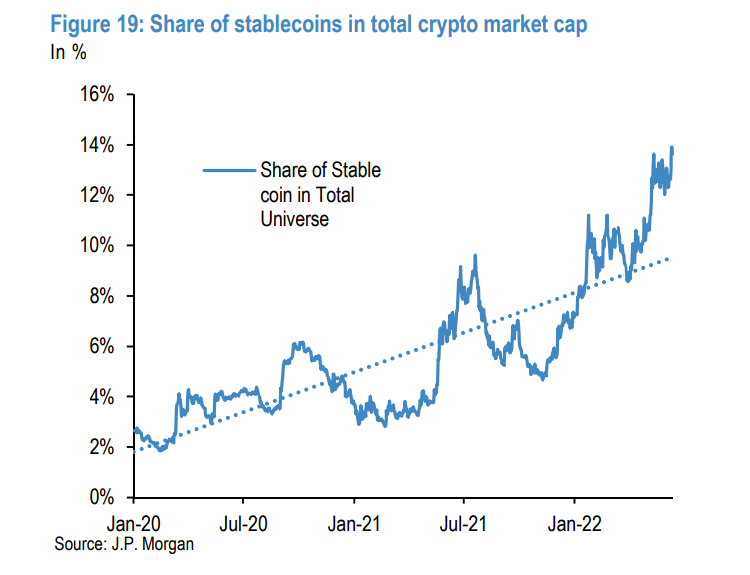

Released on June 15, the investor note reads the share of stablecoins rose to above 14%, or perhaps a “new historic high, that can bring it to well above its trend since 2020.”

“The share of stablecoins as a whole crypto market cap looks exorbitant, pointing to oversold conditions and significant upside for crypto markets came from here,” the strategists stated.

Based on the analysts, the low share of stablecoins within the crypto marketplace is connected having a limited crypto upside. At the end of April 2022, the strategists forecasted a brief-term stop by crypto prices because the share of stablecoins in accordance with the entire crypto market fell from 10% to 7%.

During the time of writing, the proportion of stablecoins within the total crypto market has surged even greater, amounting to 17%. Based on the crypto data provider CoinGecko, the need for all stablecoins equals $155 billion, as the total market capital stands at $946 billion.

The proportion of stablecoins continues to be growing in the last couple of days regardless of the total way to obtain all stablecoins shedding massively throughout the second quarter of 2022, seeing certainly one of its sharpest declines ever. The stablecoin industry continues to be connected with many different FUD because of the failure of algorithmic stablecoins like Terra. Major cash-backed stablecoin issuers like Tether happen to be reassuring their clients they haven’t been affected by issues such as the Celsius’ crisis.

Related: Tether’s USDT market cap dips below $70B to have an 8-month low

The entire market capital continues to be also tanking this season, falling previously mentioned $2 trillion in The month of january to below $1 trillion in mid-June.

JPMorgan’s crypto strategists are recognized for going for a positive stance around the cost of Bitcoin (BTC) over time. As formerly reported, the analysts reiterated in Feb 2022 their theoretical lengthy-term target for Bitcoin was at $150,000.