Bitcoin was produced to own person with average skills a peer-to-peer economic climate along with a store of wealth asset that may provide financial autonomy and use of banking, specifically for people residing in places where financial services are sparse or non-existent.

Within the last 5 years, there has been numerous blockchain projects that try to mirror Bitcoin’s original mission and also the growing recognition of stablecoins further highlights the requirement for alternative financial models. One project that’s realizing a little bit of momentum is Reserve Legal rights (RSR), a dual-token stablecoin platform made up of the asset-backed Reserve Stablecoin (RSV) and also the RSR token which keeps the cost of RSV stable via a system of arbitrage possibilities.

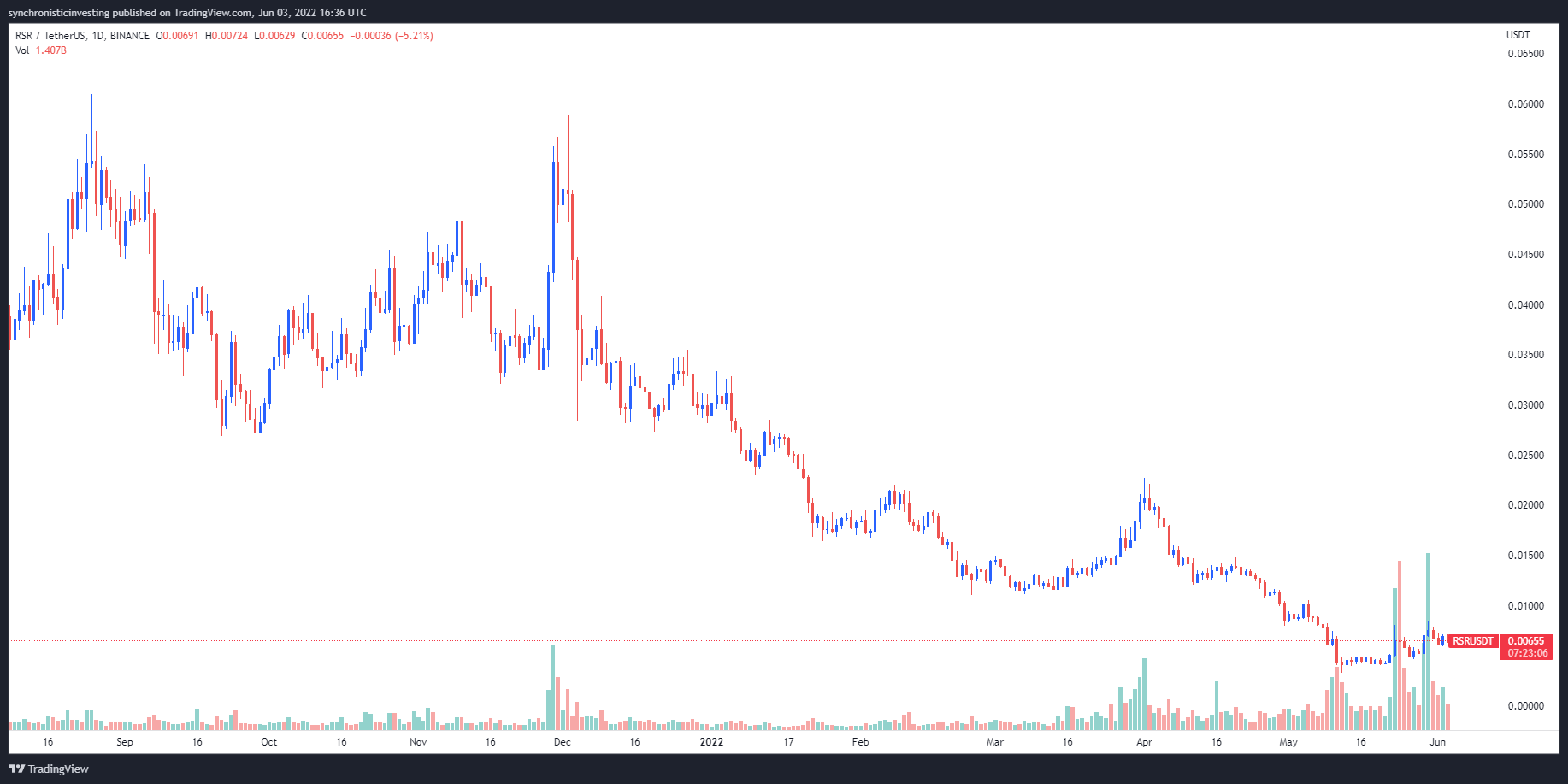

Data from Cointelegraph Markets Pro and TradingView implies that as the cost of RSR continues to be beaten lower combined with the wider market in the last couple of several weeks, the token has lately seen an uptick in buying and selling volume which implies a potential revival might be going ahead.

Three good reasons for the rise in interest in the RSR token range from the approaching launch from the Reserve Legal rights mainnet, anticipation for token staking and ale RSV to keep its peg throughout the recent market-wide volatility.

RSR mainnet launch

The greatest approaching development for Reserve Legal rights which has its community excited is its August launch its mainnet.

Following a launch of Reserve Legal rights around the Ethereum (ETH) mainnet, the entire abilities from the protocol is going to be enabled such as the ability for anybody to produce stablecoins supported by baskets of ERC-20 tokens.

Together with being fully collateralized, stablecoins around the protocol (RTokens )could be insured in an effort to help safeguard against collateral devaluation. RTokens can also generate revenue for his or her holders, the incentive for RSR holders to stake their RSR on the specific RToken.

Revenue for token holders originates from transaction charges, revenue explains to collateral token issuers and also the yields from lending collateral tokens on-chain.

RSR staking

RSR’s mainnet launch may also activate token staking. For most staking protocols which exist today, the primary function would be to lock tokens inside a smart contract which prevents a possessor from selling, however it doesn’t genuinely have any extra function for that ecosystem.

When the full Reserve Protocol has launched on Ethereum mainnet, Reserve Legal rights (RSR) holders can stake their tokens, therefore insuring & managing the network ⚖️

Let’s guide you through every detail of RSR staking within our latest article https://t.co/hS8rojPo3z

— Reserve (@reserveprotocol) May 2, 2022

Staking around the Reserve Protocol, in comparison, includes a practical use for that protocol because pledging RSR tokens to some specific RToken helps you to insure that token against collateral defaults. Which means that should the collateral tokens default, staked RSR could be grabbed to ensure that the RToken to keep its peg.

In return for using this risk, RToken revenue is distributed to RSR stakers to assure sufficient insurance. The yield provided by each RToken is determined by a number of factors, such as the market cap from the RToken, the revenue the token makes, the proportion from the revenue that’s distributed to RSR stakers and the quantity of RSR staked.

Related: Latin America’s largest digital bank will allocate 1% to BTC, offer crypto investment services

An increasing community and effective stablecoin

Another factor getting a lift to RSR may be the ongoing development of its community and also the ability because of its RSV stabelcoin to keep its peg among the current market volatility.

Throughout the height from the volatility in May when TerraUSD Classic (USTC) was collapsing, the cheapest cost RSV hit was $.9923. This means that RSV organized much better than most stablecoins on the market.

Together with RSV maintaining its peg, the Reserve Legal rights community also lately surpassed 600,000 users around the Reserve application, which now provides use of greater than 18,000 retailers across South America who accept RSV and process a regular monthly volume more than $100 million.

They behind the protocol can also be presently focusing on adding support for users in Mexico, which can initiate the onboarding of the new cohort of RSV users.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.