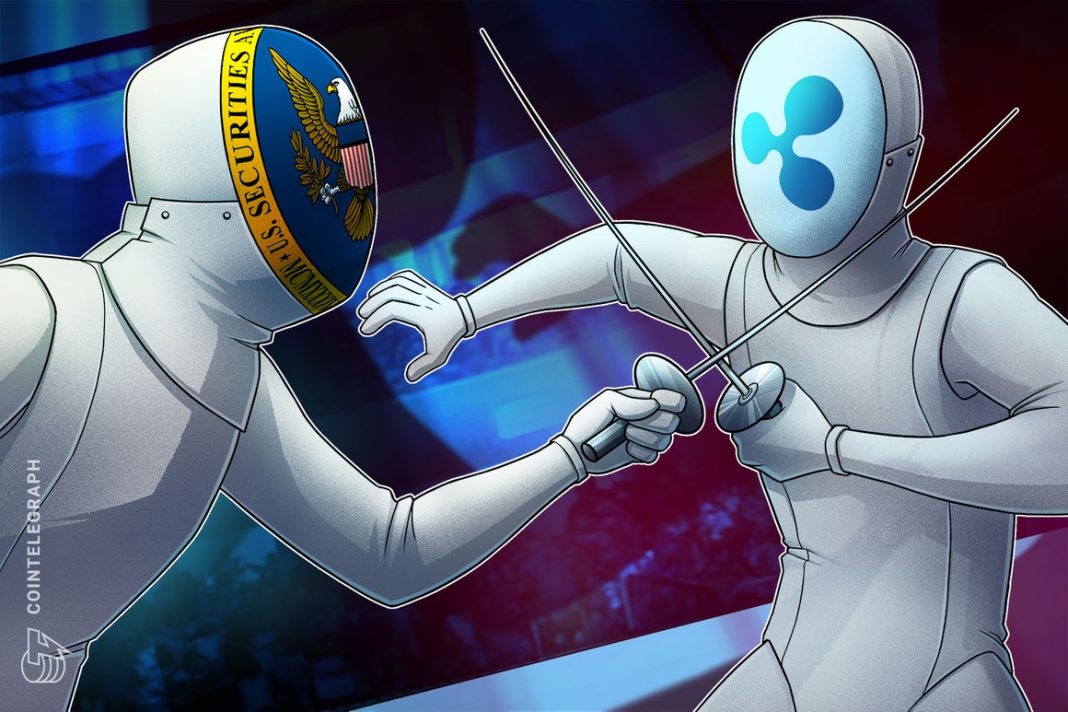

Ripple general counsel Stu Alderoty has slammed the U . s . States Registration (SEC) for attempting to “bully, bulldoze, and bankrupt” crypto innovation within the U.S. in the expanding its very own regulatory territory.

“By getting enforcement actions–or threats of potential enforcement–the SEC promises to bully, bulldoze, and bankrupt crypto innovation within the U.S., all in the impermissibly expanding its very own jurisdictional limits.”

Alderoty shared his views on June 13 amongst a continuing suit between Ripple and also the regulator, that they states belongs to the “SEC’s assault on all crypto within the U.S.” by treating every cryptocurrency like a security.

“Like a hammer wanting everything to become a nail, the SEC is keeping everything murky therefore it can argue every crypto is really a security.”

Ripple Labs continues to be embroiled inside a legal fight using the SEC since December 2020, once the securities regulator filed a suit alleging that Ripple executives had used Ripple (XRP) tokens to boost funds for the organization beginning in 2013, claiming it had been an unregistered security at that time.

Ripple fought against back, claiming that the 2018 speech delivered by Robert Hinman, then-Director of Corporation Finance for that SEC, had categorized Ether (ETH) and Bitcoin (BTC) by-association, XRP, like a non-security because of being “sufficiently decentralized”.

Ripple contended the speech is at contradiction using the SEC’s claims against Ripple and also the XRP token, however the SEC countered the argument by claiming the speech was the director’s personal views and never the state look at the regulator. This nuance continues to be probably the most pivotal facets of the Ripple versus SEC suit.

four years because the (in)famous Hinman speech, and we’re nowhere closer on understanding how to classify digital assets in america – keeping every crypto, including ETH, in regulatory limbo. I penned some ideas for @Fortune why enough is sufficient, @SECGov. https://t.co/FB16cceaia

— Stuart Alderoty (@s_alderoty) June 13, 2022

“Despite disclaimers the speech was Hinman’s personal opinion and “not always those of the Commission,” the marketplace required Hinman’s speech to heart,” authored Alderoty.

“For Ripple, Hinman’s speech affirmed the final outcome that XRP – a cryptocurrency that exists with an open, permissionless, decentralized blockchain ledger – would be a commodity and/or perhaps a virtual currency. Definitely not a burglar,” he added.

Related: Kaira Garlinghouse states NFTs ‘underhyped,’ sees new use cases Cointelegraph interview

Alderoty stated it epitomized SEC’s deliberate muddying from the regulatory waters for crypto.

“Here within the U.S., the Registration (SEC) has deliberately muddied the regulatory waters for crypto […] To unlock crypto’s true potential, we have to finally cleanup this regulatory sludge.”

Throughout a Washington Publish event on June 21, U . s . States Senators Kirsten Gillibrand agreed that many cryptocurrencies would be classed as securities underneath the Howey Test, using the apparent exception of Bitcoin and Ether.

Rostin Behnam, chair from the Commodity Futures Buying and selling Commission (CTFC) required a rather different view, stating that while you will find “probably hundreds” of coins that replicate security coins, there’s also many commodity coins, for example BTC and ETH that might be controlled by his commission.

A legal court fight between Ripple and SEC is anticipated to create a precedent to treat cryptocurrencies, particularly altcoins under U.S. securities and goods laws and regulations.