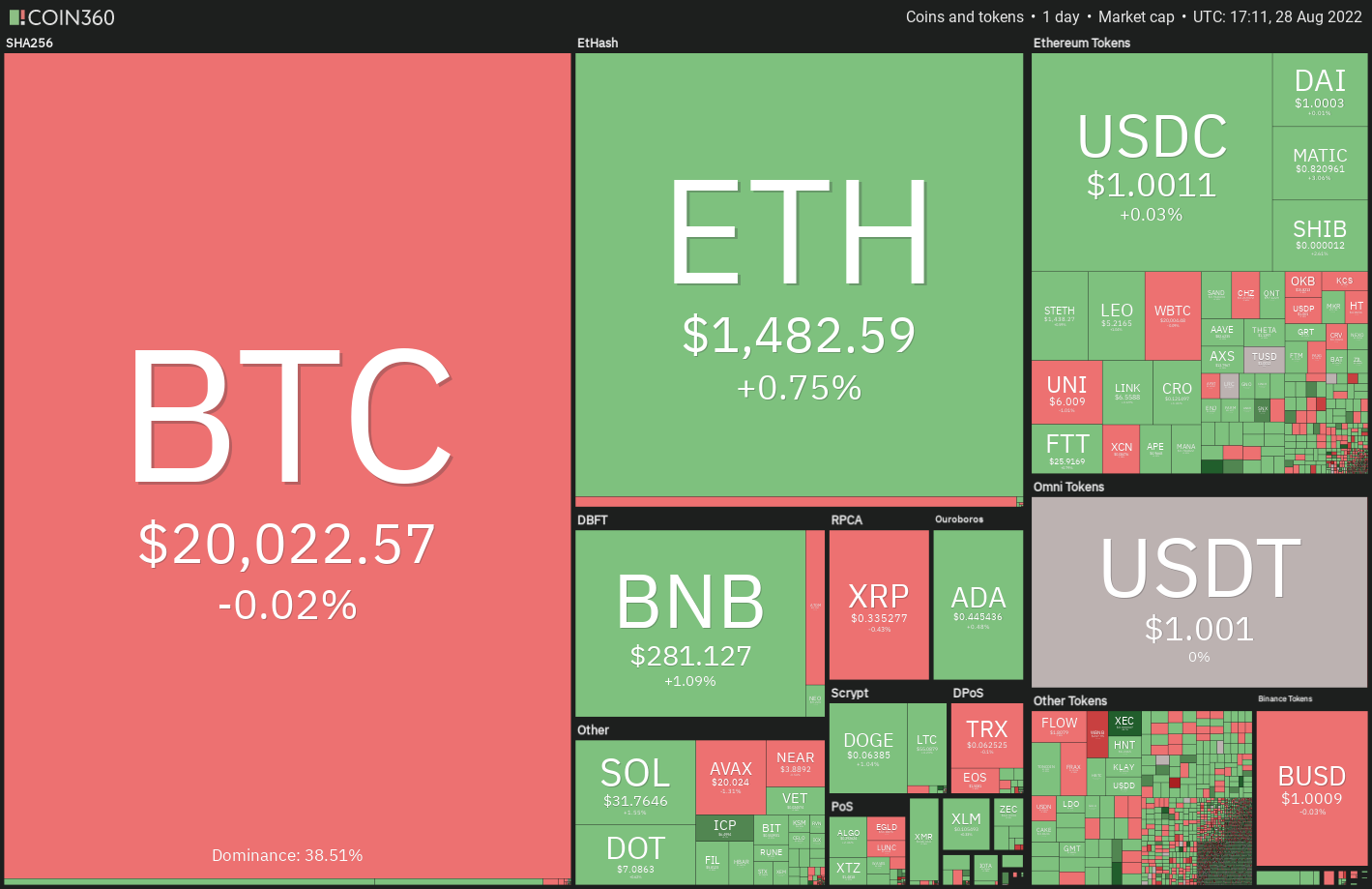

The U . s . States equities markets stepped on August. 26 following Fed Chair Jerome Powell’s speech where he reiterated the central bank’s hawkish stance. Ongoing its correlation using the equities market, Bitcoin (BTC) and also the cryptocurrency markets also observed a clear, crisp selloff on August. 26.

Bitcoin has declined about 14% this month, which makes it the worst performance for August since 2015 once the cost had dropped 18.67%. Which may be not so good news for investors because September includes a dubious record of the 6% average loss since 2013, based on data from CoinGlass.

Although buying inside a downtrending market isn’t a good strategy, traders can carefully watch on cryptocurrencies which are outperforming the markets because, in situation associated with a turnaround, these could be the very first from the block. Inside a bear market, traders ought to be patient since they’re highly prone to find lots of possibilities to purchase following the market stabilizes.

Do you know the critical levels to look at on Bitcoin? Whether it stages a turnaround, do you know the cryptocurrencies that could outshine for the short term? Let’s study 5 cryptocurrencies which are searching strong around the charts.

BTC/USDT

An inadequate rebound off a powerful support signifies that bulls are reluctant to strongly buy in the level. The bulls effectively defended the support line for a few days but tend to not push the cost over the 20-day exponential moving average ($21,806). This shows too little demand at greater levels.

Bears pounced upon the chance and pulled the cost underneath the climbing funnel on August. 26. The 20-day EMA is sloping lower and also the RSI is close to the oversold zone, indicating that bears are firmly within the driver’s seat.

The BTC/USDT pair could drop towards the strong support zone between $18,910 and $18,626. When the cost rebounds off this zone, the bulls will attempt to push the cost over the 50-day simple moving average ($22,340). When they manage to achieve that, the happy couple could rise to $25,211.

On the other hand, when the cost breaks below $18,626, the happy couple could retest the June 18 intraday low at $17,622. The bears will need to sink the cost below this level to signal the resumption from the downtrend.

The downsloping moving averages around the 4-hour chart indicate that bears have been in command however the positive divergence around the relative strength index (RSI) shows that the sell pressure might be reducing.

The very first manifestation of strength is a go above the 20-EMA. In the event that happens, the happy couple could rise towards the 50-SMA. A rest above this level could signal the correction might be over.

On the other hand, when the cost breaks below $19,800, the selling could get momentum and also the pair may plummet towards the $18,910 to $18,626 zone.

MATIC/USDT

Polygon (MATIC) has rebounded off its strong support, which implies that bulls are protecting the amount strongly. This increases the probability of the number-bound action ongoing for any couple of more days. That is among the causes of concentrating on this altcoin.

The bulls are trying to push the cost over the moving averages. Whether they can accomplish it, it’ll claim that the MATIC/USDT pair could chance a rally towards the overhead resistance at $1.05. This level could attract strong selling through the bears.

Alternatively, when the cost turns lower in the moving averages, it’ll claim that bears can sell on rallies. The bears will make an effort to sink the cost underneath the crucial support at $.75. When they succeed, the happy couple could decline to $.63.

The bulls have pressed the cost over the moving averages, the first indication the selling pressure might be reducing. Another positive sign would be that the RSI makes an optimistic divergence, an indication the bears might be losing their grip.

The buyers will attempt to push the cost over the overhead resistance at $.84. When they succeed, the happy couple could rally to $.91 which might again behave as a powerful resistance. To invalidate this positive view, the bears will need to sink the cost below $.75.

ATOM/USDT

Cosmos (ATOM) continues to be selected since it is buying and selling over the 50-day SMA ($10.58) and it is close to the mental support at $10.

The bulls are anticipated to protect the zone between $10 and also the 50-day SMA strongly. When the cost rebounds off this zone and increases over the 20-day EMA ($11.39), it’ll indicate the selling pressure might be reducing.

The ATOM/USDT pair could then rise towards the overhead resistance at $12.50 and then to $13.45. A rest above this level could claim that the downtrend might be over.

Unlike this assumption, when the cost turns lower and slips underneath the support zone, it might begin a much deeper correction. The happy couple could then decline to $8.50.

The 20-EMA has switched lower around the 4-hour chart and also the RSI is incorporated in the negative territory, indicating that bears possess the edge soon. The sellers will need to sink and sustain the cost underneath the upward trend line to challenge the mental support at $10.

On the other hand, when the cost rebounds from the upward trend line, it’ll claim that bulls are purchasing the dips for this level because they did on previous occasions. The buyers will need to push the cost over the moving averages to spread out the doorways for any possible rally to $12.50.

Related: Bitcoin threatens 20-month low monthly close with BTC cost under $20K

XMR/USDT

Monero (XMR) makes it towards the list since it is holding above its immediate support at $142. This means that ‘abnormal’ amounts are attracting buyers.

If bulls drive the cost over the 20-day EMA ($153), it’ll claim that the correction might be over. The XMR/USDT pair could get momentum if bulls drive the cost over the overhead resistance at $158. In the event that happens, the happy couple could rally to $174. The bulls will need to obvious this hurdle to signal the resumption from the up-move.

This positive view could invalidate soon when the cost turns lower and breaks underneath the strong support at $142. In the event that happens, the happy couple could slide to $132 and then to $117. The downsloping 20-day EMA and also the RSI within the negative territory indicate that bears possess a slight edge.

The buyers are trying to push the cost over the 20-EMA. When they manage to achieve that, the happy couple could rise towards the 50-SMA, which might again behave as a stiff resistance. If bulls overcome this barrier, the happy couple could rise to $158. A rest and shut above this resistance will suggest a general change in rapid-term trend.

On the other hand, when the cost turns lower in the 20-EMA, it’ll claim that bears can sell on minor rallies. The happy couple could then decline towards the strong support at $142. If the support cracks, it’ll suggest the beginning of a much deeper correction.

CHZ/USDT

Chiliz (CHZ) finds a location within this list for that third consecutive week. This is because, despite the current correction, it remains within an upward trend.

Buyers pressed the cost over the overhead resistance of $.26 on August. 23 and August. 24 but they couldn’t sustain the greater levels as seen in the lengthy wicks around the candlesticks. This might have enticed rapid-term traders to reserve profits. That pulled the cost lower towards the breakout degree of $.20, that is just over the 20-day EMA ($.20).

The bulls purchased this drop and are trying to resume the up-move toward the overhead resistance at $.26. The bulls will need to obvious this hurdle to spread out the doorways for any possible rally to $.33.

The increasing moving averages suggest benefit to buyers however the negative divergence around the RSI signifies the bullish momentum might be weakening. When the cost turns lower and breaks underneath the 20-day EMA, the benefit will turn in support of the bears. The happy couple could then decline towards the 50-day SMA ($.15).

The 20-EMA around the 4-hour chart is flattening out and also the RSI continues to be oscillating close to the midpoint, indicating an account balance between consumers. This might keep your pair range-bound between $.20 and $.26 for a while.

The following trending move could start if bulls push and sustain the cost above $.26 or below $.20. For now, the bulls will probably purchase the dips towards the support at $.20 then sell close to the overhead resistance at $.26. Buying and selling within the range will probably remain volatile and random.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.