Cardano (ADA) has dipped this This summer 21 because the market favors mounting selling pressure around its most dependable resistance levels in 2022 more than a major upcoming hard fork.

ADA cost could plunge 20% by early August

ADA’s cost fell 5% intraday to $.476. The down-side move came as part of a wider retreat that began each day after it briefly rose above its 50-day exponential moving average (50-day EMA the red wave within the chart below) near $.50.

The 50-day EMA continues to be becoming ADA’s curvy level of resistance since October 2021.

Furthermore, top of the trendline resistance of the broader climbing down funnel pattern strengthened the selling sentiment round the ADA’s 50-day EMA wave. Earlier in June, exactly the same resistance confluence had triggered a 35% cost drop toward the channel’s lower trendline.

Therefore, ADA’s restored correction move risks leading the cost toward $.384 by This summer or early August, lower about 20% from This summer 21’s cost.

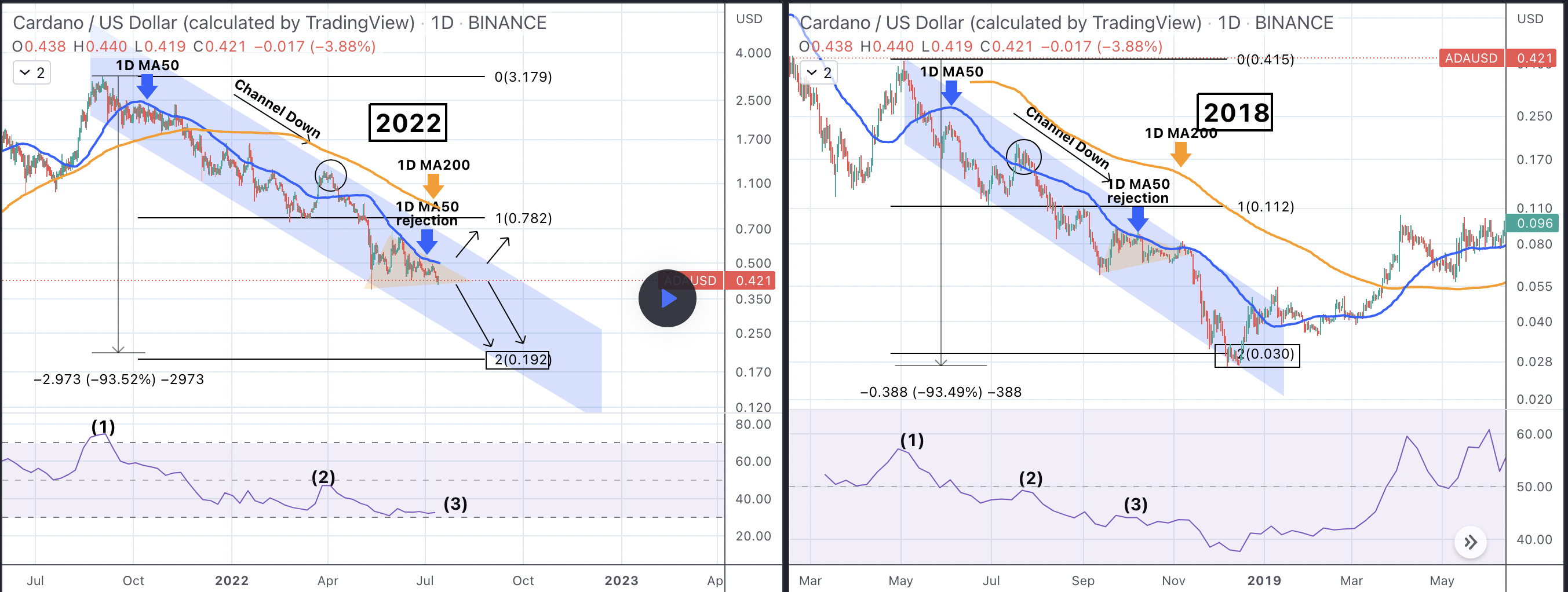

2018 fractal suggests $.20 per ADA

However, another analysis sees ADA falling to much deeper levels than $.384.

Penned by TradingShot, the bearish ADA forecast draws comparisons between your ongoing correction and also the one observed throughout the 2018 market crash, as proven below.

At length, the 2018 chart above shows ADA undergoing multiple bearish rejections near its 50-day EMA (the orange wave) while trending downward inside a climbing down funnel pattern. The token’s downtrend grew to become exhausted after correcting by nearly 93% from the local high.

“According to 1D RSI terms, we appear to be the 3rd (3) and final leg underneath the collapse,” TradingShot authored, adding:

“Therefore if ADA holders want to avert this, they have to begin to see the cost break over the 1D MA50 and sustain buying and selling above it for any week a minimum of. Otherwise, finishing a -93% drop in the top can be done around .200.”

When hard fork?

The most recent ADA cost correction seems dads and moms prior to Cardano’s hard fork.

Dubbed “Vasil,” hard fork was designed to go reside in June but was delayed before the a week ago of This summer over several outstanding bugs. Nevertheless, by This summer 21, Input Output Hong Kong (IOHK), the firm behind the Cardano blockchain development, hasn’t announced the precise launch date.

Vasil is anticipated to create significant performance and capacity upgrades towards the Cardano blockchain, including faster block creation and greater transaction speeds. From a simple perspective, the upgrade could boost ADA adoption because of improved network efficiency.

But Cardano has past logging sharp cost corrections after most network upgrades, suggesting a prevailing “sell this news” sentiment on the market.

For example, the blockchain’s Alonzo upgrade in September 2021 partially motivated ADA to increase by over 200% to the record a lot of $3.16 before launch. But following the upgrade, the Cardano token fell by greater than 85%.

ADA has risen by only 25% after bottoming out in your area at $.384 on May 10, suggesting that Vasil’s impact available on the market continues to be limited.

Although not everybody thinks. For instance, analyst Lark Davis believes the token will “rip” following the hard fork, trained with seems to hold 50-day EMA as support.

#cardano $ada has damaged past its 50 day EMA, now we simply need Charles to announce the date from the Vasil hard fork which puppy will rip! pic.twitter.com/yQTiCiCE6H

— Lark Davis (@TheCryptoLark) This summer 20, 2022

For now, ADA will probably stay underneath the “sell this news” pressure, pressured further by ongoing macro risks as well as their negative effect on crypto markets.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.