Lido DAO (LDO) has declined by greater than 40% within the last thirty days with increased room to fall within the future among a potential sell-the-news event, like the Merge.

Lido DAO Ether deposits surge 160% in 2022

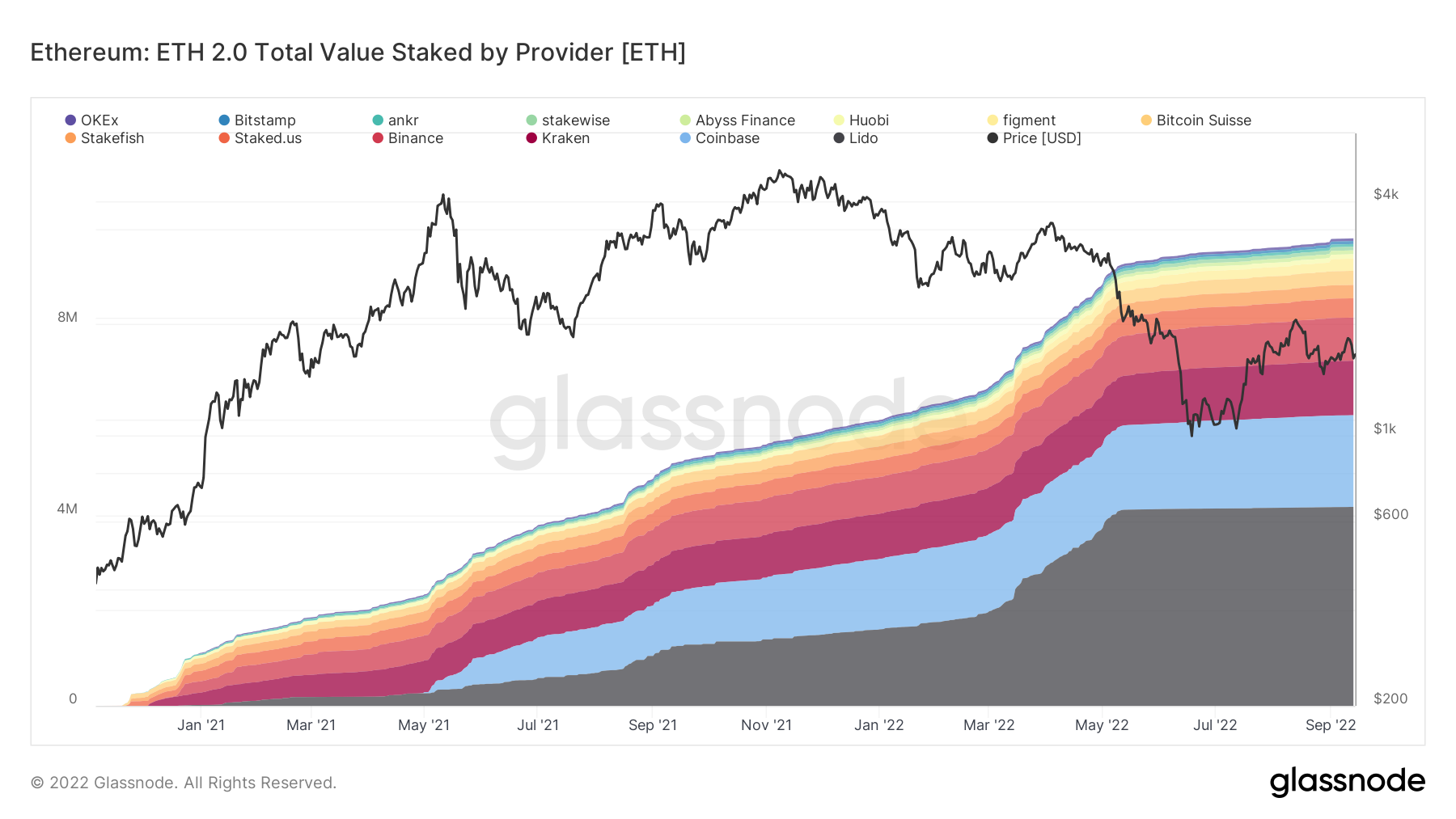

Lido DAO is Ethereum’s greatest staking service, getting deposited over 4.14 million from the blockchain’s native asset, Ether (ETH), in to the Ethereum 2. smart contract with respect to its users, based on the latest data.

Compared, Lido DAO’s total staked amount was around 1.six million ETH at the outset of this season. The boom reflects an increasing interest in Lido DAO services in front of Ethereum’s scheduled transition from proof-of-work (Bang) to proof-of-stake (PoS) via the Merge on Sep. 15.

LDO, a governance token within the Lido DAO ecosystem, has additionally gone through an unparalleled cost rally in recent several weeks, up greater than 350% after bottoming out at $.39 in June.

Still, the token’s sharp correction previously month raises the potential of a long downtrend since the pre-Merge hype is nearing its finish. Additionally, a technical setup also alerts in regards to a potential cost decline ahead.

LDO shows climbing down triangular reversal

The most recent selling period within the Lido DAO market began after LDO capped at $3.10 on August. 13. This downtrend has colored a design that seems to become a climbing down triangular.

Climbing down triangles that form at the very top suggest bullish exhaustion. Theoretically, a climbing down triangular breakdown underneath the lower trendline could crash the cost to the stage in more detail comparable to the utmost triangular height.

LDO now tests the triangle’s lower trendline area, around $1.79-$1.82, as support. The token could drop toward $1.17 whether it breaks underneath the support level while associated a boost in buying and selling volumes. Quite simply, a 35% drop from current cost levels.

On the other hand, a rebound in the $1.79-182 support area might have LDO test the climbing down triangle’s upper trendline around $2.10 as resistance.

Also, a decisive breakout over the upper trendline would risk invalidating the bearish setup discussed above.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.