As Singapore is constantly on the play an energetic role in boosting crypto adoption over the Asia-Off-shore region, the country’s first licensed crypto exchange Independent Reserve conducted a retail-focused survey to higher comprehend the underlying potential from the controlled market.

Independent Reserve’s survey — conducted across all age ranges and genders from the Singapore population — revealed a powerful interest in various financial possibilities introduced forward by decentralized finance (DeFi) along with other investment possibilities.

As described by Raks Sondhi, md of Independent Reserve Singapore, the country’s rapid crypto adoption is driven by higher level of trust later on of crypto:

“58% [Singaporeans surveyed] see Bitcoin as a good investment asset or perhaps a store of worth.”

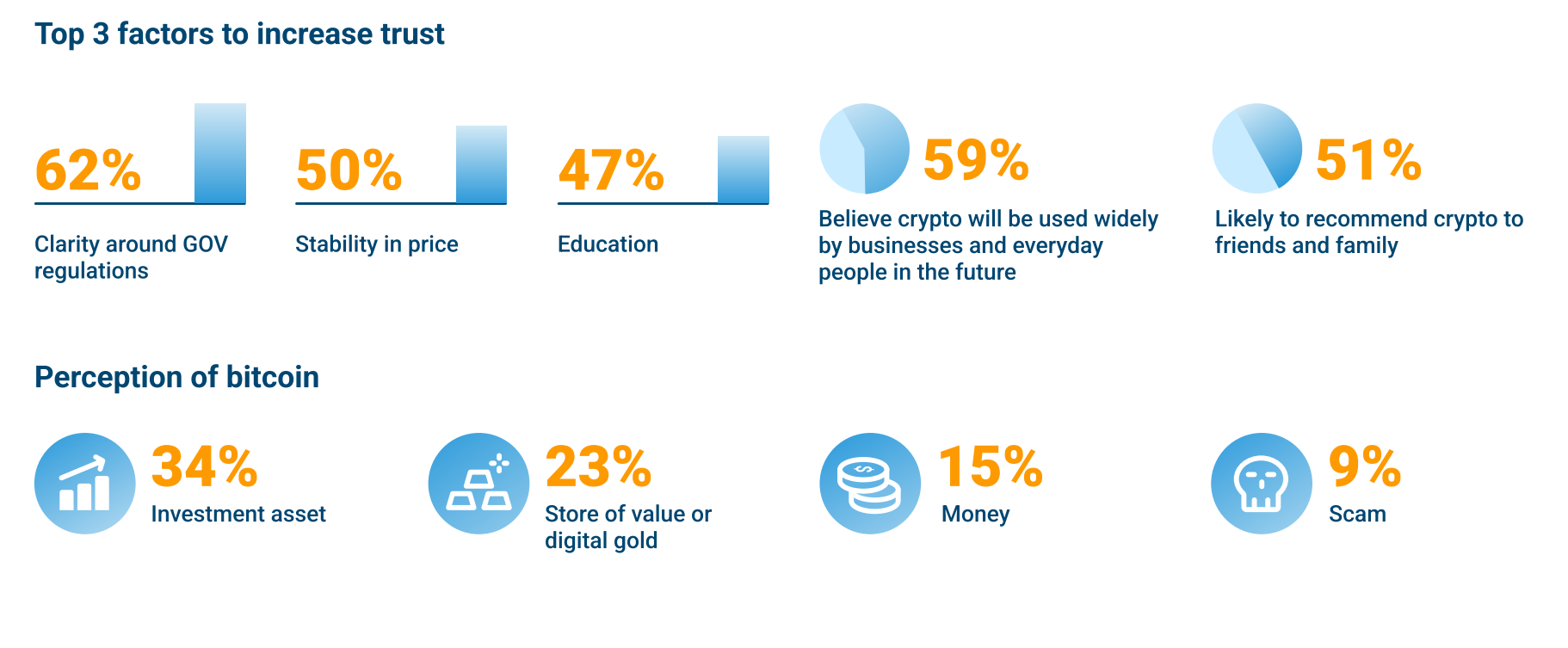

Supporting the above mentioned trend, over fifty percent from the surveyed individuals demonstrated a likeliness to recommend cryptocurrency investments for their buddies and family. In 2021, nearly 60% of investors in Singapore supported crypto’s possibility to achieve mass-scale adoption. This season, however, 15% from the respondents have began thinking about Bitcoin (BTC) as a genuine type of money.

Based on Independent Reserve, growing investors’ rely upon the Singapore market boils lower to tackling seven important aspects: clearness around government rules, education about how it operates, companies utilizing it, stability in cost, a choice to make sure crypto, convenience and employ and never being monitored.

In line with the survey, clearness around government rules can lead to the greatest participation from Singaporean investors. It had been also discovered that investors originating from high-earnings households were more prone to purchase cryptocurrencies.

The cost stability of cryptocurrencies and education were also revealed is the top factors impacting the participation of crypto investors. Regardless of the concerns, curiosity about crypto remains with an upward trend in Singapore, with ongoing interest to buy:

“47% intend to increase investment to their current crypto portfolio within the next 12 several weeks.”

Concluding laptop computer, Independent Reserve highlighted that more youthful adults between 18 and twenty five years were most prepared to diversify into DeFi or nonfungible token (NFT) projects.

Related: Singapore aims to streamline financial watchdog’s authority over crypto firms

The Singaporean government approved legislation, giving the Financial Authority of Singapore (MAS) additional power to reply to crypto firms conducting business outdoors the nation.

As Cointelegraph reported, MAS says the most recent legislation will need crypto companies working off-shore to become licensed and susceptible to Anti-Money Washing (AML) and Combating the financial lending of Terrorism (CFT) needs. Speaking with respect to the brand new ruling, MAS board member Alvin Tan mentioned:

“Digital token providers could easily structure their companies to evade regulation in almost any one jurisdiction, because they operate mainly online.”